Updated in July, 2021

Bringing leads into your sales funnel and converting them to loyal customers and brand advocates requires significant planning. However, even after a lead has turned into a loyal customer, your work is still not over. The focus must then shift to customer retention and enacting strategies to minimize both voluntary and involuntary churn.

Proper customer-centric strategies and communication are essential for reducing voluntary churn, but involuntary churn is most often neglected and caused by not using the right tools.

Focusing on Involuntary Churn

Many SaaS marketers understand the techniques necessary to reduce voluntary churn. However, preventing involuntary churn can be much more enigmatic, because it is often caused by technical glitches that SaaS marketing teams have not considered or tested. And most importantly, involuntary churn is preventable to a significant extent, which means that you can eliminate as much as 20% of this churn with little effort.

Bonus: Watch the webinar with Avast and find out how to identify product pain points through analysis of your customer churn.

The events that cause involuntary churn mostly related to payment processing issues—are addressed by standard tactics:

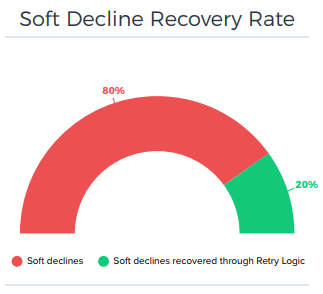

- Soft declines are temporary authorization failures which may be successful upon re-trial of payment.

Reasons include:

- Insufficient funds

- Card activity limit exceeded

- Processing failures – timeouts

- Expired cards

- Hard declines are permanent authorization failures that cannot be recovered and should not be retried. We estimate that 10 to 20% of declines are hard declines.

Reasons include:

- Stolen or lost card

- Invalid credit card data

- Account closed

Involuntary Churn Benchmarks

Industry benchmarks for involuntary churn vary by, well, industry. While the overall software industry average for start-ups is 6.73%, B2C companies can expect to see more churn than B2B companies, perhaps due to the less critical nature of solutions that consumers choose and also due to the buying process, which for B2B is more thorough and involves more people. On average B2B churn is about 6.22%, while B2C companies churn at 8.11%.

While churn rate is important, it’s also crucial to consider the value of your customer. The greater the value of your customer to your business, the more you need to combat churn. In other words, make sure to look at churn alongside other key metrics such as revenue, average revenue per user, CLTV, new accounts, customer acquisition costs and other important details for the business.

Just as there are many reasons why payments fail, there are also numerous ways to prevent and recover them. Advanced payment tools can provide invaluable ways to increase authorization and conversion rates, reduce churn and improve the customer experience while retaining much-needed revenue. Specialized revenue recovery tools can drive up to 20% revenue uplift, and luckily, there are options available in this area.

Tested Tactics to Improve Involuntary Churn

To combat both hard declines and soft declines, you should put in place some smart payment tools. As a SaaS, obviously, you shouldn’t need to worry about these or start building them. Just to be aware of what you need to look for when it comes to payment options, especially on the recurring side.

The following capabilities, easily provided by a comprehensive eCommerce platform like 2Checkout, will help you maximize your MRR or ARR and reduce customer churn:

Prevent Payment Failures with Intelligent Payment Routing

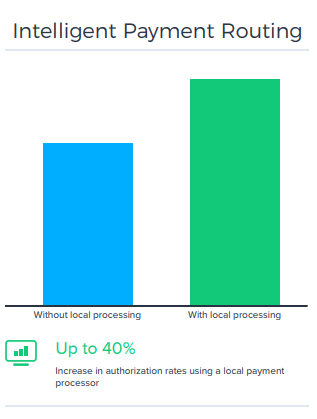

Intelligent Payment Routing can route and re-route card transactions to the payment gateways that are best equipped to handle them, as well as retry authorizations using a failover or back-up mechanism. Combining these methods can increase overall card authorization rates between 2% and 5%.

An equally important aspect of payment processing involves routing transactions to local payment processors. Doing this can increase authorization rates by as much as 40%. In other words, it’s a technique your payment provider can’t afford to ignore.

Use Account Updaters

From enterprise-level solutions like Visa’s Account Updater to those focused on SMBs, an automatic account updating solution will provide the information needed to ensure that your customers do not end up dropping your product simply because their cards have expired.

Account updaters can help your business salvage over 90% of otherwise unusable cards and update out-of-date credit card accounts to ensure customer subscriptions continue smoothly. Avoiding service disruptions will also help preserve customer loyalty, increasing retention by up to 40%.

Visa, Mastercard, American Express, and Discover all offer subscription services for account updaters. But even these large schemes do not cover all countries (more are being added every year).

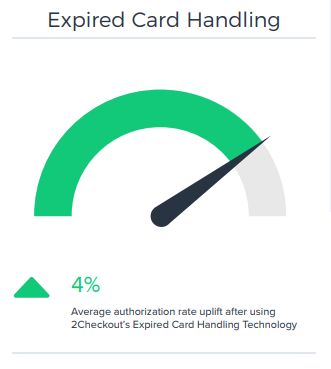

Commerce platforms like 2Checkout offer additional internal account updater services that allow them to easily identify expired cards and automatically update the expiration dates on file (extending expiration dates is a standard banking procedure) so stale cards don’t affect revenue or detract from your relationship with an otherwise happy subscriber.

Implement a Smart Retry Logic Strategy

The relatively common “soft card declines” are one-time payment issues that can typically be resolved with subsequent retries. What is the best strategy for retrying recurring order processing? If you want to decrease involuntary churn, consider creating an automated system that processes through the moments when transactions are declined due to technical issues, and retry the payment so that customers have the chance to choose.

Some frequent causes of soft declines include insufficient funds, going over the card activity limit, or unexpected processing errors due to system, technical, or infrastructure issues. Our Configurable Retry Logic lets you minimize failures and complete up to 20% of failed transactions.

Use Pre-Expiration Billing to Prevent Lost Revenue

To increase your authorization rates, some eCommerce platforms empower you to define when and how many times authorization attempts can be made prior to the expiration date for a subscription and notify shoppers about them in due time.

That way, if billing happens to fail at any of these points before subscription expiration, shoppers will be aware of the problem and have the opportunity to update their payment details and subscription term accordingly, to continue benefiting from your services.

Use Dunning Techniques for Declined Cards

Dunning is the process of methodically communicating with customers to ensure the collection of accounts receivable. It’s a standard and effective way of addressing churn.

For software companies wanting to reduce involuntary churn rates caused by hard declines, dunning is simply a basic customer service. This customer service mindset makes sure to deliver customers automated notifications that a card failed to process, ask for an updated card, offer alternative payment methods, or provide additional options for downgrading or putting an account on hold temporarily by pausing the subscription.

In these payment situations, the appropriate dunning messages can be sent to customers via email or may even be showcased in the product (e.g., the customer gets a clear and easy notification in their product dashboard informing them of the payment issue).

In fact, your dunning messages for involuntary churn can actually provide you an opportunity to grow customer satisfaction and strengthen customer relationships if implemented appropriately. Simply get in line with these best practices for involuntary churn emails to ensure you communicate effectively:

- Say who you are. Be upfront and let the customer know from the start who is sending the email, to show credibility and grab attention. Include the brand and support agent’s name, even for automated emails—it’s a personal touch.

- Address the situation clearly and directly from the start. Avoid getting distracted with brand talk or sales pitches. Be sure to include the key information related to the payment issue, the amount still owed and the subscription name.

- Let the customer know what’s going to happen next. Tell the customer when the subscription will be stopped unless they pay.

- Include the right ways to get in touch. Financial issues can lead to additional inquiries from the customer, so it’s vital to include information about how customer can reach you with timely questions. Foster an email dialogue by sending dunning messages from an email account that accepts replies.

Case study: How smart revenue recovery tools helped businesses fight involuntary churn

Absolute successfully fought involuntary churn using revenue recovery tools (RRT) on the 2Checkout platform. The company saw an overall 23% revenue uplift when using a variety of tools. The revenue recovery tools achieved an impressive 35% recovery rate on auto-recurring transactions. In addition, Absolute obtained 5% revenue uplift with shopping cart recovery on new acquisitions, further boosting its business.

Similarly, VWO, a full-funnel A/B testing platform, attained a 8%+ overall revenue uplift by activating recovery tools for both new acquisitions and renewals:

- About 8% of automatic renewal revenue was recovered specifically with 2Checkout’s Revenue Recovery Tools, representing 5% overall revenue uplift;

- 9% of new customer revenue was recovered with follow-ups on unfinished payments, representing a 3% overall revenue uplift.

Develop a Customer-Service Mindset

The best way for your business to reduce churn of any type is by focusing on creating great customer service success. When utilizing these tools or any other software solutions for reducing involuntary churn, great companies approach the project with the attitude of systematic customer service. Customers are given the right tools to ensure that they get the product they want and expect, no matter what happens with their payment.

Activate and use these revenue recovery systems to reduce involuntary churn, increase your customer retention rates, and improve customer satisfaction among both new and existing users of your subscription software.

Does your company use any of these tested strategies to curb involuntary churn? Leave a comment and let us know how they work for you.

Want to learn more?

2Checkout provides recurring-revenue based businesses with a comprehensive suite of Revenue Recovery Tools, as well as the expertise and guidance to tailor and fine-tune your strategy to achieve industry-high revenue loss prevention and revenue recapture rates.

Download this free eBook to learn how to fine-tune your strategy to achieve industry-high revenue loss prevention and revenue recapture rates.