Can your business grow on recurring revenue if your payments aren’t secure?

No! Although people crave convenience, they don’t want to risk their bank accounts and personal data.

The subscription economy is growing rapidly, and the key reason behind this growth is convenience. From OTT streaming and playing games to listening to songs and receiving meal kits, subscription-based models have revolutionized customer interactions and payments.

But making payments is still a risk! Remember that fitness app, missed renewal, and that unused application? These are the exact opportunities cybercriminals wait for to creep in and steal sensitive data.

With millennials taking 17 paid media subscriptions each on average, cybersecurity concerns rise and become the primary factor for long-term business success. In this blog post, we will look at the subscription economy and cybersecurity’s role in it.

Understanding the Subscription Economy

The subscription economy is a business model where customers transition from traditional one-time purchases to making recurring payments to access a product or service for a predefined period. It can be for a week, a month, six months, or even a year.

The term refers to the broader market shift towards subscription-based business models. The characteristics of a subscription-based economy are:

- Recurring revenue: Businesses rely on recurring payments, generally monthly or yearly. A fixed number of users make payments, leading to predictable and robust revenue streams. You can even forecast future financial needs and refine business strategies.

- Temporary access: Subscription-based customers aren’t interested in owning the product; they just want temporary access to fulfil their needs. Subscription models offer the flexibility to pause subscriptions at any given time.

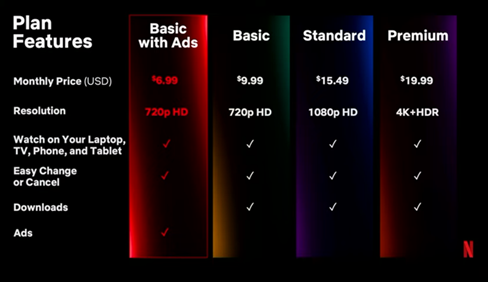

For example, Netflix operates on a subscription-based model. It receives recurring payments from users and, in return, allows access to streaming services for a limited time.

- Customization: Customers accept traditional products the way they are, without getting the option to customize them. But in subscription models, you can customize your package by including the necessary services and tools.

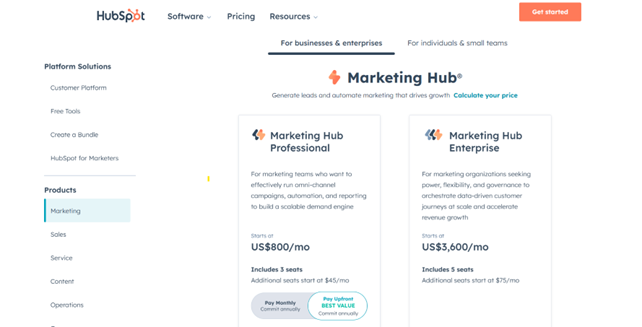

For instance, HubSpot, a SaaS company, offers customized plans to its users to access the marketing software. They offer two plans:

- Marketing hub professional: For small marketing teams.

- Marketing hub enterprise: For large marketing organizations.

Based on your business size, choose a plan and exercise the benefits.

- Customer satisfaction: Re-engaging customers after a purchase is time-consuming and unproductive. Since subscription models work on regular payments and instant service delivery, customers feel satisfied and engaged, which fosters trust.

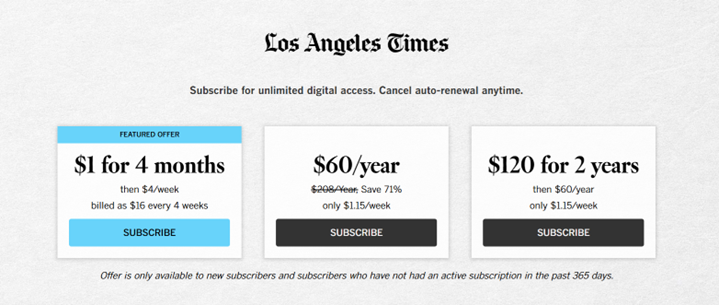

For example, news websites like The Los Angeles Times offer subscription-based digital access to the latest news and updates. The website even notifies users about breaking news, keeping them up-to-date and engaged.

When we talk about these digital platforms, one thing raises concerns — cybersecurity threats and the impact on payment gateways. Let’s understand the connection between cybersecurity and the subscription business.

Cybersecurity: The Hidden Backbone of Subscription Businesses

The subscription economy is expected to reach $3485.51 billion by 2029 with a CAGR of 59.5%. With this rapid growth, the model becomes prone to cybersecurity threats, alerting businesses to take precautionary steps.

Even customers prefer making payments and sharing personal details with platforms that have a protective layer to secure data. Therefore, efficient cybersecurity isn’t just a nice-to-have; it’s an irreplaceable factor to build trust and credibility.

There are three pillars of cybersecurity:

Preparation

- Developing a robust incident response plan

- Protocols to ensure clear communication in the event of a breach

- Regular audits and threat assessments

Organization

- Employing two-factor authentication across platforms

- Introducing role-based access control (RBAC) frameworks

- Strict security policies with frequent evaluation

Awareness

- Organizing security training programs

- Conducting phishing exercise sessions

- Well-defined security briefs

The subscription business is not only about monitoring plan validity. It needs to consider cybersecurity protocols to prevent fraud and build customers’ confidence. Let’s explore why cybersecurity is the backbone of subscription business:

1. Shared access weakens authentication

Giving access to multiple users opens the window for cybercriminals. For instance, if a friend, colleague, or family member with whom you shared access falls victim to a phishing scam, it can compromise sensitive data like bank details and credentials of all the users associated with that particular account.

A common scenario is when team leaders share Slack access with multiple team members without ensuring proper authentication.

Solution: Deploy single sign-on (SSO), two-factor authentication (2FA), and multi-factor authentication (MFA) to strengthen access control. You can also employ professional time tracking software to monitor users’ activity and detect unauthorized access.

2. Risking payment details

No matter what subscription the customers take, they have to share their payment details with your platform. In the event of a cyberattack, the payment information of all the users is at risk. If a customer uses the same payment method across multiple platforms, then a single breach can expose their entire financial information.

Solution: Offer payment options like virtual credit cards, wallets and alternative payment methods (APMs) to create a bridge between the bank account and the platform. You must also.

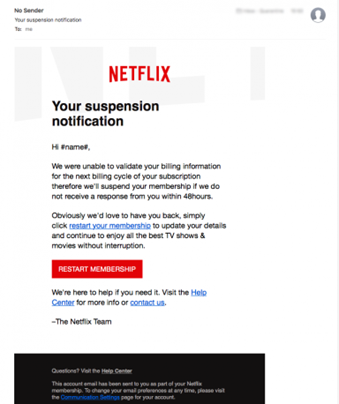

3. Subscription scams

A notorious cyberattack tactic is to send fake renewal alerts and account suspension notifications through phishing emails. These emails carry links to fake websites mimicking the original service. Users get tricked into entering sensitive banking data, giving attackers full access to their bank accounts.

According to a survey led by cybersecurity professionals, on average, 31,000 phishing attacks happen daily using ChatGPT to craft formal business emails.

Solution: Educate users about fake links, and utilize email filtering tools to detect phishing messages. You can also use AI-powered session monitoring to send regular account updates to the user.

4. Unused subscriptions invite cybercriminals

Forgetting a subscribed streaming account is fine, but not deactivating it is the problem. Cyber attackers leverage dormant accounts to access login details and perform a digital scam. A common tactic is credential-stuffing, where attackers gather data of leaked credentials from historical breaches to log into multiple platforms.

Dormant accounts are an easy target because they have weak passwords and are not monitored. According to Okta’s State of Secure Identity Report 2022, 34% of accounts fell prey to credential stuffing attacks on their platform.

Solution: Use subscription management tools to track unused accounts and cancel subscriptions. Keep fewer dormant accounts to minimize the risk of a security breach.

5. Unauthorized sign-ups

A team member may sign up for a subscribed sales CRM tool without IT approval. This scenario is termed as shadow IT, which increases the chances of cyber attacks and harms compliance. Shadow IT offers a direct entry to malware and bugs to steal vital client data.

Shadow IT has increased to 56% in the SaaS industry as companies typically use about 270-364 applications to handle various tasks.

Solution: Leverage cloud subscription management tools to centralize account management and enable IT professionals to reinforce security protocols. Also, AI-led fraud detection can identify suspicious sign-ups and block access.

The Challenge of Payment Complexity in a Subscription Model

Although subscription models generate a stable income and recurring revenue streams, they also introduce challenges of payment complexity along the way.

Some common challenges in a subscription model include:

1. Regulatory compliance

Operating a subscription-based business model requires strict compliance with GDPR and PCI DSS regulations to ensure data protection. For instance, if you operate a tech startup, complying with multiple legal requirements becomes mandatory for scaling globally.

Non-compliance often results in hefty fines of up to $100,000 per month (for PCI DSS non-compliance).

2. Customer retention

In recurring revenue models, customer retention is the most important component because the retention rate determines revenue. This involves investing heavily in delivering tailored content to customers and a transparent payment process.

Factors like unclear pricing, uninformed price surges, and failed payments decrease customer satisfaction and increase churn rates. Therefore, a user-friendly billing process and a self-service portal are a must-have to improve customer retention.

3. Strong payment servers

Businesses must partner with dependable payment servers to minimize scenarios of failed payments. Develop strategies to deal with expired credit cards, insufficient funds, and server downtimes. These strategies might include automated reminders, payment retries, and multiple payment options.

For instance, a SaaS company can integrate with international transaction gateways to minimize payment declines.

4. Data storage

To collect recurring payments, businesses store their customers’ banking details for seamless transactions. But the challenge here is the storage of sensitive data. A breach targeting payment data can lead to substantial monetary loss and legal penalties.

Payment information is the most targeted data for committing fraud and selling on the dark web.

Integrating Simplified and Secure Payment Systems

Introducing secure payment systems (SPS) is crucial for every subscription-based business model. SPS provides safe transaction lines in cloud spaces to guarantee secure payments, mitigating fraud and payment failures.

The key elements include:

- Encryption

- Tokenization

- Payment gateways

- MFA

- Digital wallets

- PCI DSS compliance

A combination of all these elements prevents fraud and offers a satisfying user experience. With people resorting to online payments and digital products or services, integrating simplified SPS has become critical. Let’s understand this with an example:

Amazon, a leading online retail store, implements tokenization in its payment process. For instance, when you make a transaction with Amazon Payment Services, it generates a token containing your card details. This ensures that the card details aren’t stored on the servers.

Now, whenever you return, you just need to enter the 3-digit security code, and the token will complete the transaction. Amazon also uses this token to process recurring monthly payments and ensure that sensitive card details are never stored on the website.

Hence, payment risks are minimized and revenue streams are uninterrupted.

Secure Your Payments for a Sustainable Subscription Growth

The increasing adoption rate of subscription-based business models demands seamless payment experiences. This is possible when businesses go beyond convenience and focus on building trust and credibility.

Customers prefer to engage with platforms offering unquestionable cybersecurity. Cybersecurity boosts customers’ confidence to share sensitive data without any hassle. From securing payments to retaining customers, cybersecurity is the pillar that supports the subscription economy.

Want to partner with a trusted payment gateway?

Visit 2checkout.com today and maximize your revenue securely from anywhere in the world.

About Author