Did you know that Canada currently ranks as the world’s ninth-largest economy based on GDP and that the average Canadian spends CA$2,703 on eCommerce purchases every year?

The home of hokey and maple syrup, with its robust economy and digitally engaged population, stands as a compelling opportunity for online retailers in North America and across the globe. Canada’s unique market dynamics, coupled with its high internet penetration and consumer purchasing power, all come together to create a fertile ground for eCommerce ventures.

To help you succeed, in the Canadian eCommerce market, this guide will provide essential advice and insights for selling in this vibrant and growing space.

Understanding the Canadian eCommerce Market

1. The Rise of eCommerce in Canada

Despite recent global economic pressures, Canada’s economy has shown notable resilience, mirroring its southern neighbor’s post-pandemic recovery trajectory. With a steadily growing disposable income and a consumer base increasingly inclined toward online shopping, Canada offers a promising arena for both B2C and B2B eCommerce entities.

Backing this, research indicates that the B2C eCommerce penetration in Canada will be near 80% by 2027. This has a lot to do with the recent availability of website builders, making the establishment of an online presence more accessible. In particular, WordPress platforms are a favorite amongst entrepreneurs, as they tread the line between ease of use and customization, presenting a middle point between the likes of Shopify and full-on custom code.

2. A Growing Digital Consumer Base

Boasting some of the highest internet penetration rates globally, ranging from 94% to 97%, Canada is further committed to expanding the country’s high-speed internet access. The government has promised to invest nearly $3.3 billion to achieve full high-speed internet coverage for the entire population by 2030.

This initiative is expected to bring an additional 2.3 million users into the high-speed internet fold by 2028, translating into a substantial pool of potential eCommerce customers and driving the demand for online shopping solutions.

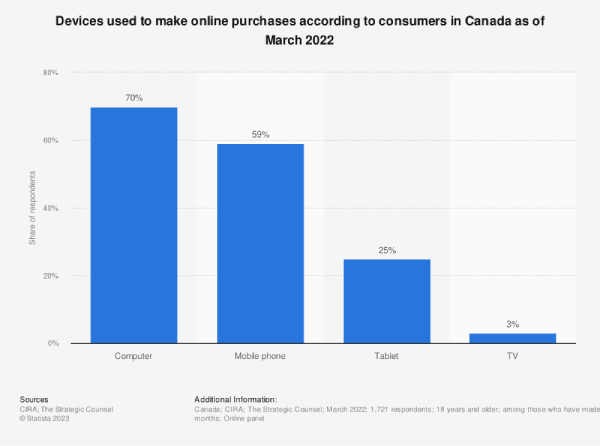

3. Emerging Market Opportunities in Mobile

The rise of mobile commerce, also known as m-commerce, is backed by high smartphone penetration and investment in mobile shopping platforms. This move directly underscores the ongoing shift towards Canadian consumers preferring omnichannel retail experiences.

From 2017 to 2024, the proportion of mobile shoppers in Canada escalated from 27.9% to 34.5%. Given the nearly 92% smartphone penetration rate and the fact that 40% of Canadian businesses are enhancing their investment in consumer mobile applications, growth is expected to persist. Analysts predict this upward trend will continue through 2026, by which time mobile purchases are projected to exceed 42%.

Succeeding in the Canadian eCommerce Market

1. Changing Shopper Preferences

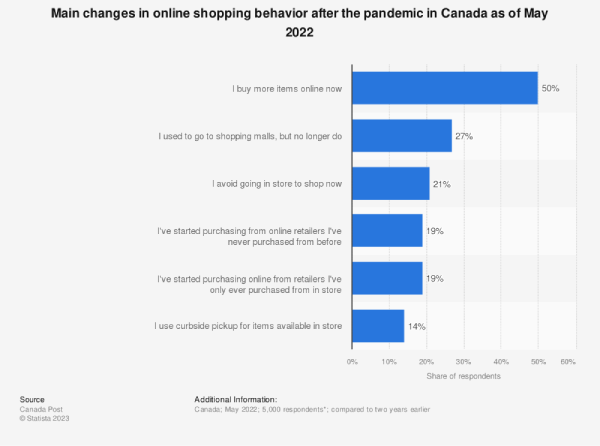

While unique in its own right, Canada’s eCommerce market has evolved in tandem with the U.S. market, reflecting some shared traits in terms of both infrastructure and significant shopping events. Some of the key motivators for Canadian online shoppers include competitive pricing, the convenience of direct home delivery, and ease of shopping.

However, when choosing their shopping destinations, Canadians place a high emphasis on straightforward, effortless return policies, exceptional customer service, and an overall satisfying shopping experience.

2. The Importance of Pricing

Price consciousness is rising among Canadian consumers, mirroring a trend seen in the United States. A recent survey indicates a majority of online shoppers in Canada are actively aiming to reduce their spending due to the current economic uncertainties. Despite this inclination toward frugality, Canadian online consumers continue to exhibit robust spending behaviors.

In fact, when it comes to the average spending per transaction, Canadian online shoppers outpace those in nearly every other country, trailing only behind the US and Japan. The reason? Well, 82% of Canadian eCommerce shoppers bumped their spending during the pandemic.

3. Focus on Reviews and Free Delivery

Investing in customer feedback and reviews, along with optimizing delivery services, are both important for online retailers that are targeting the Canadian market. Reviews and ratings tend to significantly influence purchasing decisions, with nearly half of Canada’s online shoppers consulting them before deciding to buy.

The importance of efficient fulfillment processes cannot be overstressed—naturally, Canadian consumers love free shipping, with 80% of shoppers pointing to it as a key factor when deciding to purchase a product online. However, the efficiency of delivery is equally vital here; timely delivery is expected, and any delays can significantly impact customer trust, potentially deterring about 30% of consumers from future purchases or loyalty to the brand.

4. The Big Business of B2B Commerce

Canada’s eCommerce sector, ranked within the global top 10 and generating over $55 billion annually in B2C sales, is dwarfed by its digital B2B market, which is estimated to be five to six times larger. This substantial growth in the B2B arena is largely driven by consumer eCommerce trends, prompting significant investments in digital commerce technologies.

From 2012 onwards, revenues from B2B online sales have outright quadrupled in Canada. By 2016, half of the B2B vendors reported that a quarter of their revenues came from online transactions, and by 2019, this sector’s online earnings surged to approximately $220 billion.

The advent of the COVID-19 pandemic further accelerated this growth, with a year-over-year increase of 30% in online B2B sales, culminating in nearly $290 billion in revenue in 2021.

The Growing Software Market

The Canadian software market, ranking among the largest globally, experienced a slight downturn during the COVID-19 pandemic but has robustly bounced back. Projections suggest it will surpass $21 billion by the end of 2023. Over the next four years, the market is expected to grow at a compound annual growth rate or CAGR of 4.65%, reaching an estimated $26.44 billion by 2028.

A significant portion of this market, over 41%, is attributed to enterprise software, which is anticipated to generate revenues of $11.6 billion by 2028. Beyond enterprise solutions, the Canadian market is also recognized for its vibrant productivity software segment, presenting ample opportunities for software vendors of various scales across different sectors.

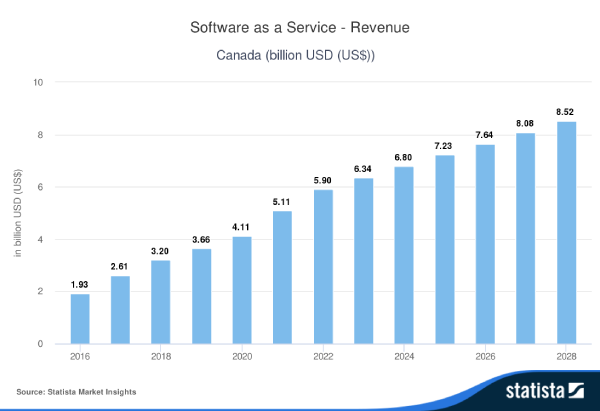

Steady Subscription Growth

The rise of the subscription economy and the pursuit of recurring revenue are reshaping business strategies in Canada, a trend that was already in motion well before the COVID-19 pandemic. Canada’s subscription market was notably strong across various categories, with the software-as-a-service or SaaS sector leading this transformative growth.

From 2016 to 2019, the SaaS industry experienced rapid expansion, with revenues soaring from $1.9 billion to $3.7 billion. The advent of generative AI and the substantial corporate investment in subscription software—over $300 per employee—signal a promising yet unpredictable growth trajectory for the SaaS sector, which is projected to achieve a CAGR of 5.80% through 2028, potentially reaching $8.5 billion.

Beyond SaaS, the subscription model thrives in other areas as well. Canada stands out as a major hub for streaming services, coming in just behind the U.S. in terms of penetration rates globally. Currently, 75% of Canadians have at least one streaming service subscription, with 80% engaging in some form of video content consumption through subscription or ad-supported platforms. Netflix dominates the market, but Canadian services like Crave are also on the rise.

Music streaming services enjoy widespread popularity, too, with the average Canadian spending about two hours daily on these platforms. Additionally, the Canadian market is embracing subscriptions for physical goods and services, including replenishment services, beauty and fashion items, meal kits, pet supplies, and curated box subscriptions.

Succeed at Selling Online in Canada

There are three specific best practices you must implement when selling online to Canadians:

Localize the Cart and Checkout Experience

Localizing content to cater to both English and French speakers is essential, not just in terms of language but to align with various cultural nuances. On top of this, your pricing should be displayed in Canadian dollars, and social proofs or testimonials should be integrated into the shopping experience, particularly in the checkout interface.

Canadian shoppers dislike paying in USD due to high currency exchange rates. Since the currency symbol ($) looks the same for CAD and USD, you must explicitly state on your website and shopping cart that pricing is in CAD or USD to avoid confusion and cart abandonment.

While static hard coding of these elements is one approach, it lacks scalability, especially for global retailers managing numerous storefronts and product lines. A more dynamic and adaptable solution is recommended, such as using templates that automatically adjust pricing and language preferences based on the shopper’s location (Quebec or otherwise) and the language settings of their browser.

Various factors, such as currency fluctuations, a rising inclination towards local purchasing, and the bilingual nature of the population at large, all present unique challenges for international retailers to sell in Canada. To succeed in the Canadian market, these foreign sellers must deliver an exemplary shopping experience, encompassing every aspect from site navigation to checkout.

Offer Accessible Payment Options

Over 44% of Canadians currently engage with some form of digital financial service. In 2022, a striking 98.1% of Canadian consumers executed at least one digital transaction within the year.

Despite the nation’s significant embrace of fintech, credit and debit card transactions continue to predominate in the eCommerce sphere, accounting for over half of all purchases. However, the market is constantly evolving, and alternative payment methods, including digital wallets and Buy Now, Pay Later services, are increasingly popular and are projected to incrementally reduce the market share of traditional bank cards going forward.

In fact, many upstart e-commerce entrepreneurs rely on small business savings accounts and even unorthodox financing options, such as invoice factoring or trade credit. This directly stems from the fact that Canada stands out as one of the most heavily banked countries globally, boasting nearly complete penetration and fostering a robust digital banking culture.

Taxation and Compliance

Canada’s approach to sales tax is notably distinct from UK and Europe. Canada lacks a uniform sales tax system, and the rules for defining and taxing digital goods and services vary significantly across its provinces and territories. This is similar to the US system, where each state sets and governs its own sales tax.

This decentralized framework means that tax regulations are primarily determined at the provincial level, ultimately leading to a diverse array of policies. For instance, certain provinces mandate the collection of sales tax on all digital products and services, while others, such as British Columbia, implement various exemptions. However, there is also a federal Goods & Services tax (GST) that is layered on top of any provincial sales tax.

For businesses operating in Canada, this necessitates either a diligent effort to stay informed of and comply with the tax rules of multiple jurisdictions or the adoption of a platform or service that can manage these complexities on their behalf. Likewise, e-commerce accounting is mostly digital, which allows site owners to just use Freshbooks, Xero, ZohoBooks or similar accounting tools for remote and painless tax filings, monthly reports, and investor presentations if needed.

In addition to taxation, it is important to understand compliance and privacy regulations in Canada. While the pace of adopting stringent data protection regulations may not match Europe’s, privacy remains a critical concern among Canadian consumers.

The nation is gradually progressing towards establishing GDPR-esque privacy safeguards to protect its citizens. Vendors aiming to enter the Canadian market or conduct business within any specific province are thus advised to seek guidance from legal professionals or consult with relevant Canadian trade authorities to help them overcome regulatory hurdles.

Tapping into Canada’s Vast eCommerce Opportunities

Canada’s digital marketplace offers a vibrant and diverse environment for online retailers, characterized by its robust economy, high internet penetration, and a consumer base eager to engage in online shopping.

While exploring the potential of the Canadian eCommerce market, it’s important to acknowledge the operational backbone of most e-commerce brands: small but agile teams. In this competitive market, the prowess of a well-trained, cohesive team cannot be overstated.

For many, the dream of leveraging advanced solutions like SAP staff augmentation, automation, and upscaling remains just that—a dream. However, even small teams can explore strategic enhancements to help them improve efficiency and market responsiveness.

The country’s distinctive market attributes, including its currency-sensitive shoppers, bilingual culture and varied regional tax laws, present unique opportunities and challenges for eCommerce ventures. So whether you’re looking to expand your B2C offerings or tap into the burgeoning B2B eCommerce sector, understanding Canada’s specific needs and preferences is essential for your company’s success.

To learn more about the eCommerce market in Canada, including the largest barriers to cross-border purchasing according to Canada consumers, read our eBook “eCommerce in Canada” and discover everything you need to sell on the eCommerce market in Canada.