“What is a chargeback?”

Asking the question is probably a good place to start if you want to prevent chargebacks.

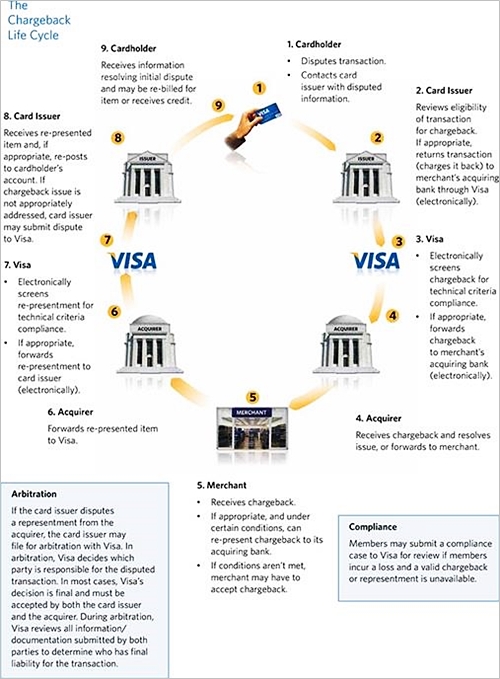

A chargeback is a transaction reversal designed to protect consumers. Most refund requests that vendors like you deny will end up in a dispute or chargeback if the customer feels the problem hasn’t been solved. The chargeback process is also initiated when a customer is not willing to work with the vendor to solve a problem and instead goes directly to the card issuer to file a dispute.

Why is there a need to keep chargebacks in check?

Keep in mind that when chargebacks occur, the transaction value isn’t the only amount you lose. You’ll also need to pay extra chargeback fees, such as:

- Operational costs for the resources needed to fight the dispute

- The transaction commission, which is non-refundable even if the customer loses the dispute

- Any chargeback fee, if applicable; this will depend on the contract you have with your current payment provider.

BONUS: Check out this eBook on to better understand chargebacks and avoid them!

Additionally, continued chargeback requests that exceed certain thresholds defined by VISA, MasterCard or American Express will subject you to chargeback monitoring programs: something you definitely don’t want. By now, you may be asking yourself, “How low should my chargeback rate be?” Keep on reading to find out the chargeback rate formula and get tips on chargeback protection for merchants.

What is an acceptable chargeback rate?

Before we determine what’s acceptable, let’s first look at how to calculate the chargeback rate. The chargeback rate calculation is pretty straightforward:

The number of open chargebacks (regardless of current status) divided by the number of finalized transactions, both in the previous month.

Only include finalized transactions for payment methods that allow chargebacks (including credit cards and PayPal). Otherwise, your calculation will underrepresent actual chargebacks.

Here are two examples of the chargeback rate formula in action:

| Payout interval | May 1 – 31, 2017 | June 1 – 30, 2017 |

| Number of orders | 100,000 | 120,000 |

| Number of chargebacks | 1,000 | 720 |

| Chargeback rate | 1% | 0.6% |

Now that we’ve mentioned “status,” let’s define the possible status options for a chargeback:

- Open – A customer opened a chargeback, but it’s not yet resolved.

- Won – The vendor won the dispute and no money was paid to the customer.

- Lost – The vendor lost the dispute and the value of the order was reimbursed to the customer.

- Accepted – The vendor accepted the chargeback and reimbursed the entire value of the order to the customer.

Customers usually have a limited amount of time to file a chargeback with their card provider. This may be known as the chargeback time limit and is typically within 60, 90 or 180 days of purchase.

Understand the reasons for chargebacks and how to prevent them

Now that you understand how the chargeback rate is calculated and where you stand with your chargeback rate, let’s look at how you can lower it. In order to do that, you need to understand why your shoppers file chargeback requests. There are several reasons shoppers file chargebacks. Here’s a shortlist that is specific to software and digital products with no physical delivery involved:

- Agreed refund not processed – The customer opened a chargeback dispute because a refund the vendor agreed to provide didn’t go through.

- Authorization problem – The payment authorization failed and the customer is surprised to see that the charge went through.

- Canceled recurring – The customer doesn’t recognize, agree to or accept an automatic renewal.

- Duplicate order – The customer was charged twice for the same product.

- Fraud or order not recognized – The customer doesn’t recognize the charge.

- Information request – The customer’s bank requested details about a charge. This temporary status can be closed once customers recognize the charge, or it may lead to a chargeback for one of the reasons listed here.

- New or renewal order not recognized – The customer doesn’t recognize a new order.

- Order not fulfilled/delivered – The customer didn’t receive the product purchased or can’t access the service.

- Product(s) not as described or nonfunctional – The customer claims that the product, subscription or service doesn’t work or works differently than advertised.

The chargeback reasons above are translated and standardized from the card providers’ language. Providing an overview of chargeback reasons is a good practice for eCommerce providers because it helps clients (vendors) understand chargeback reasons across the card schemes so they don’t have to “learn” the language of each network separately.

Let’s dive into two of the most common reasons for chargebacks in more detail:

Renewal order not recognized – The customer not recognizing, agreeing to or accepting an automatic renewal is THE most frequent reason for chargebacks. Most customers don’t know they agreed to be automatically billed for a product or service, often because they just checked a box in the shopping cart without really reading it, or because the box was pre-checked and they didn’t realize what it meant. Either way, the customer ends up with an unexpected payment on the statement and disputes it.

Cancelled recurring transaction or installment billing dispute – This happens when a recurring transaction was processed after the cardholder requested to terminate a subscription, the account was closed, the charge exceeded the predetermined amount, or the merchant failed to notify the cardholder of the upcoming charge.

How to address chargeback reasons and lower your chargeback rate

There are many ways to avoid the chargeback process altogether. Here are a few strategies to prevent chargebacks.

1. Offer clear, transparent pricing details in the cart and send notifications. To address the most frequent chargeback reason, “Renewal order not recognized,” vendors should have a transparent billing policy. The shopping cart must be clear about how frequently customers will be billed and confirm that they are signing up for recurring billing. Staying in touch with the customer by sending notifications about the expiration and renewal dates is important, and you should make it easy for customers to disable auto-renewal if they prefer. Be sure to send a renewal notification a week before expiration, whether by email or displayed in the product as a pop-up. The message can be as simple as, “Hey, your license is about to expire. You signed up for automatic renewal, so we’ll bill you prior to expiration.” A little notice is all most customers need.

2. Offer clear product details. Use clear and concise product descriptions, along with screenshots or demos your customers can watch to learn what to expect and what’s included before purchasing the product or service. This level of detail applies not only to functionality, but also to packages: whether your product is available in gold, silver, platinum or other levels, be very clear about what each package has to offer. This will help prevent chargebacks related to the product not matching what was described.

3. Be transparent about your billing policy. Customize your statement information and inform your customers about the data they should see on their credit card statements upon purchase and/or billing. Keep in mind that customers could receive their credit card statements weeks after an initial purchase, depending on your billing cycles, so make sure to tell them where their money goes and what to expect.

4. Provide flawless customer service. Make sure your customer service contact information is easily accessible on your website and provide contact information in your order confirmation emails. Keep track of customer inquiries and communicate with customers if they need extra information before and after purchase. You can greatly reduce the chance of chargebacks and refunds if your customers can easily get in touch with you to get their issues resolved.

5. Cancel inactive auto-renewing accounts. Keep a close eye on product usage. There’s no point in auto-renewing a subscription that hasn’t been used in the past six months (or more). That’s basically an invitation to open the chargeback process. Avoid chargebacks in these situations by notifying your customers about their inactivity and planned cancellation before you charge them for another billing cycle. This step should be part of a larger retention and churn prevention plan.

If these reminders manage to get your inactive customers to become active again, so much the better: you will gain some additional revenue. If the customer doesn’t need your product or have the resources to use it, they’ll be grateful you were proactive about renewal and may even come back for your services at a later point, creating a win-win situation. Often, these customers will eventually cancel anyway, but may do it via a chargeback request if they find out too late that they’ve been charged a recurring fee, which is a losing situation for everyone involved.

6. Offer easy-to-use self-service features. Let your shoppers keep an eye on their order status, disable auto-renewing subscriptions and change payment details through a myAccount style subscription management area to help keep chargebacks down.

7. Offer refunds and be transparent about it. The whole point of chargebacks is to protect your customers against fraud, not against your normal ways of doing business. Naturally, chargeback policies are developed in favor of the customer. Chances are that if customers aren’t satisfied with your product or service, they’ll get their money back, whether you like it or not. So why not spare yourself the hassle and simply refund orders that don’t rise to the customer’s expectations? Make sure to inform the customers when the refund will be processed and how long it should take before they get their money back.

If you’re taking care of payment processing and managing chargebacks in-house, you can add two more techniques to your list to fight chargebacks:

8. Confirm customer identity. Use advanced tools, such as 3-D Secure and Address Verification System. Enrollment in 3-D Secure prevents your customers from asking for chargebacks.

Note: Even if you’re not taking care of processing in-house, understanding 3-D Secure is important. Your payment processor may suggest that you activate this feature and you should understand why and how it works. Be sure to analyze overall implications when you make such decisions. For example, in the US, enabling 3-D Secure may actually impact conversion rates in a negative way, so you might need to accept some additional chargebacks to counteract a poor conversion. In other markets, such as the UK or Japan, 3-D Secure has a positive impact on conversion and will also lower your chargebacks, so there’s really no reason to not use it.

9. Join chargeback alert networks. Issuing banks that are part of a network will alert you when their cardholders file disputes for your transactions. This way, you can take quick action and offer refunds before the dispute takes place.

The key takeaway for chargeback prevention

When fighting chargebacks, understanding why your customers ask for chargebacks is key. Then, take actions to avoid those reasons in the future, using one or more of the approaches above, and you’ll be able to avoid chargebacks for a long time to come.

Share below what you’re doing to fight chargebacks and what’s been most effective for you.