Any business operating internationally knows you cannot succeed in a country without first knowing its financial trends and structures. Understanding just how potential customers tend and expect to pay for your software, particularly when it comes to recurring payments, is a crucial part of developing a service that resonates with your local audience.

One particularly interesting case study in this regard is Japan. SaaS companies earn more than $20 billion in revenue per year in this highly developed nation. As a whole, 75% of Japanese residents have purchased products online, and total transactions have surpassed $100 billion.

However, if you are just entering the market, how do you know how your financial backend should be structured for success? Here’s what you need to know about local payments in Japan.

Traditional Payment Methods

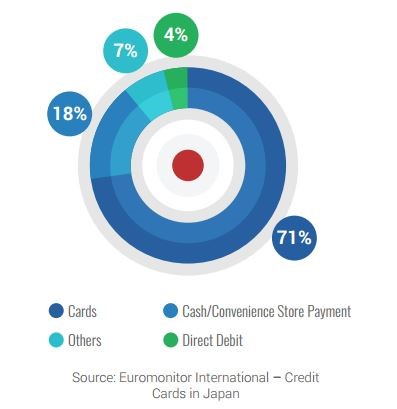

Like their counterparts in the United States and around the world, Japanese e-commerce shoppers prefer credit cards. In fact, 71% pay with either debit or credit cards when buying products online. Cash and convenience store payments (Konbini) are the second most used payment method, totaling 18% of transactions. Other payments methods, including Direct Debit, amount to only 11% of the total number of transactions.

Japan is also familiar and comfortable with mobile payments. According to CyberSource, 40% of the Japanese population owns a smartphone, and 44% of these users have made a purchase on it. In all, 25% of payments to the country’s largest e-commerce merchant, Rakuten, come from mobile devices.

Country-Specific Nuances

E-commerce and SaaS providers from European or American economies should familiarize themselves with Konbini, a provider of convenience store payments, especially designed to defer payments for those who don’t (yet) qualify for a credit card.

The system is simple: select Konbini as an option at checkout, receive a reference number, and take it to your local convenience store to pay in cash. Generally, customers have about six days to make the payment. Konbini payments account for 18% of e-commerce payments in Japan, a number that has remained steady in recent years.

Its continued popularity means e-commerce merchants entering the market should at least consider adding it as an option, but remain careful: as a deferred payment method, it’s less reliable than its alternative. About 15% of Konbini payments are never made, so waiting to ship products until payment has posted should be standard business practice.

Another development that relates to Japan specifically is its advanced position in using fingerprinting as an alternative payment method. Ahead of the 2020 Olympics, the country plans to put into a place a system that replaces entering credit card numbers in favor of simply allowing phones to scan fingerprints.

Finding a Payment Solution

When entering the Japanese e-commerce and SaaS market, being familiar and comfortable with the above payment methods and trends should be an important part of your strategy. Finding a payment portal and partner that knows the market is crucial to succeed against local competition.

That’s where we come in. Avangate’s SaaS platform supports both JCB and Konbini payments, enabling you to provide payment opportunities that match local market demands. Over 25% of all Japanese transactions on our platform have been made through JCP, and more than 40,000 convenience stores across the country accept Konbini payments.

Offering support for Konbini and Pay-easy through a single page, Avangate gives merchants who sell in Japan access to both online and offline payment methods. Pay-easy is an online payment method that allows shoppers to pay for their purchase from their online bank account. They can also use ATMs to complete their payments, provided they make a note of the payment reference.

Avangate opens up the primarily cash-based Japanese culture to international merchants, enabling you to easily accept Konbini and Pay-easy payments and expand your business in the area.

Partnering with Avangate means better preparation for your market entry.

Want to sell worldwide? Check out our Payment Methods Datasheet for a comprehensive list of 45+ payment methods supported out of the box by 2Checkout, enabling you to sell seamlessly in a multitude of countries worldwide.