SaaS companies need the right information and tools to support themselves in all business areas—including finance. That’s why it’s important to know SaaS accounting inside and out.

But what exactly sets it apart from conventional accounting, and what key metrics should you track? On top of that, which considerations should factor into your choice of SaaS accounting software?

We’ll answer all these questions, plus some more, in this guide to SaaS accounting.

What makes SaaS accounting different?

Research estimates that by 2025 85% of business apps will be SaaS-based—and this reliance on SaaS technology tells us one thing very clearly. SaaS is here to stay.

Image sourced from bettercloud.com

So, how is accounting for SaaS businesses different than for their non-SaaS counterparts?

The main separating factor is the subscription-based model that SaaS companies use. This sees them charging their users a fixed monthly fee—which might stay completely static or fluctuate, depending on how much flexibility a SaaS company’s pricing tiers offer.

Since SaaS companies help their users scale up and down easily, this also means that their revenue from a given client can increase or decrease suddenly. This makes SaaS business incomes harder to predict, which is why SaaS accounting differs from conventional accounting.

Key financial metrics for SaaS companies

SaaS companies often need to track different financial metrics than their counterparts—though in some cases, there’s overlap. We’ll walk you through the most important financial metrics for SaaS companies to keep an eye on.

MRR and ARR

Monthly recurring revenue (MRR) and annual recurring revenue (ARR) are particularly relevant to SaaS companies, as these will make up the bulk of their earnings per month or year. These metrics measure the kind of income that recurs predictably each month or year.

You can use your MRR to predict your ARR by multiplying it by 12. This helps you form a fact-based projection for your annual earnings, as your MRR is generated based on recurring customer revenue.

Payroll

A key business expense for any company, SaaS businesses must also pay attention to their payrolls. These will typically fluctuate depending on factors like commission bonuses for salespeople, as well as increased spending during business upscaling.

Your payroll is a good indication of the status of your SaaS company. If you’re suddenly spending far less on your payroll, that’s an indication that your sales have decreased.

On the flip side, spending more than expected on your payroll can actually be a good thing, as it indicates you’re selling more.

Monthly financial reports

Generating reports on your finances at least once each month lets you get real-time insights into your spending and earnings. This helps you effectively track any seasonal changes in your business and quickly identify any problems.

These reports should always include details of where your money went and where it came from. This helps you pinpoint your best sources of income—and the biggest money sinks.

Customer Acquisition Cost

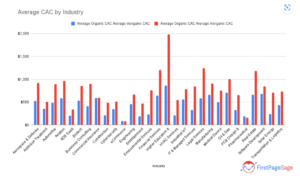

It’s rare to attract new SaaS customers without lifting a finger. In fact, while customer acquisition costs (CACs) can vary depending on your industry, CACs for software companies can enter the ballpark of $400:

Image sourced from firstpagesage.com

A lower CAC means less money spent in exchange for a paying customer, which is always a good thing. SaaS businesses that save on CAC while still creating brand loyalists can secure higher MRRs, which in turn makes those businesses more profitable.

Customer Lifetime Value

CLV, or customer lifetime value, describes the total revenue a given customer has generated for your business. Better CLV means better ROI on your customer acquisition expenditures—which leads to a boost in your bottom line in the long run.

In other words, when you use customer success to lower churn and create loyalists, you make sure that every dollar invested into acquiring and retaining a customer pays off more.

SaaS accounting considerations

Now that we’ve covered the kinds of metrics that a SaaS business needs to focus on, it’s time to look at the considerations that should factor into your SaaS accounting approach. Each of these has a major and consistent impact on your finances, which is why they merit thought.

Prepaid expenses and deferred revenue

You don’t always have to pay your expenses the moment they arrive, especially not if you knew they were coming. In some cases, you’ll be able to pay ahead of time—when you’ve got the money available—so you don’t have to worry about dealing with lots of expenses all at once.

Likewise, revenue isn’t always earned the moment someone pays for your services. You can use the deferred revenue method when a customer pays in advance for a year’s subscription. The deferred revenue method lets you spread your revenue out over more time, so it’s not all taxed at once.

A dedicated ERP system would help you with all of this, as it ensures you always know where your resources will be spent and when. It keeps track of all your day-to-day business processes and provides you with detailed insights to streamline your operations and reduce expenses.

Software development costs

A major part of successfully hitting your SaaS goals involves creating the exact product you envision. This is done through software development, which is why the costs associated with that development are a SaaS accounting consideration.

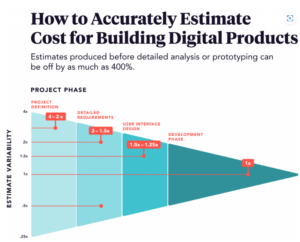

Creating new software is no simple task—nor is it a straightforward source of expenditure. The following image gives you a good idea of the kinds of estimates to include under software development costs:

Image sourced from praxent.com

As these costs can fluctuate, you’ll want to take this as a guide rather than a fixed source of truth. For example, you might need to spend more time and money on user interface for a brand-new product.

Capitalized software development costs

This covers the overhead costs that are capitalized on your company’s balance sheet, including software tester fees and developer salaries.

Software costs can’t be capitalized at random. This is because capitalized costs don’t count as incurred costs, meaning the rules surrounding them are different.

Regarding rules, your company can only capitalize costs if one of two conditions is met. Firstly, the app has to still be in development if it’s going to be used internally within your own company. Otherwise, it’s got to be completely feasible for your app to be sold to the public for capitalization to take place.

Amortization of capitalized software development costs

If you’ve heard of depreciation, the process of an asset losing value over time, then you’re familiar with the basics of amortization. The latter always refers to an intangible asset—like your SaaS software, for example.

Amortization is not necessarily a bad thing. That’s because it’s not realistic to expect your goods—tangible or otherwise—to retain the same value forever. Amortization helps you get a realistic idea of how the value of a piece of software changes over time.

This is very helpful for any SaaS business owners planning to sell their software in the future. It’s also useful for planning-savvy SaaS accountants who want to make sure they’re using the correct business value estimates in their calculations.

That’s why amortization of not just your software but your capitalized costs is a major factor to consider when it comes to SaaS accounting.

Choosing the right software for your SaaS company

The most important tip to bear in mind is this: there’s no universal “right solution” that works for absolutely every company.

That’s because each company is unique. Some are particularly large, while others are very small; some have operated for years, with others having started just weeks ago. These factors, among many others, determine which software is the best for a company.

That said, one option to consider is a cloud ERP system. This all-in-one solution can be tailored to your company’s specific needs and will unite all your business processes on a single platform. It gives you increased access to data across your entire company, so you can extract real-time insights on the go and improve collaboration between your teams.

This not only helps your accounting team, but all of your departments as they can develop efficient, flexible processes while working from a single unified database.

When choosing the right software for your company there are some key guidelines that can help.

Firstly, always check what accounting features it has. If a piece of software is very feature-rich, you can most likely customize it to suit you perfectly. Some will have specific tools for SaaS companies which will make things much easier.

There’s also ease of use and UI layout. A solution that can do everything you want, but is clunky to use, is going to weigh you down over time.

Lastly, there’s pricing. Cheaper isn’t always better—nor more expensive—so you should always consider whether you’re getting the right value for money. A solution that charges a little more to give you something perfect is better than a cheap one that leaves you wanting.

Use SaaS accounting to stay ahead of the competition

SaaS accounting helps you stay on top of any and all developments in your SaaS company. By giving you accurate, data-based insights into your company’s financial health, SaaS accounting also creates opportunities to boost your bottom line without increasing your spending too much.

You’ll need the right software, as well as trained experts, to get the most out of your SaaS accounting experience.

When you use SaaS accounting to your advantage, you can more easily gain advantages over your competitors. Also, you can make sure your company is prepared for any sudden events or changes in the fast-paced world of SaaS business.