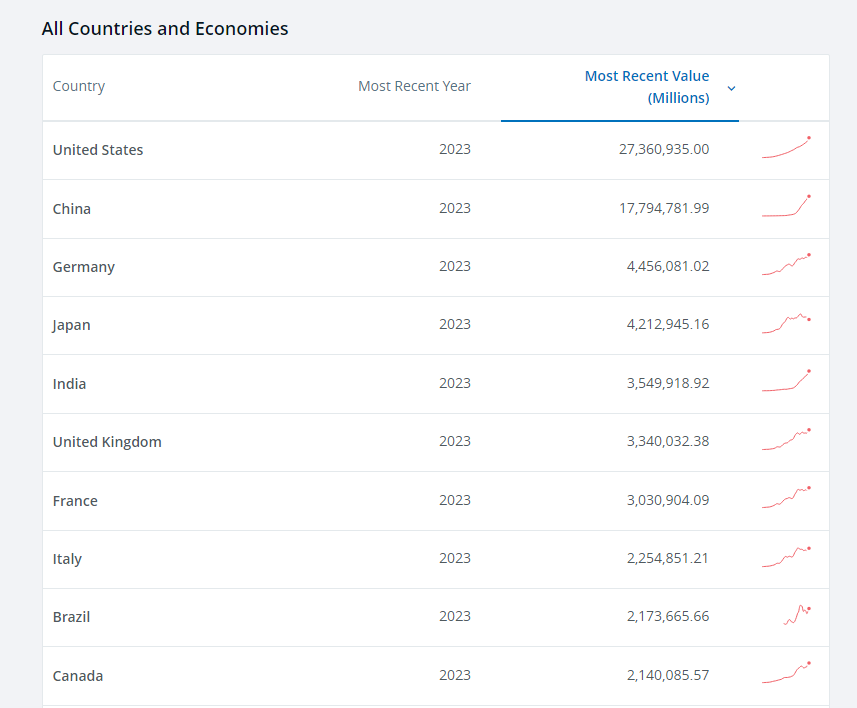

Did you know that Japan is currently the world’s fourth-largest economy based on GDP, with each person spending approximately $2,200 annually on eCommerce purchases?

Several fundamental factors have contributed to the significant growth of this region over the years, such as the high population density, cutting-edge technological infrastructure, high levels of consumerism, and a renowned work culture. However, entering the Japanese eCommerce market comes with a distinct set of challenges that companies must understand and learn to overcome.

Source: World Bank Group

Success here requires having a core understanding of Japanese consumer shopping behaviors, their various payment preferences, and the expectations they have for service, alongside understanding the region’s taxation systems and its logistical operations.

The Current State of Japan’s eCommerce Market

The Size and Scale of Japan’s eCommerce Market

By most metrics, Japan has proven itself to be an undisputed eCommerce success, boasting some of the world’s largest B2C and B2B markets with combined sales of nearly $3.6 trillion.

However, despite its massive size (nearly $200 billion today), the consumer market is still behind other developed nations in terms of growth. Japanese retailers have been somewhat cautious in embracing eCommerce, particularly in contrast to the country’s more progressive traditional commercial sector.

Their cautious approach is then further compounded by an aging population, low smartphone adoption (only 79%), a preference for offline shopping, and a strong inclination toward cash transactions.

The Country’s Unique Market Dynamics

There are several factors that contribute to Japan’s growing-yet-complex eCommerce environment. While the densely populated urban centers, housing nearly 92% of the population, are ideal for rapid-delivery networks, they are also home to mature offline retail markets where consumers can easily access goods.

Japanese consumers tend to exhibit a notable preference for offline shopping, but when they do make online purchases, they are more likely to spend significantly on high-value items. In fact, Japan is currently the world’s third-largest market for luxury goods.

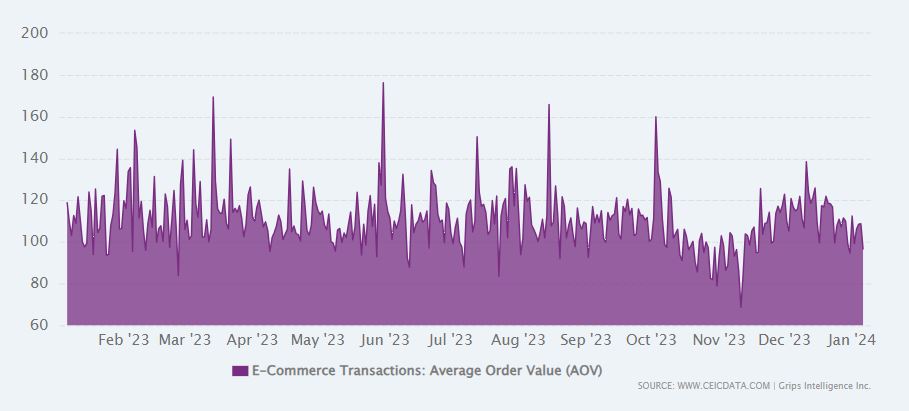

Source: EcomerceDB

The Impact of the Pandemic

Prior to the COVID-19 pandemic, Japan’s eCommerce market was growing steadily, albeit slowly. The pandemic, however, catalyzed a substantial increase in online shopping, raising eCommerce penetration from under 40% of households in 2018 to nearly 53% of households shopping online today.

The shift here proved to be especially pronounced among older consumers, with a notable 11% rise in online shopping activity among this demographic between 2019 and 2020. The pandemic forced many consumers to turn to online platforms for both essential and non-essential items, significantly altering the country’s more traditional shopping habits and preferences.

Japan’s Future Growth Prospects

Japan’s strong technological infrastructure, generally affluent consumer base, and high internet penetration rate of 86.2% all work together to provide a strong foundation for growth in the eCommerce sector going forward.

While internet use has stabilized, there has been a marked increase in smartphone adoption that has helped fuel a parallel rise in mobile shopping. Before 2019, under 58% of the population used smartphones. Currently, about 72% of people use them, with projections indicating this number will approach 80% by 2028.

From 2019 to 2023, the proportion of online shoppers increased by over 25 percentage points, reaching approximately 80% of the population. Projections suggest that by 2028, more than 94% of Japanese consumers will partake in online shopping, indicating a promising future for eCommerce in Japan.

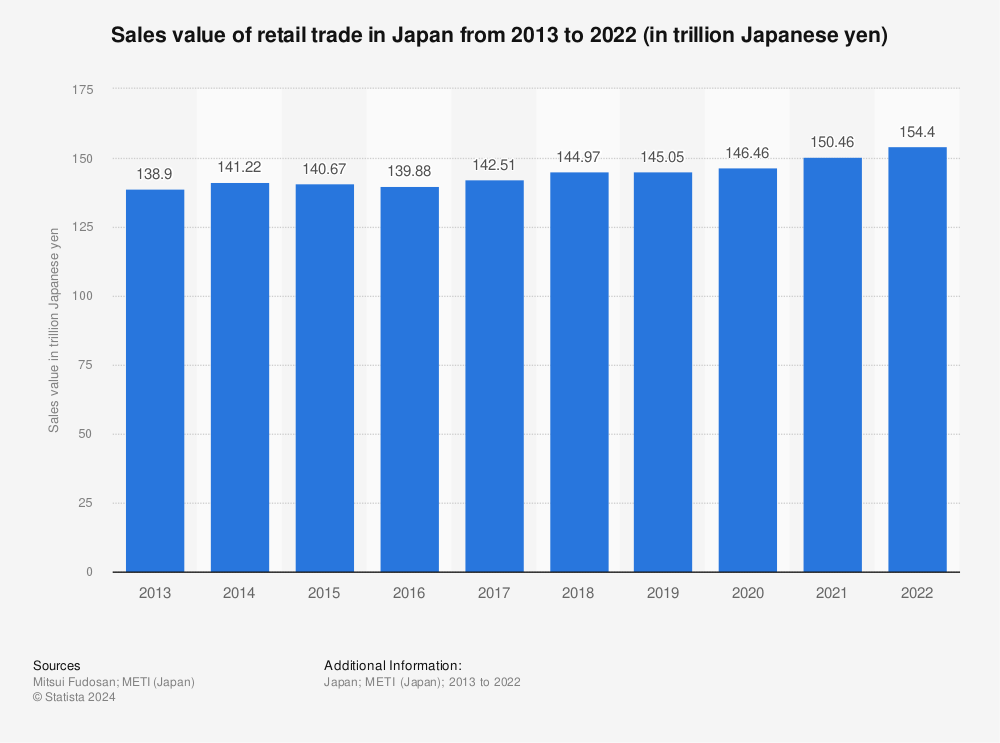

The Increasing Share of Retail Revenue

Japan’s retail market, which is currently valued at approximately $1.1 trillion, is one of the most mature and diverse globally.

Source: Statista

The market share of the eCommerce sector had risen all the way up to 12.2% by 2021. This growth was largely driven by a general increase in shoppers going online, as well as retailers offering new payment methods and buying incentives to draw them in further.

Mobile Commerce Driving New Growth

With the rise in smartphone usage, Japanese shoppers are increasingly embracing commerce applications and new innovations, with 48% preferring to shop through an app over using a browser.

While desktops still account for the largest share of online revenue, mobile commerce contributed approximately $66.5 billion in 2020, or about one-third of the total. With the rapid increase in smartphone adoption and m-commerce growing faster than desktop, mobile is expected to become the leading eCommerce method sooner than anticipated.

An Ongoing Shift in Shopper Preferences

Japan’s eCommerce market reflects the country’s distinct culture, society, and overall economics. Despite the market’s ongoing evolution, core consumer preferences and behaviors have largely remained consistent.

Japanese online shoppers are characterized by their patience, and only a small percentage (5%) expect 2-hour delivery for their orders. They’re also far more forgiving toward brands or marketplaces that fail to meet their expectations, with only 33% refusing to shop with them again.

Consumers in Japan also tend to exhibit greater impulse control than other consumers, showing less inclination towards “compressed commerce” or rapid transitions from inspiration to purchase. Given their patience, Japanese shoppers are also highly deliberative, particularly with significant purchases, with 33% conducting online research before buying.

Historically brand loyal, this trend is shifting as younger shoppers increasingly rely on social media and influencers for cues and guidance, especially when it comes to things like new brand innovations, cosmetics, and different fashions.

Source: CEIC Data

Typically, Japanese consumers go online at least once a month, spending nearly $97 per transaction that they make. A smaller segment of people, about 25%, shops two to three times a month, with about 7% shopping multiple times weekly.

Cross-Border Commerce is on the Rise

In recent years, Japan’s cross-border commerce has experienced substantial growth that’s projected to continue.

Traditionally, Japanese consumers have shown a strong preference for specialty and luxury items from the US and Europe. The recent surge in online sales, coupled with the introduction of new payment options such as the BNPL partnership between Paidy and PayPal, has further driven this trend. In 2021, cross-border sales from the US reached $3.1 billion, marking a 9.1% increase from the previous year.

In addition to the United States, some of Japan’s most significant cross-border online sellers come from China and South Korea.

The Popularity of Points and Other Shopper Incentives

In Japan’s eCommerce sector, a defining characteristic of many businesses is the extensive implementation of points systems and other incentive programs aimed at consumers. These programs allow consumers to earn credits for future purchases, which in turn significantly boosts repeat business for sellers.

Points systems, in particular, have proven to be a big hit in Japan, with a recent survey showing that nearly 47% of shoppers favor retailers that offer these incentives.

The Big Business of B2B Selling

While the B2C market brings in nearly $200 billion annually, the B2B sector is roughly fifteen to sixteen times larger, valued at about $3.4 trillion today—in fact, wholesale alone generates $1 trillion, which highlights the massive scale of the sector. Its growth stems from Japan’s industrial modernization, part of a strategic plan to digitize manufacturing, sourcing, purchasing, and the entire supply chain.

As digital exchanges between businesses grew more complex, larger marketplaces like Monotaro and Askul emerged, offering sophisticated services that rival even Amazon.

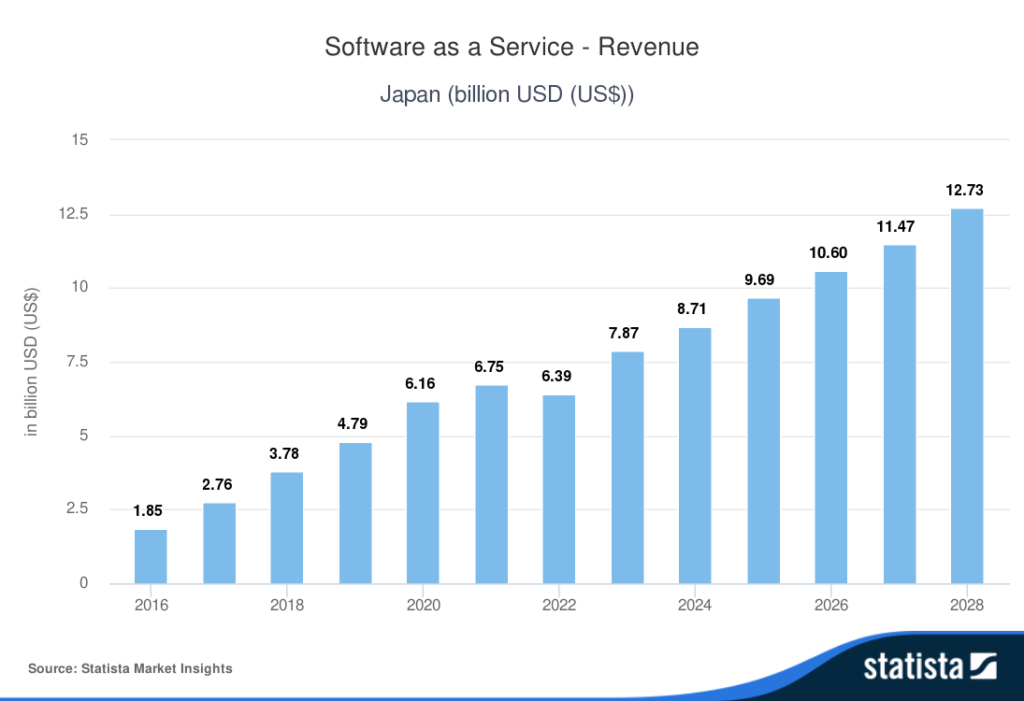

The Rise of The Software Market

Japan holds a prominent position in the software industry, with its market ranking among the largest in the world.

Although the sector experienced a downturn during the post-Covid recession, it is now on the rebound and is projected to exceed $29 billion by the end of 2028. Companies in Japan are investing significantly in software, spending nearly $130 per employee.

The SaaS sector is particularly strong in Japan – it is expected to generate $8.71 billion in 2024 and grow annually by 9.95% through 2028 when it is forecasted to reach $12.73 billion.

Source: Statista

The Current State of Subscriptions

Japan’s subscription economy is thriving and is currently valued in the billions. Despite a slow start in the streaming sector due to the country’s long-standing preference for physical media, the Video on Demand (VOD) category is now worth $4.5 billion, with over 52 million accounts in roughly 55 million households.

Beyond video, Japan’s subscription media market, including video games, e-publishing, and music, generates significant revenue, close to $24 billion.

The expansive subscription industry, which includes a diverse array of products and services designed specifically for the Japanese way of life, is also experiencing remarkable growth. The SaaS category alone is worth $8.7 billion, and overall subscription services saw a 10.6% spike between 2021 and 2022, with projections reaching nearly $11.3 billion by the end of 2024.

Essential Tips for Selling Online in Japan

A Shift in Payment Preferences

In recent years, the Japanese government has made a number of efforts to push for a cashless society, known as the “Cashless Vision.”

While this initiative has decreased the use of cash and spurred the growth of the fintech sector, cash remains a popular payment method. Because of this, some unique features have emerged in the Japanese market, such as the rise of konbini culture, where shoppers pay for online purchases through 55,000 offline cash machines that are typically located inside convenience stores.

An interesting side note is that payment on delivery is still preferred by 20.5% of shoppers.

Mobile and Alternative Methods on the Rise

Despite the persistence of cash and the dominance of credit cards, new payment methods are gaining traction. The push to digitize retail has led to rapid innovation in mobile payments, which now account for 39% of all purchases, a 12 percentage point increase since 2020.

Credit cards still make up 64% of transactions, supported by their integration with mobile payments. However, alternative methods such as bank transfers (furikomi) and Buy Now Pay Later (BNPL) are also growing in popularity.

With this in mind, vendors should offer major credit cards and digital wallets and also include local popular mobile payment options.

Improving The Cart and Checkout Experience

Japan’s monoculture, with its single language and distinct national identity, is home to diverse regional cultural differences and preferences. When you’re setting up an online store in Japan, it’s important to carefully cater to each of these nuances.

Japanese shoppers prefer dense, text-heavy web pages with minimal whitespace. Stores should be localized using the Japanese language and currency, with social proof and other assurances displayed in the customer’s shopping cart.

For scalability purposes, it’s generally advised to use dynamic checkout templates that automatically adjust pricing and language based on the user’s location and browser settings.

Make Your Transactions Fast, Secure, and Frictionless

Japanese shoppers prioritize security, speed, and a frictionless checkout experience. With the rise in online shopping, fraud has become a significant concern, with nearly $140 million in losses to online banking fraud in 2022 alone.

To help combat this, increased security measures like 3D Secure and 3DS 2.0 can help in the fight against fraud.

On top of this, the introduction of secure, alternative payment methods such as mobile wallets and direct debit can enhance transaction security and provide the peace of mind that shoppers want from their purchases.

The Role of Taxation in Japanese eCommerce

In 2015, Japan introduced a “consumption tax” set at 10% for businesses with consumer sales exceeding approximately $100,000. This regulation requires foreign businesses to register with Japan’s tax authorities and appoint a local tax agent.

For B2B transactions, Japan uses a reverse-charge mechanism, placing the responsibility for tax payment on the buyer rather than the seller.

Start Successfully Selling in Japan

Japan’s eCommerce market offers dynamic and lucrative opportunities for businesses looking to expand. Get the full picture on what it takes to succeed when entering this market by reading our full guide.

Once you’ve understood the market, having a robust and adaptable eCommerce solution is essential—and this is exactly where 2Checkout can help. As the leading comprehensive monetization platform, we simplify the complexities of modern commerce, and can help you streamline your entrance into the Japanese market.