Chargebacks can be a nightmare, but knowing what causes them can guide a business to where and how it needs to improve its online payment processing capabilities. As such, there are times when false chargebacks can occur and disturb the safety of online payments. In this post, we’ll take a look at what fraudulent chargebacks are and what measures you can take in order to protect your online business.

Online transactions are sometimes hijacked by scammers, which affects the customer’s experience and can make them feel insecure when buying online. In today’s eCommerce environment, both merchants and shoppers expect nothing less than a smooth and safe digital experience, but with the growth of digital commerce come some serious security challenges that every merchant has to confront in order to keep a safe environment for its business and shoppers.

The COVID-19 pandemic has only increased the risk of fraudulent behavior and transactions. While scammers are taking advantage of the fact that most people buying online these days due to quarantine, merchants are left dealing with the consequences.

It is the merchant’s responsibility to ensure the security of the digital environment where shoppers complete their transactions. Therefore, managing fraudulent chargebacks is something online businesses must all keep an eye out for, whether they outsource the whole process to their payment service provider, or decide to take it upon themselves and manage it with an in-house team.

How do fraudulent chargebacks happen?

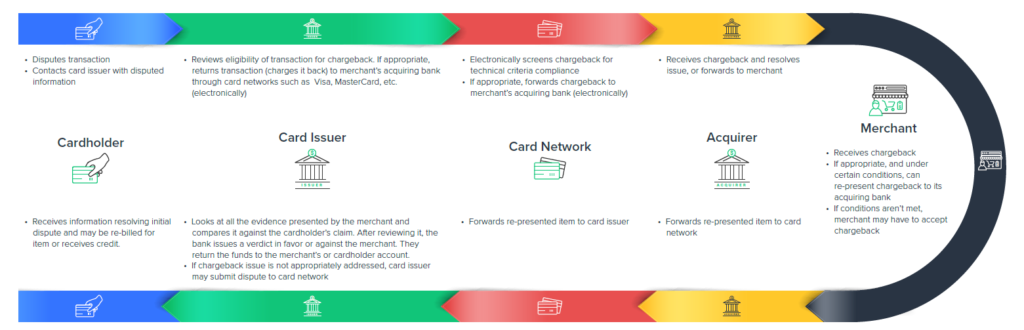

First things first: the chargeback process occurs when a shopper (apparently) placed an order on the merchant’s online store, and, for a range of various reasons, do not recognize the transaction later and request their money back.

Now, this may appear similar to a refund, yet there is a slight difference between the two.

The chargeback process starts with the shopper going straight to the issuing bank to request their money back, instead of contacting the merchant with the demand. Afterwards, the bank investigates this situation and, if it reaches the conclusion that the shopper’s request is valid, funds are returned to the customer, forcing the merchant to lose revenue. (Our free eBook resource on the subject, “Understanding Chargebacks and How to Avoid Them,” provides a detailed look into all stages of the chargeback process).

There are two types of chargebacks.

A friendly chargeback occurs when the cardholder files a chargeback instead of trying to first obtain a refund from the merchant. This can also happen due to unknown purchases made by family members or unclear product details on bank statements or invoices. For example, let’s say you notice a payment you do not recognize on your card, and you make a request to your bank to refund the amount. The amount in question could have been your automatic withdrawal for a subscription you had signed up for and forgotten about, or maybe someone from your family okayed the transaction. This falls in the friendly category because there was no ill-intent behind the user’s action, it was simply an error by omission.

The second type includes the more serious fraudulent chargeback, when an illegal transaction is initiated by someone who stole a credit card or the credit card details, and the payment was accepted. In this scenario, the fraudulent purchase is disputed by the official cardholder, generating a chargeback.

In order to take preventive measures against chargebacks, merchants should consider implementing automated protection features and revisiting the way the customer experience unfolds. Following are some tools to help you provide the ultimate protection for your customers, and, in turn, your business and its bottom line.

Address Verification Service

Address Verification Service, also known as AVS, is a transaction security measure established by Visa, MasterCard and American Express in USA, Canada, and the UK, used extensively in the United States, that helps merchants prevent fraud. This service works to verify if the cardholder’s address is correct or invalid, based on the card’s billing address that is granted and registered in the bank’s files. After the bank has checked the data, it provides the information to the merchant or the merchant’s payment provider with the address details, to see if it is correctly associated with the cardholder. The Address Verification Service compares the address, including postcode, entered by the shopper with cardholder’s records and the results are passed back to the merchant/provider who decides how to further proceed with the given transaction information. AVS is a very helpful security tool to reject potentially fraudulent transactions, minimizing the risk of chargebacks.

PSD2

PSD2, also known as Payment Services Directive 2, is a set of laws for payment services, that aims to make the European payments market much more efficient and safe by protecting its users against fraud. PSD2 offers a wider layer of protection via Two Factor Authentication (2FA), a mechanism that plays an important role combating fraud. So, to protect the confidentiality of end customer’s security credentials, each online purchase within the European Economic Area must pass the 2FA process. In order to meet its requirements and to proceed with the payment transaction, the authentication requires at least two of the following elements:

- Knowledge – something the customer knows (PIN, password)

- Possession – something the customer owns (token, phone device, email, application)

- Inherence – something the customer is (this includes biometric authentication, such as fingerprints, facial features, voice patterns, etc.)

These requirements were created to optimize transactions and protect the process against fraud behavior, improving both shoppers’ and merchants’ experience with high security measures, in order to achieve faster and secured payments.

3D Secure 2.0

3D Secure 2.0 is the latest technology version of 3D Secure, which allows merchants to verify transactions with the cardholder’s issuing bank, bringing a new approach for authentication by allowing banks and merchants to share rich data in the background.

So, after a shopper places an order, the transaction is processed by the issuing bank that will approve or deny the transaction, based on the customer’s information. This information is checked for risk assessment and 3D secure verification, and the resulting data is sent immediately back to the merchant.

Credit card security codes (CCV)

Credit card security codes are very important when it comes to preventing chargebacks. This is a safety feature that helps both parties because it improves the shopper’s confidence and protects merchants from dealing with fraudulent and suspicious chargebacks. The card security code is featured on each card, a code of three or four digital numbers that help authenticate online transactions. This CCV code is collected by the merchant/provider along with the rest of the card details, and sent directly to shopper’s bank for authentication. If any issue occurs, the bank cancels the transaction.

Flawless customer service

The best protection against chargebacks is prevention.

If your clients feel compelled to turn to the bank first, it may be because they are having a hard time contacting you. Make sure your contact channels are easily accessible and visible. Caring for customers is the key for every eCommerce business, and a flawless customer service experience will increase their trust and confidence in your business.

This will in turn make them less likely to turn refunds straight into chargebacks. Communicate with users about any issue, whether it is technical or just a misunderstanding due to communication, and notify your shoppers when you experience setbacks that could affect their transaction’s processing and delivery. Keep regular updates in order to inform your customers about any situation that could potentially affect them.

Delivery Confirmation

Delivery confirmation is a helpful tool for merchants that sell both digital and physical goods, as it provides useful information about the order’s status, such as the exact date and time the purchase has been made, and when and how it will be delivered. This mechanism will boost your shopper’s confidence in your services, and it is also an important piece of evidence for any merchant in case a customer decides to start a dispute.

Transaction Review

When it comes to chargeback prevention, reviewing your transactions for fraudulent activity or unhappy customers applies to both new sales and existing sales. Review your older sales to see if there are suspicious transactions or upset buyers with orders that require a partial or full refund, in order to avoid chargebacks. Make sure you also review your orders to check that information is legitimate, such as valid phone numbers, and confirm that they match the states and/or countries listed on the billing information. If you see that information does not match or is not valid, verify the order via phone to ensure its authenticity. When in doubt, ask your payment provider for assistance with your fraud review.

It is very important to analyze each transaction made in order to avoid scammers. Make sure you keep all transaction history and examine any purchase that has turned into a dispute, to better understand what to do in the future to prevent any fraud issue from happening again.

The key findings for staying away from fraudulent chargebacks

Fraudulent chargebacks are without a doubt a big challenge for every eCommerce business, but merchants have an array of tactics they can deploy to keep chargeback rates low. Embracing the strategies listed above will help you combat chargebacks. Clear communication and honesty are important mindsets in creating a strong bond with your clients, avoiding the risk that they will run straight to their bank.

Although managing fraudulent chargebacks is a serious and complex ongoing project, it is not an impossible task. As a payment processor with integrated services, 2Checkout can help merchants implement fraud-prevention tools, such as card and address verification systems, pre-authorization, and dynamic 3DS to keep their business protected.

In general, fraud detection tools are vital when selling online in local or global markets, helping you combat fraud, manage business transactions, and assisting you in lowering chargeback rates and improving overall customer experience levels.

If you want to learn more about preventing your eCommerce business from fraudulent payments and more, watch our free webinar – Payment Fraud Prevention: An eCommerce Industry-Wide Perspective.