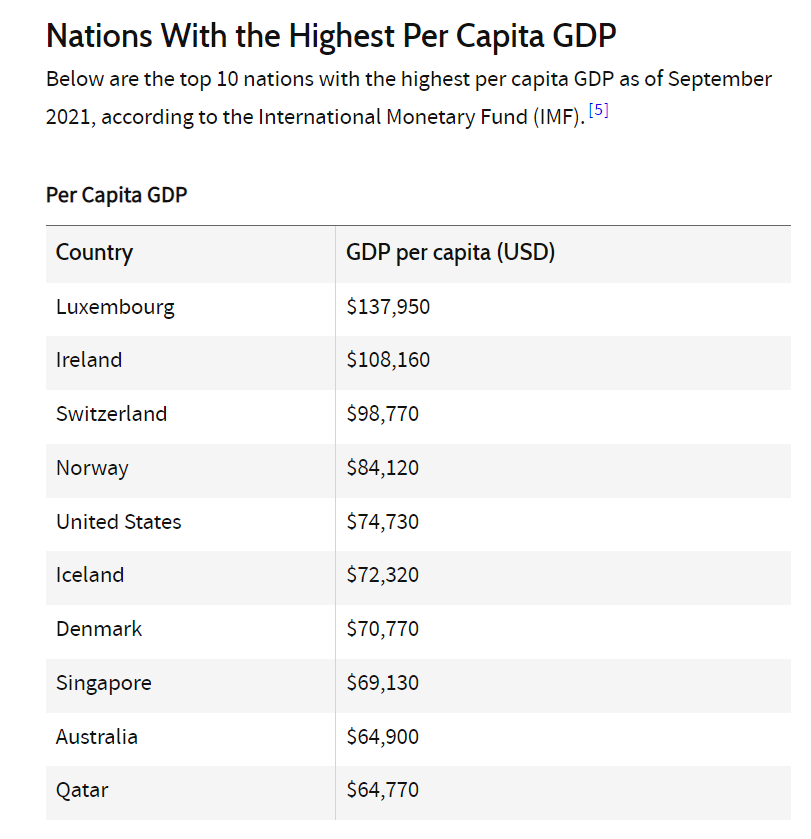

Despite Australia’s massive size, its geography of bushlands and deserts is responsible for keeping its population of 26+ million on its western and eastern shores. Nevertheless, the former British colony boasted a GDP of US$1.42 trillion in 2021 and a per capita GDP of nearly US$63,000. And, as of 2021, Australia was ranked 11th among top-ranking eCommerce markets.

Source: Investopedia

The market for eCommerce was already well-saturated before the Covid-19 pandemic. Still, in its aftermath, a renewed boost in online growth and changes in consumer behaviors have analysts forecasting an eCommerce market that may reach the US$70 billion mark by 2025. Opportunity, though, gives way to change: the eCommerce market in Australia may favor domestic sellers thanks to the country’s isolated geography and its concentration of large local and global players.

In light of this situation, global businesses must embrace and cater to Australia’s distinct purchasing and payment preferences while carving out their own space in the country’s market share. To that end, let’s dive into the challenges businesses may face when selling online on the Australian market and ways to overcome them.

An Overview of the eCommerce Market in Australia

Toward the end of 2019, and several months before Covid struck, Australia was already enjoying a healthy eCommerce market generating just over US$24 billion in sales. Then, when the pandemic took the world by storm, Australia saw many consumer purchases shift toward online sales. The increase in online shopping was dramatic: the country nearly doubled its revenue and grew its online uptake in almost every category imaginable.

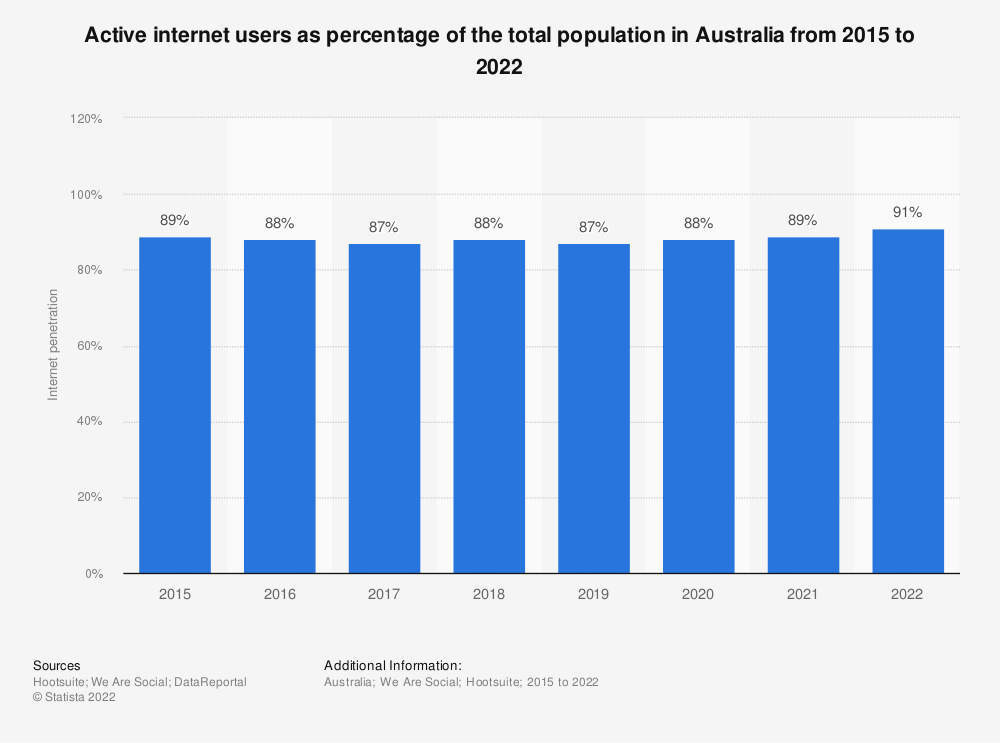

It’s safe to say that Covid acted as a catalyst for Australia’s increase in online shopping, but that increase was already evident before the pandemic’s breakout. By the time 2020 rolled around, Australia was boasting internet penetration of nearly 90%, thanks to several years of investments in mobile and heavy growth. So, when the Covid outbreak was in full force, the shift to mobile payment methods was already ingrained in the habits of Australian people, thanks to their mobile/fixed high-speed internet connections.

Source: Statista

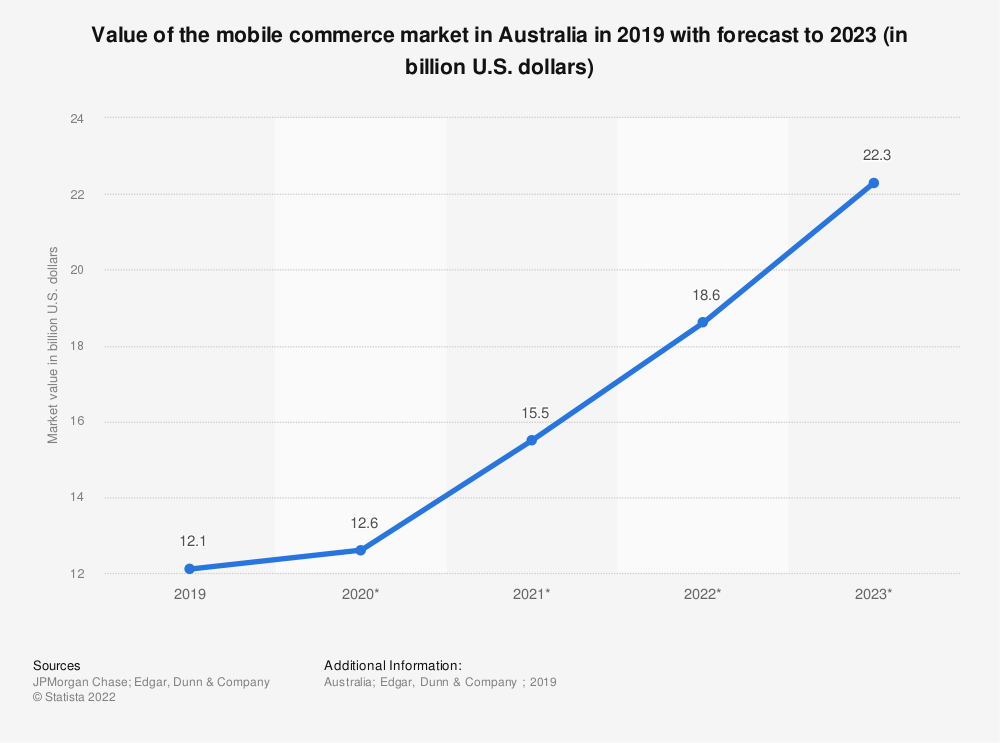

Also key to Australia’s eCommerce uplift is its high smartphone penetration rate. The country is among the most mobile-forward worldwide, as Australians tend to favor their smartphones when it comes to purchasing devices. This preference has gone a long way toward making smartphones major drivers of the eCommerce market in Australia. And, despite user adoption receding somewhat during the pandemic, analysts still anticipate that mobile commerce will take the lead over alternative methods for the foreseeable future.

Shopper preference for mobile commerce puts greater importance on businesses’ omnichannel and mobile strategies. So, at the very least, the business plans and strategies of cross-border merchants who want to get a piece of the Australian market should incorporate mCommerce-focused methods to reach those goals. Specifically, these merchants should work toward better optimization of their stores, payments, and mobile device-based cart flows and experiences.

Source: Statista

Know Your Shoppers

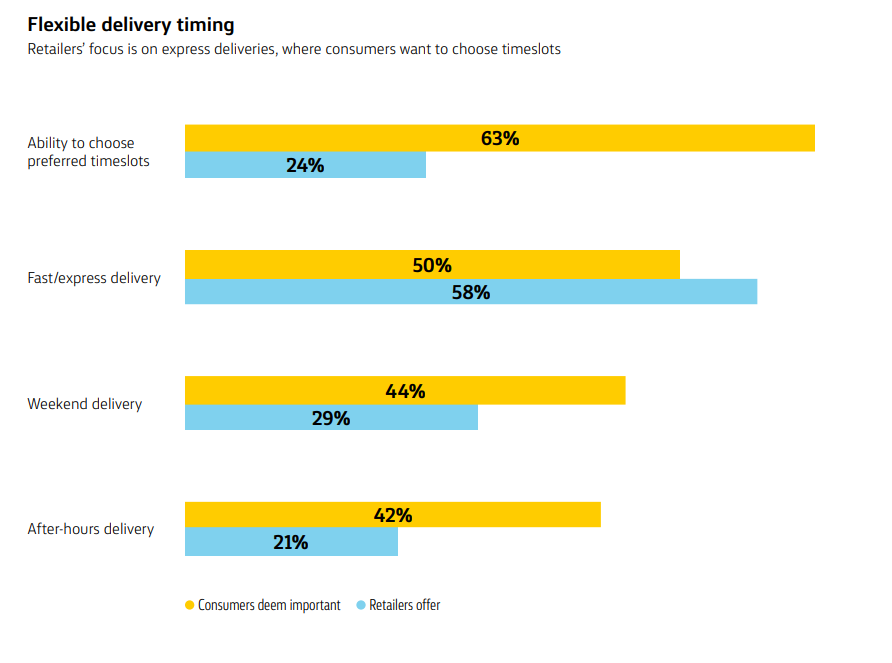

1. Australians Value Fast, Convenient Delivery

As Australian digital commerce has boomed, so have the expectations and scrutiny of its users. The pandemic saw more online shoppers place heightened importance on the speed of delivery, whereas before buyers in this region could have waited even weeks for a cross-border shipment. When it comes to receiving physical goods ordered online, half of Australians expect express shipping options to be offered, while a whopping 63% want to be able to choose their own delivery window. So, if you are seeking to be successful in Australia, be ready to deliver your products whenever your prospects expect them, including overnight and express delivery.

Source: CommBank

2. Australian Shoppers Are Keen on Sustainability and Buying Local

For the past few years, the whole world experienced a closed border scenario, which redirected shoppers’ attention to more accessible local products and fueled existential concerns and movements towards sustainability and local patronage. Nowadays, three-quarters of Australian shoppers acknowledge considering sustainability practices, which places extra pressure on merchants looking to breakout in this market.

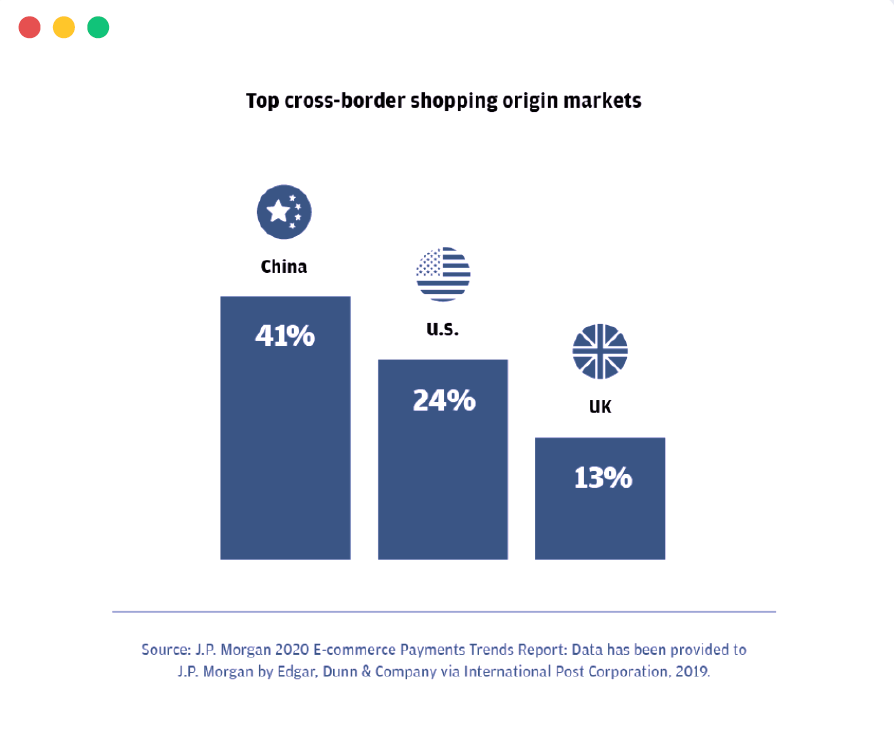

However, this approach still leaves enough space in Australia for cross-border merchants, as evidenced by the multitude of orders locals place with Chinese, American and British eShops. As long as prospects’ desire for sustainability is taken into account when setting up the market penetration strategy, foreign online sellers have plenty opportunity to attract and convert users from this region.

Source: J.P. Morgan

3. Australians Shop Across Categories, for Physical and Digital Goods Alike

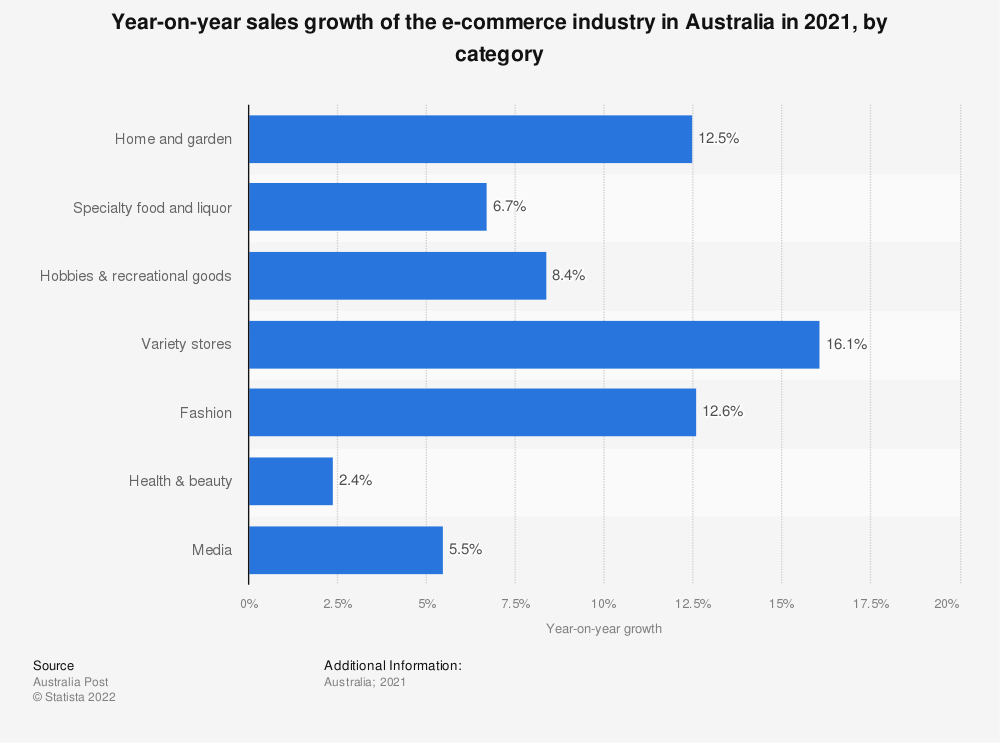

The diversity of goods purchased online by Australian shoppers reflect this market’s maturity. Many goods categories registered even double-digit growth in 2021, lead by fashion, home and garden and specialty stores categories.

Source: Statista

Digital goods particularly are registering increased adoption rates among local shoppers. Subscription Video On-Demand (SVoD), or video streaming, is one of the fastest-growing segments in this category, currently boosting a 33% penetration rate. The average Australian spends about $118 (US) on this category alone, with analysts expecting the SVoD market to reach 9.3 million Australian users by 2026.

Any merchant selling subscription digital products should consider expanding into the Australian market, for all the lucrative opportunities that await here. 2Checkout (now Verifone) platform data shows that the average renewal rate for subscriptions sits at 87% in this market, placing it even higher than renewal rates registered in European countries.

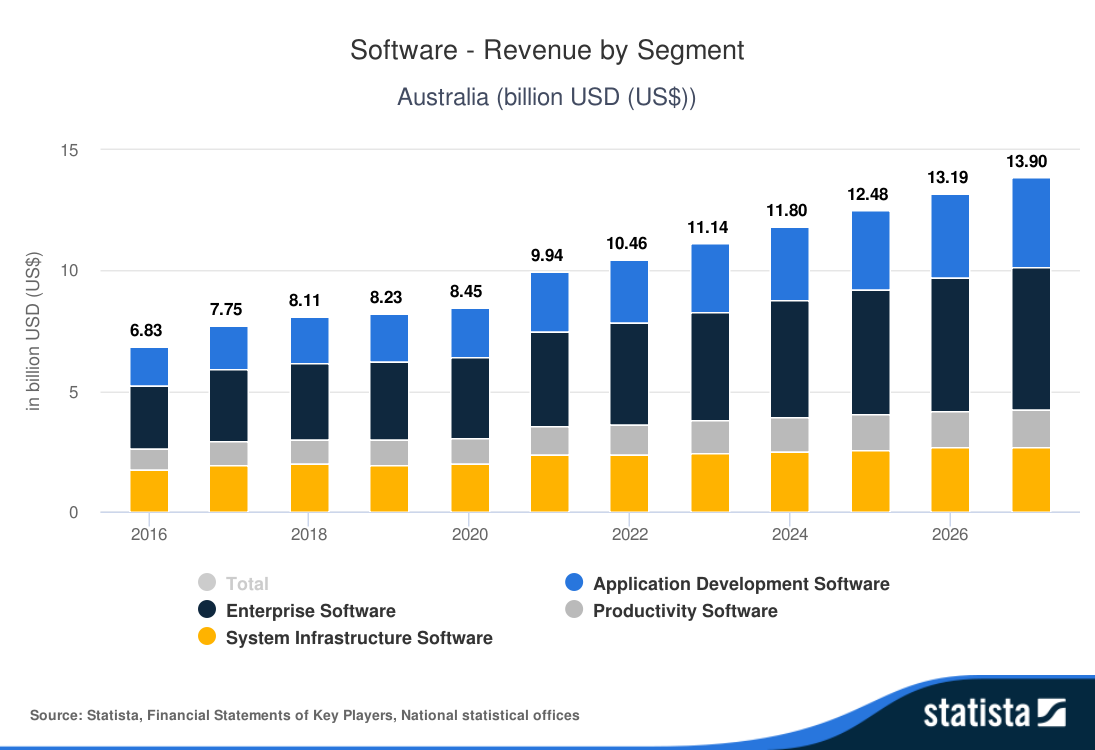

Software products are also sought-after down under, as Australia boasts the 8th largest software market in the world. The Australian software eCommerce market is expected to reach almost $14 billion US by 2027, bringing new opportunities for SaaS providers from across the globe.

Source: Statista

Selling Online in Australia: Getting Started

Catering to local shopper preferences is a must whenever taking on new markets, and Australia makes no exception. Let’s start with online payment methods. Australia is among the most banked nations in the world – the country’s credit culture is strong, and more than two-thirds of its adult population use at least one credit card. As of 2021, debit and credit card transactions made up 48% of online transactions in Australia. Whether digital wallets will overtake credit and debit card transactions in terms of popularity remains to be seen. However, some experts believe digital wallets will become Australia’s most popular purchasing method within a few years.

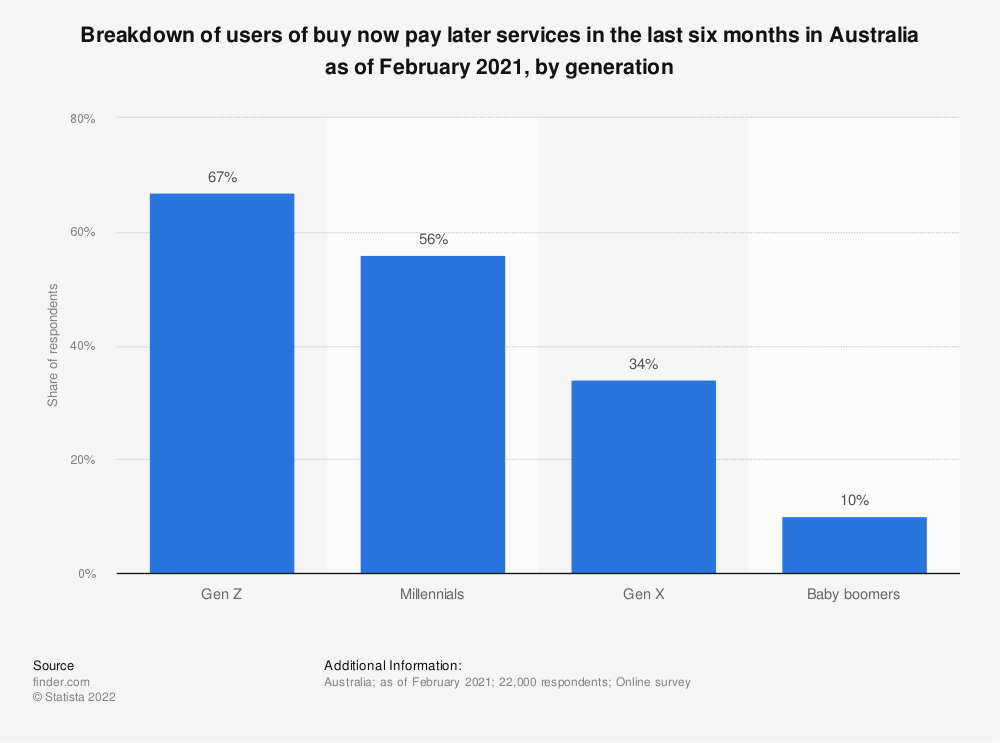

Another payment trend that cross-border merchants should take note of is the Buy Now and Pay Later (BNPL) trend. BNPL is widely used among Gen Z and younger consumers, and it’s expected to account for a sizable portion of transactions by 2025. Merchants should also consider methods like online bank transfers from checking accounts, which are often inextricable from BNPL schemes.

Source: Statista

Cross-border merchants should consider investing in a wide selection of Australian payment methods that are reliably popular, offered by global card schemes or payment providers: Mastercard, PayPal, and Visa are a few that come immediately to mind. PayPal, for instance, is Australia’s most popular choice for digital wallet providers, despite looming competition from brands such as Apple and Google.

Merchants may also consider including local payment methods like Splitit, whose BNPL service deducts from debit cards rather than checking accounts. Additionally, it’s recommended that cross-border merchants adopt PayPal Express optimization to accelerate their conversion rates, considering that nearly one-fifth of digital wallet transactions are made using PayPal.

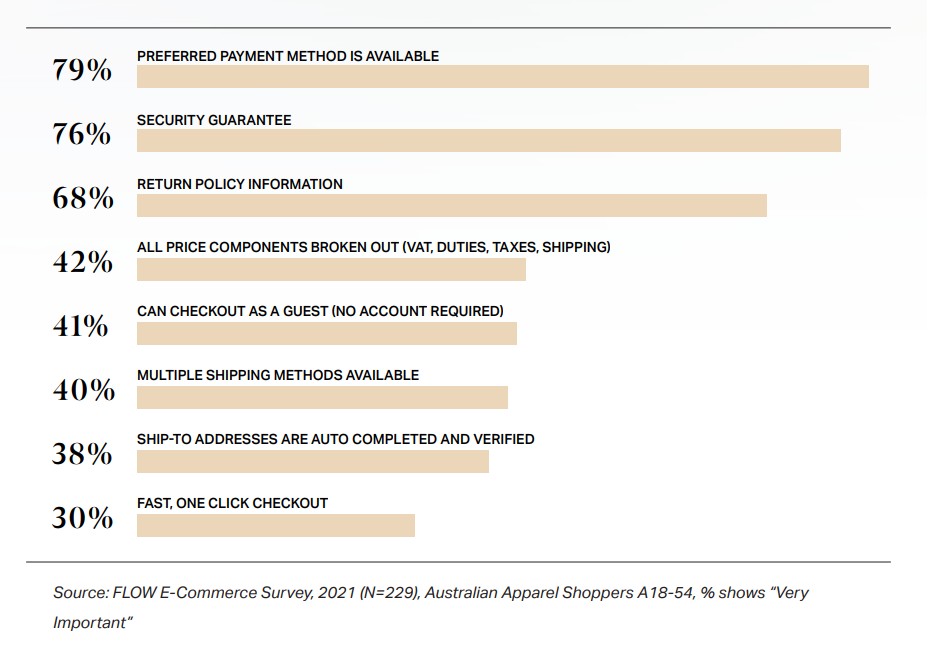

Once they’ve considered online payment methods in Australia, cross-border merchants would also be wise to review their cart and checkout experience. Although Australians are inclined to make cross-border purchases, non-native merchants may find it challenging to gain an Australian foothold thanks to the recent pandemic and a burgeoning buy-local movement. Therefore, cross-border merchants must give consumers a high-quality experience that starts at the store and ends at checkout.

Source: Flow

Australians are likely to respond well to a cart and checkout experience that is locally presented and includes strong site security, seasonal-appropriate products, transparent policies on item returns, and a wide selection of payment options. Localization should also consider currency, language, social proof, and other elements. And, since it’s not feasible for cross-border merchants that have multiple stores to hard-code these values and fields, it’s recommended that you use dynamic templates that use location-tracking to localize language and pricing.

Finally, when it comes to your cart and checkout experience, remember to test and optimize the flow of your cart regularly. At 2Checkout (now Verifone), we’ve found that while nearly half of our merchants use a longer cart flow when selling online in Australia, those who have tested out a cart flow that is streamlined and that doesn’t include a review step have experienced a 14% increase in their cart’s conversion rate. Although data indicates that customers prefer to skip a review page during a cart flow, we recommend that you still test and optimize your flow.

Conclusion

Australia is home to many young, affluent consumers who make cross-category purchases, but challenges remain for cross-border merchants who want to compete with domestic vendors. Their challenge is not to convince local shoppers to start spending their eCommerce dollars abroad. Rather, cross-border merchants need to key into Australia’s unique preferences when it comes to purchasing and payment methods. Additionally, it’s essential for them to wrestle away market share from domestic sellers as well as large global vendors.

If you’re looking for a helping hand to start selling online in Australia, the 2Checkout all-in-one monetization platform offers all capabilities needed to localize the shopping experience to your local audience’s delight. Discover our know-how on all of the large digital commerce regional markets and start optimizing shopping experiences for your visitors around the world.

For more insights about selling online in Australia, make sure to check out our eBook “eCommerce in Australia: A Merchant’s Cross-Border Guide to Online Sales.”