Every year, cloud software and online services companies lose millions of dollars in potential recurring revenue to customer churn. While reducing churn is mission one for any subscription-based business, most retention strategies neglect one of the biggest and most recoverable causes of lost recurring revenue: failed payment authorizations.

With more than one out of every six card transactions failing for one reason or another, implementing strategies to reduce and/or recover declined authorizations is one of the best investments any recurring-revenue based business can make. Just as there are many reasons for payments to fail, there are numerous ways to prevent and recover them. The most successful retention strategies use many of these tactics simultaneously, and advanced tracking and analytical tools to monitor and optimize results.

We touched in a previous blog post very briefly on the need to optimize authorization rates. Here we’ll dive deeper into how you achieve that though some examples of revenue recovery tools and their impact on authorization and renewal rates. Even if you don’t have the in-house resources to manage these as a vendor, at least you know what to ask from your commerce or payments provider.

Multi-currency Management

Multi-currency management offers access to local billing currencies and improves localization. While pretty obvious, it’s worth reiterating it’s an important capability to have and use, from new acquisitions to renewal pricing configurations.

- Limits cart abandonment

- Increases authorization rates by up to 25%

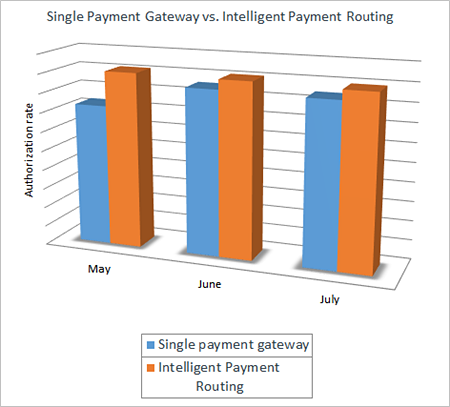

Intelligent Payment Routing

Prevents payment failures before they happen

Intelligent Payment Routing enables you or your provider to automatically match or route card transactions to the payment gateways best equipped to handle them and retry authorizations using a failover or back-up gateway.

- Increases authorization rates between 2% and 5% globally

- Up to 40% increase in authorization rates using local payment processors in specific markets

Dynamic 3D Secure

Has a positive impact on authorization in specific countries and mitigates fraud risks

3D Secure is provided by the credit card schemes, allowing an additional layer of security on card-not-present transactions.

3D Secure can have a positive impact on authorization in specific countries, for example in Japan and European markets. There are also countries – e.g. the US – where it is not recommended to use this service, so this strategy needs to be granular at country level.

- Using 3D Secure for risky transactions decreases fraud & chargeback rate

- Authorization rate uplift: 1%

Account Updater Service

Ensures billing continuity for active subscriptions

Account Updater enables you or your provider to automatically update subscription customer card data when cardholder information changes or goes out of date.

- Seamlessly updates stale (out of date) credit/card accounts

- Authorization rate = over 75% for updated cards

Expired Card Handling

Increases authorization rates for expired cards

Expired Card Handling enables you or your provider to identify and update expired cards in order to increase authorization rates.

- Automatically extends the expiration date for subscribers’ debit and credit cards

- Authorization rate uplift: 4%

Configurable Retry Logic

Enables the automatic recovery of payments for soft declines

Configurable Retry Logic recovers up to 20% of failed transactions due to soft declines. These are temporary authorization failures which may be successful after subsequent attempts: insufficient funds; card activity limit exceeded; failures due to system, technical or infrastructure issues; expired cards.

- Minimizes failures and increases recovery rate

- Combined with Expired Card Handling achieves 40-50% authorization rates for expired cards

Dunning Management

Recovers revenue even from hard declines

Dunning is used in the case of hard declines. These are permanent authorization failures that cannot be recovered: stolen or lost cards, invalid credit card data, account closed

- Impact: 10- 20% of total declines.

- Authorization rate uplift: 1%

Hope you found these examples useful!