Unexpected costs are a major reason for cart abandonment in eCommerce around the world, with 37% of online buyers deciding to give up a basket if it surprises them with extra costs. And, while focus on the customer’s experience has made many sellers more transparent with shipping or service costs, handling taxation in the checkout is still perceived as a difficult business challenge.

Why is handling taxes in checkout so hard?

In their attempts to grow by reaching new markets and selling their products across borders, merchants quickly find that, in order to be compliant in these new regions, they have to follow local regulations for taxing the sale of goods and services. “Nothing a qualified accountant or legal collaborator couldn’t handle for my business, right?” you may think. And sure, legal council is invaluable in handling taxation in a country, but it doesn’t cover the customer experience side of the transaction.

Beyond registering, reporting and remitting taxes, one of the current pain points in cross-border eCommerce is introducing the customer to taxes in a timely and accurate manner.

What are the different taxes involved?

To start with, there isn’t one universal tax merchants have to collect. Depending on where they sell around the world, merchants will have to collect and pay some form of consumption tax that may vary significantly from one country to another.

Generally speaking, consumption taxes are those taxes that apply to the sale of goods or services, with the goal of collecting government revenue from the end consumers for the goods or services acquired. Sales tax is the most widely employed form of consumption tax, either in the form of GST, VAT or sales tax, but other similar tariffs and excises also belong to this category. The end consumer is always the one that bears these taxes on consumption, either directly or indirectly. And it is this second scenario that gives merchants a hard time when trying to be transparent with all the applicable costs.

Think of it this way: the customer enters your site and decides to buy a product/service from your offering. As a merchant, it is your responsibility to collect any sales tax applicable to this sale, and then send it back to the state during tax seasons. This is easy enough when you’re selling in your home market, but what if you’re targeting 5 countries? Or 10 countries? Or 20 countries on 3 different continents? The more a merchant scales to new markets, the more attention they must pay to adapting their taxation regime to the regulations in force in that country. And, subsequently, the more effort they have to put into ensuring their storefronts and online websites are featuring a predictable tax experience for prospects in that country. Further complications arise from the fact that many of these taxes are levied on end consumers, but not business consumers, so stores need to be properly equipped for each tax scenario.

Let’s see how online merchants in different regions handle taxation and what expectations customers are bringing to the table.

Selling in Europe

Value Added Tax (VAT) is a general tax applied to all sales of goods and services in the European Union. VAT is a consumption tax, meaning it is paid by the end consumer, but merchants doing the selling are the ones who charge the VAT rate to the client. The VAT rate varies among EU countries and it can be anywhere between 17% and 2% (reduced rates may apply for specific goods or services).

VAT in the EU is applied to sales of both physical and digital goods, but the two categories have different rules on how taxation is regulated for cross-border sales. Let’s look at each in turn:

Digital goods are classified by the European Commission as those which are delivered over the Internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention, and impossible to ensure in the absence of information technology.

VAT for digital goods sold in EU is collected as follows:

- For businesses located outside the EU selling digital goods:

- B2C: Always charge VAT on the sale of digital goods using the VAT rate applicable in the European customer’s country.

- B2B: Use the reverse-charge VAT mechanism. Do not collect VAT from the buyer, but request their VAT number and provide them with a detailed invoice.

- For businesses located inside the EU selling digital goods:

- B2C and B2B in the European country where your business operates: Always charge VAT when selling digital goods in your home country.

- Outside your home country, in the EU:

- B2C: Always charge VAT for all B2C sales. The VAT rate depends on the yearly volume of cross-border digital good sales you make across the entire EU. If you sell below €10,000 (~$12,000) in digital goods throughout the EU in a year, you may charge the VAT rate of your home country. If you sell more than this threshold in a year, then you must charge the VAT rate of your customer’s country of residency.

- B2B: Do not charge VAT, but request the buyer’s valid VAT number for invoicing and your records. The buyer will pay the VAT themselves to their own government.

You can verify another business’ VAT number on the European Commission VIES VAT platform.

If you’re selling physical goods in the EU, VAT charging may depend on your annual sales.

- Businesses located outside the EU selling physical goods:

- B2C: Always charge VAT at the rate of the European customer’s country of residence.

- B2B: Use the reverse-charge VAT mechanism (provide an invoice with information and your customer will pay the VAT).

- Businesses located in the EU, selling physical goods outside your own country:

- B2C: Always charge VAT. If your annual sales to that country exceed a certain threshold (which varies by country), charge the destination country VAT rate and register for a VAT number in that country. If your annual sales to the consumer’s country are below the imposed threshold, then you charge the VAT rate of your own country and file for taxes in your own country.

- Note: These rules do not apply to excisable goods, like tobacco or oil, for which the thresholds do not apply and must charge VAT in the purchasing country!

- B2B: Use the reverse charge VAT mechanism and collect the business’ VAT number.

Real-world VAT examples

Let’s start with a look at Germany. The country imposes a VAT of 19% on taxable goods or services, though some items like eBooks or food may qualify for reduced VAT of 7%. Shoppers in this market always expect to see the final price, including the amount owed for VAT. As a result, the total price is shown from the very product page.

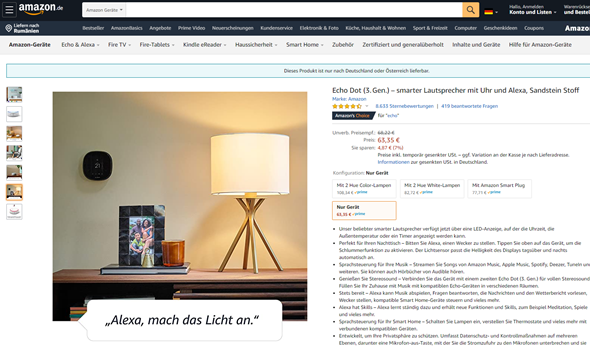

On this Amazon.de page, we see an Echo Dot price with VAT included. The disclaimer under the text specifies “Prices including temporarily reduced VAT – if necessary, variation at the checkout depending on the delivery address.” The page includes an informative link on the reduced VAT rate in Germany.

Besides the product page, the price including VAT is also shown in the checkout.

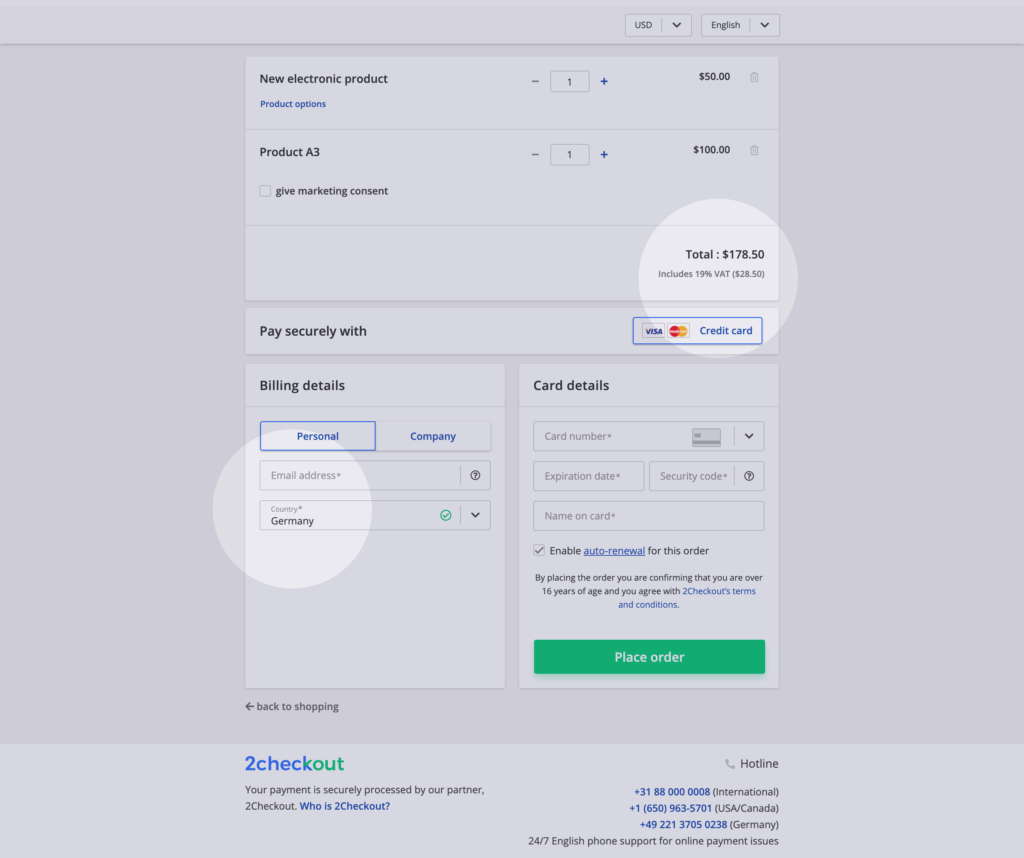

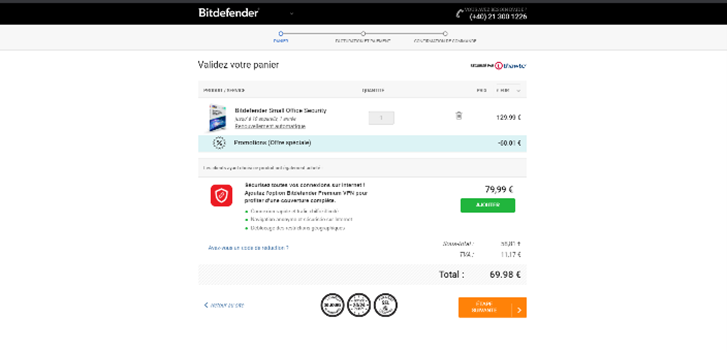

Let’s try another example, from France. A standard VAT rate of 20% applies in France on taxable supplies of goods or services and some items also qualify for reduced VAT in France, such as certain pharmaceuticals. Much like their neighbors in Germany, shoppers in France also expect to see the full price, including VAT, from the start of their purchasing journey on visits to eCommerce sites.

The sale in this example concerns an electronically delivered product, Bitdefender antivirus, which advertises a bundle of licenses for business shoppers. The product page shows the full price, including VAT.

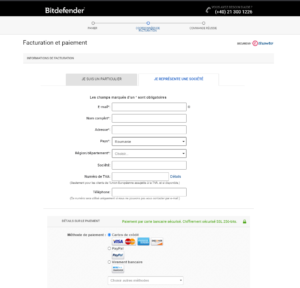

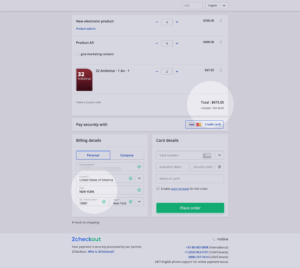

On the checkout page, as expected, the total price is shown again, as well as the subtotal plus VAT. In the billing stage of the checkout, the buyer will be prompted to identify his business with a valid EU VAT. If such an identifier is provided, VAT will not be applied to the final price in the cart.

Furthermore, VAT may also apply for digital goods sold in other European countries that are not members of the EU. For example, sales in the United Kingdom, Switzerland or Serbia may generate the obligation to register in these respective countries to collect and pay VAT to the authorities. There are still countries in Europe where a VAT registration requirement has not been implemented yet (e.g., Ukraine), but you should keep an eye on the news as the legislation may change soon.

Selling in the U.S.

Unlike Europe, which operates under the value-added-tax (VAT) system, the United States issues a tax on sales or on the receipts from sales. Currently, 45 states and the District of Columbia issue a general sales tax on most goods and certain services (with some exemptions in place). Sales tax in the United States applies at both the state and city level, resulting in thousands of different tax rates across the country. As if that weren’t enough, each state and city has different rules on whether or not sales tax applies to a particular good or service. This means that the sale of a service may not be taxable in California, but it may be taxable in Arizona. Additionally, you may find that there is a reduced rate or exemption for children’s clothing in New Jersey, but that the same children’s clothing sold in Ohio is taxable. Finally, a service may be exempt in the state of Illinois, but the city of Chicago (located in Illinois) will impose a tax on that same exact service! Does that sound complicated? It is.

With hundreds and thousands of different tax rates across the United States that vary based on exactly where and what is being sold, sales tax in the United States can get mind-boggling really fast.

To ease the pain, sales tax is charged at the time of sale to the end customer and is determined at the point of checkout. This allows the merchant to calculate the appropriate amount of sales tax based on what is being sold (and where) to accurately determine how much needs to be charged to the end consumer. As a result, throughout the United States, a merchant’s list price will always be exclusive of sales tax. This is very different from countries in the EU where tax is generally embedded in the list price. At the final point of sale, whether we’re talking about an online checkout or an in-store POS payment, the shopper will pay the product’s listed price, plus the applicable sales tax for that particular product based on the jurisdiction’s specific rates. So, for example, if the list price for a product is $100.00 and the tax rate for the product in the jurisdiction where it is being sold is 5%, the total price paid by the end customer at checkout will be $105.00.

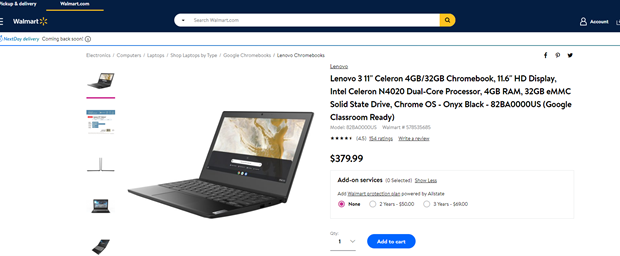

In this example from Walmart, the final price due to the customer (including sales tax) isn’t shown on the product page. Nor is it shown in the second step, where the shopper is asked to confirm their location via ZIP code. It won’t be calculated for the location until the next step in the checkout process, like in the example below.

Are B2B transactions treated differently? Yes and no. It depends on whether the business holds a valid sale tax exemption certificate (e.g., non-profits, charitable organizations, etc.) or a reseller’s certificate (i.e., that the business intends to make a forward sale of the product and the product is not for final consumption). In such cases, the business will need to furnish the exemption or reseller certificate to the merchant in order to qualify for a tax-exempt sale. No such certificate in hand? Tax will be due on the taxable sale or service.

Selling in the rest of the world

Many countries in the world have implemented provisions similar to the EU and the U.S., meaning that you may be obliged to register to collect and pay to the authorities the appropriate sales tax.

The situation differs from country to country, meaning that there are some jurisdictions where businesses are obliged to register for both B2B and B2C sales (e.g., Japan, South Africa), other countries where you should register only for B2C sales (e.g., Australia, South Korea, India) and jurisdictions where such taxation rules have not been yet implemented but the authorities intend to update legislation soon (e.g., Egypt).

Best practices when displaying pricing

Pricing is one of a shopper’s key elements for considerations during a store visit, as attested by the multitude of pricing models that have been developed in the SaaS space. The way pricing is handled in the checkout process can make the difference between a sale and an abandoned cart. You can create a seamless purchase funnel by ensuring that the price displayed on your ads, landing pages and website is consistent throughout. This will avoid any unpleasant or confusing surprises when a shopper is making a purchase decision on the checkout page. Some of the most important elements include ensuring the price is displayed in the shopper’s local currency throughout the purchase process, and that the price includes or excludes sales tax according to the shopper’s location.

We recommend using in-country pricing or “pretty pricing” to establish a set price point (e.g., $39.99) instead of relying on the daily foreign currency exchange rate, which changes often and will likely result in a random price (e.g., $39.18). This may require you to implement geo-location on your website to detect the shopper’s location and integrate with your shopping cart through an API to pull the local in-country price from the catalog. This technology is not difficult to implement and can have a significant impact on cart conversion rates. For example, 2Checkout platform data shows that merchants using the local currency can experience conversion rates 25% to 95% higher than when using a generic currency. As far as cosmetic localization is concerned, be sure to display the currency in a style that is familiar to shoppers in your targeted region. Whether we’re talking about the currency symbol, its placement or the decimal separator, your payment provider’s multi-currency management capabilities will go a long way here.

In terms of market-based localization for pricing, consider aspects like the exchange rate to avoid buyers getting a subscription at a price level and then renewing at a different one.

Conclusion

Each new market you want to sell in requires paying attention to local currency and taxation rules, as these translate into user journey elements that either convert customers or scare them away. There is no one general rule to follow to understand how a state or a country handles taxation.

Experts in the field recommend that, given the multitude of taxation regulations in each market and their updating nature, online retailers, small business owners and other providers can benefit from the right software solutions to manage the complexity of taxation. This way, merchants can ensure they’re always local and relevant in the way they present themselves, and they can enhance this customer experience aspect in the process. This can be achieved by working with a payment provider in a Merchant of Record (MoR) or reseller business model. Your provider, the MoR, assumes your financial and legal responsibilities for transactions and takes care of all tax obligations in each market where it’s acting as your reseller.

As an all-in-one commerce provider, 2Checkout enables merchants all over the world to bring their offerings to foreign markets and deliver shopping experiences that align to customers’ currency, pricing, and taxation expectations. Our platform includes versatile capabilities to geo-locate the pricing shown in the checkout, adapting it to local preferences. In addition, you can also work with 2Checkout in a reseller model, offloading the complexity of tax handling to us in the markets you’re selling into.

Talk to a consultant today to see how 2Checkout can help you streamline eCommerce activities while complying with complicated tax regulations.