Pricing your online product is important because it affects numerous aspects of your eCommerce business, namely: finances, marketing, and sales. An inappropriately priced product could lead to your company’s death while an appropriately priced product could place you as a prime competitor in your space.

This is certainly no easy task as it is a good combination of both art and science. But, you can’t get caught in the trap of thinking about it forever as that would impede your eCommerce business’ growth. Recognize that pricing evolves as expenses change, customer demand changes, and competitor success changes. This flux should help you feel comfort in trying a certain price, or pricing strategy, knowing that it might not be the one that brings the most success, but that you will be changing it at a later date no matter what. As with every aspect of your business, try something, learn from it, and iterate.

Your goal is to maximize profits so that you can continue to grow and get as much market share as you can. Price isn’t the only factor affecting market share, but it sure plays a critical role. There are a variety of ways to consider pricing to ensure that you are not overpricing or underpricing your product.

There are four overarching angles to consider when pricing a product for retail:

- your costs,

- your competition,

- psychology of your buyer,

- the market.

We will dig into them all.

How to price an online product

There is no hard and fast answer to how to determine the price of a product. Your competition, costs, objectives, and buyers all factor into the right answer for you. Let us explain.

What does your competition charge?

Buyers in the market for your product rarely shop in a vacuum. They will almost certainly compare you, your prices, and the value you offer, to those of your competitors.

Consequently, it is prudent to take careful note of your competitors’ prices, as well as understand how your industry tends to price their items. Do they bundle products a certain way? Do they offer a freemium model? Is pricing flexible as demand changes? Certainly always be analyzing the market to respond quickly to any changes.

What are your costs?

The price of a product must be determined, at least in part, by your costs. It is especially essential to generate a profit on an item if it is the sole item you sell. Your costs will be a prime consideration of your pricing in order to have a sustainable business. We will dig into this in more detail in a future section.

What profit margin do you want?

Your desired profit margin is a factor in how much you charge for a product. Once your costs have been met, how much more do you want to have of surplus? You may wish to maximize your profit margin potential as a strategy to enable business expansion without a loan or investments.

Who is your buyer and how do they think?

First and foremost, you should only be selling to someone you know inside and out. It may seem obvious, but many never take the time to ask their customer what they are willing to pay. You can discover this information by having a conversation or sending out a survey. By talking to your customer, you’ll learn whether they are looking for a budget option, which means you would need to be priced cheaper than your competitor, whether they want status or convenience, which means you can charge more, or whether they want something in between that is just average.

With your costs in mind, what do you make of these conversations? Does it look like you need to charge more than what your buyer can pay in order to break even and generate a profit? What could be a solution to this? Lowering your costs? Changing your target market? Or maybe what they are willing to pay aligns perfectly with what you already had in mind.

Beyond what your buyer can afford, neglecting their psychology would be a travesty. There are several common pricing concepts that help companies maximize the value of their customers.

- One is called the “Rule of 100.” This rule suggests that when your product is going on sale the sale should be communicated as a percentage off if the original price is less than $100. If, however, the price of the product is over $100 originally, then you should communicate the sale price in number of dollars off. The perception this creates has been deemed an effective sales pricing tactic.

- The other psychological concept to apply to pricing is called “charm pricing.” Charm pricing is at work when you go to the store and see an item marked at $8.99 instead of $9.00. A single penny “discount” is negligible, but people process $8.99 as a far better deal and are more inclined to buy.

- Make the buyer feel like they are getting a good deal by giving them something free with their purchase even if you are charging a higher price. The addition just needs to provide some sort of value to them but does not need to cost you much or any money. Alternatively, offer discounts on future purchases, and the opportunity to unlock exclusive deals to add even more appeal.

Ultimately, your product needs to be priced to keep your customer.

What conversion rate does it yield?

You don’t just want to fall into the trap of thinking that the price with the highest conversion rate is the way to go. It’s possible that a higher price point would lead to a lower conversion rate, but still bring in more revenue. It is true that if you price your product higher, you may lose out on the business of those who would purchase at a lower price point. How can you avoid losing this business? Create sales, periodically, that don’t go low enough to make you lose money, but are low enough to land the customers who wouldn’t pay the full asking price.

Product pricing methods

We just went over considerations on how the price of a product is determined. Here are 6 actual product pricing methods to use based on the considerations.

- Cost-based pricing (or cost-plus): Thinking about your pricing this way revolves around your break-even point. This means identifying how many units need to be sold to meet all of your expenses and not generate a profit. This product pricing method is good for establishing a baseline price, as it does not factor in the market and what your competitors are charging. We will go over the formula, below, to help you determine what your baseline cost for your product should be.

- Value-based pricing: There is a rule that states that customers should get a perceived value of 10x what they paid for a product or service. If a product is far greater than 10x cheaper the value they will derive from it, they will be turned off. Do not underprice your product even if you would still make great margins. Because, not being able to sell it at all would keep you from even breaking even much less generating a profit. To price your product appropriately, you should understand the value that customers place on it and how they compare your product to competing products. If the perceived value is higher than the cost-plus value factoring in a good profit margin, you could charge even more.

- Market-oriented pricing (competitor pricing): You can determine the price of your product using the market-oriented pricing method. This method is based largely on your industry, what market trends there are, and how your competitors price what they produce. The quality of your product is a large factor in using this pricing method. Your customers will judge the quality of your product based on its price and how it stacks up against the price and quality of your competitors’ products. An underpriced item will make you seem cheap. People are actually willing to pay more for good value. Your price leaves an impression on would-be buyers; the question is: what kind of impression do you want to leave? Stay ahead of the curve, and always be considering where your market stands and where it is headed. Are there any weather patterns or law changes coming up? What about change in societal views?

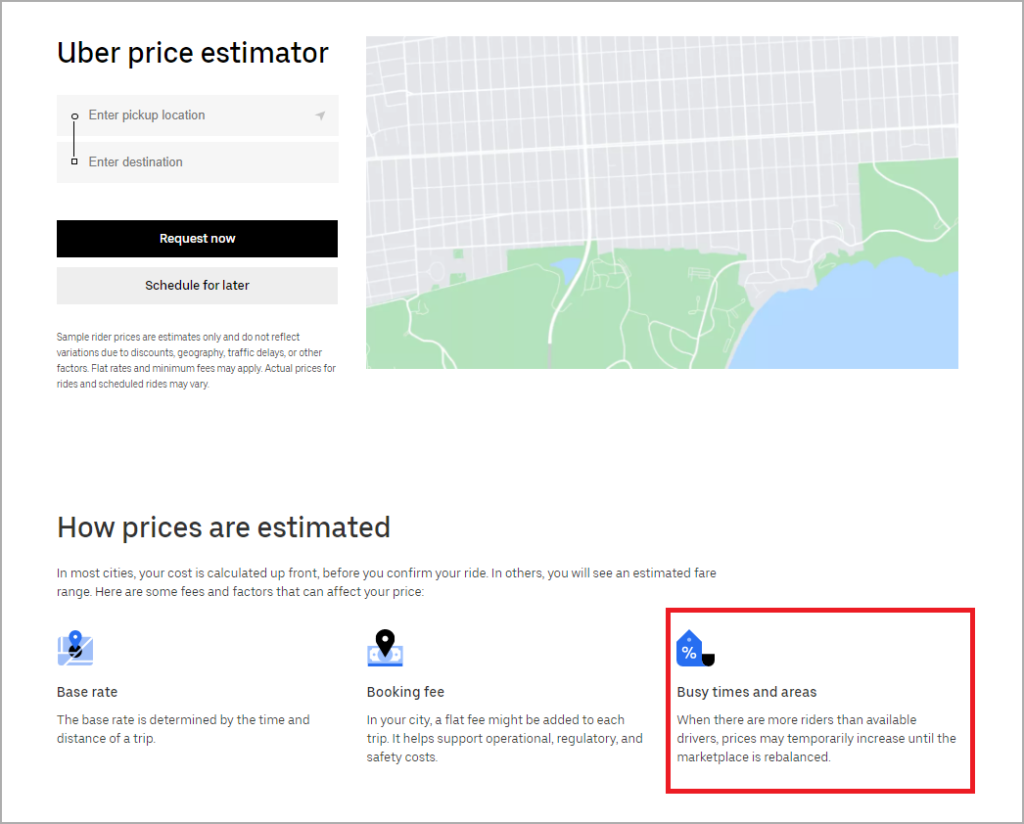

- Dynamic pricing: Dynamic pricing features price changes based on market demand weekly or even daily. A few companies and industries may come to mind that do this on the regular: Amazon, Uber, hotels, and airlines. Raising and lowering prices based on demand can help you hit more people. There are some fantastic tools like QuickLizard, Omnia Retail, and Profit Peak that help companies with dynamic pricing.

- Loss-leader pricing: Loss-leader pricing is essentially a form of marketing. It gets people in the door with a sale so low that it makes you lose money on the product, only to be made up by profit through the sale of other products that have high margins. The grocery retailer, Aldi, and outdoors apparel company, Patagonia, are known for this type of pricing to attract buyers to their store and website. Alternatively, this form of pricing could be done by bundling low-cost items with higher cost items. This method requires a lot of knowledge about your costs and margins.

Patagonia’s loss-leader products

- Price skimming: This strategy implies that you start with a high price (think of the highest your clients would pay), and drop it over time. Usually used for innovative products, when there’s no real competition, in order to maximize the profit for every segment of your addressable market. This approach is actually is contrasting the next model.

- Market penetration pricing: As previously mentioned, this one is the opposite of price skimming: you start low to capture market share, and then raise the price to build on profitability. The main goal of penetration pricing is to spark the curiosity of your prospects and entice them to become customers. This method comes with some a risk: once prices increase, customers may choose to leave and switch to a cheaper competitor.

- Captive pricing: Like penetration pricing, captive pricing involves counting on expansion revenue to offset an initial discount. In this case, you provide the core product at a discount but charge a premium for additional products and services (like what a mobile service will do with data usage) to use or get the most from it. Use this wisely not to create customer frustration if pricing for dependent products is too high.

- Anchor pricing: The last pricing method we want to introduce you to is called “anchor pricing.” This is when a company makes a “regular” price visible to their buyers, but regularly sells it at a discount. This functions to catch the people who are always on the hunt for a good deal.

If you are selling SaaS, there are a few pricing models you could employ, often used in combination with one another:

- simple or flat rate

- tiered

- per feature

- per user

- metered/usage-based

- freemium

- premium

- free trials

- mixed pricing

- dynamic pricing

2Checkout’s resource, Pricing for Success in SaaS: An Essential Guide, includes extensive, actionable helpful pricing insights, tips, and examples around SaaS pricing. Make sure you get your copy!

How to calculate selling price of a product

Many of the product pricing methods above are based in part on art, psychology, and a solid intuition, however, the cost-based method uses a formula centered around business expenses to calculate the selling price of a product.

This is what the formula looks like. It’s fairly simple.

All costs ($) + profit margin ($) = price of product ($)

You may see the equation presented as:

profit = total revenue – (cost to produce 1 unit)(# units) – total fixed costs.

This equation breaks down the costs so that you can think about them in terms of variable costs per tem that you sell and the fixed costs involved with running your business.

Or, if you know what profit margin percentage you want, you can use this formula:

target price = (variable cost/ product)/(1-decimal profit margin)

You can calculate the selling price of your product by making a simple spreadsheet of all the costs involved in producing it. These are called variable costs and include those of:

- Materials

- Time

- Packaging

- Shipping

- Credit card transactions

- Marketing

But then there is also your company’s overhead, which is fixed costs (not directly related to the production of your product). These costs are for things like:

- Legal fees

- Rent

- Electricity

- One-time start-up costs

After you’ve figured out your costs, you can determine the profit margin that you want to factor into the price of your product. The profit margin is your markup. It’s okay to have products with low margins if you have products with high margins to make up for it. Some high-margin items are furniture, skin care products, and eyeglass frames.

For eCommerce, a good profit margin would be 20%. So, if a product cost you $10 to produce, and you wanted to make a 20% profit margin, your target price would be $10/(1-.20), which is $10/.8, and amounts to $12.50. Therefore, your profit margin in $ amount is $2.50 per unit sold ($12.50 – $10).

In wholesale, this pricing formula and market acceptability permits doubling the cost of the variable costs to arrive at the product price. Then, in retail the cost could be doubled, yet again.

Beyond the basics of how to price your product

You may know your prices at any given moment, but there are some long-term considerations that are important to keep in mind, as well. Always be aware of where the market is going and how your competitors are pricing their products. These can change with the drop of a hat.

Additionally, there are certain expectations that come with your price. For example, people generally do not expect high quality if you are selling a cheap product. However, if your product is priced above that of your competition, they expect it to be of superior quality.

As we mentioned earlier, no price is ever permanent. In fact, companies that regularly update their pricing realize almost twice that growth in average revenue per user than those that don’t.

That might make you breathe a sigh of relief. Your company goal is to maximize your potential for profit, and you don’t know for certain what the response will be when you make a certain price change. No matter where you want to go with your price, ensure you make gradual changes so as not to jolt anyone. These gradual changes will also help identify optimum pricing. If you create new versions of your product, the price can certainly go up (or even down).

But, above all, be open, honest, and transparent with your pricing to build trust and avoid confusion. And, if you are offering a sale, play the mental game of how good of a deal they are getting by showing the sale price alongside the original price.

Conclusion

You can think about how to determine the price of a product forever — but, don’t.

Don’t get stuck thinking about pricing; it’s time to make some money! Take what you know about your costs, your buyers, and your industry and just try something. That’s not a stab in the dark; it’s a very educated guess.

Thankfully pricing evolves as expenses, customer demand, and competition change. So, no matter what your pricing is now, it will change — great news if you are uncertain of getting it wrong initially. You cannot go wrong when you base your pricing off of all the information you have.

Good luck with your first retail product price! Here’s to great profit margins.