As critical as payment providers are for businesses, they can at times fall short in fully addressing the needs of merchants and their shoppers. With more users than ever on the internet, digital opportunities and threats have increased tenfold in recent years and many businesses are finding they may require a more flexible payment provider as they’ve scaled.

Given the dynamics of the eCommerce space, is it possible that you have outgrown your payment provider?

In this article, we will go over the main signs you should look for, some common challenges, and what you should consider when choosing a payment and eCommerce provider that can support your growth.

Signs that you have outgrown and need to change payment providers

1. Difficult to monetize existing customer base

Money and payment processors may seem like an obvious combination, but you’d be surprised.

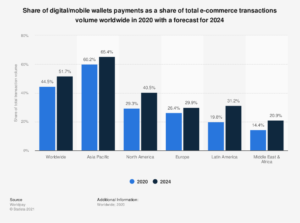

One common issue that can arise in this area is a lack of availability of multiple payment options, and this can be a huge problem depending on who your customers are. 15-20 years ago it would have sufficed to offer card payments on your site, but now buyers expect more flexibility and diversity.

If your payment provider doesn’t offer coverage of modern, alternative payment options, like Apple Pay, PayPal and Skrill, they’re definitely behind the curve. Younger customers commonly use these payment methods already, and older ones are starting to catch up.

Source: Statista

Another important aspect to consider about your payment processor is the authorization rates it achieves for your business. This is simply the percentage of transactions that you submit to a card network and that successfully go through. The key thing to keep in mind here is that if your authorization rate is below a certain threshold, it can be bad for the merchant. This is why it is important to make sure that your payment provider manages network declines well, and that they have good fraud detection systems in place to avoid false positives, or false negatives.

So, if you’re customers want to pay with payment methods that your current provider can’t support or if you’ve noticed your authorization rates declining, it might be time to upgrade your payment provider.

2. No regular updates/innovation from your current provider

This is one sign that can be dangerous to ignore. The payments industry is changing often, and with new regulations, FinTech’s growth, and other advancements, you may think of updates and innovations as an afterthought, not as something that would be good to have.

Periodic payment platform updates, however, are a must-have for ensuring compliance with the financial landscape and a relevant, up-to-date experience for your shoppers.

The best payment partner to support you in your growth journey will continuously stay up to date with market developments and consumer trends, ensuring it periodically pushes new updates and innovation to its platform to cater to these expectations.

For example, in Europe, merchants saw the introduction of the new Payment Service Directive 2 in recent years, which rolled out at different periods in different markets. PSD2 called for updated checkout flows, in order to further authenticate/authorize a purchase with a card. Merchants working with providers who hadn’t taken the timely steps to provision for the new challenge flows had to deal with an increase in unfinished payments, thus hurting their bottom line.

Continuous taxation updates all over the globe also call for working with a flexible payment provider who periodically updates their platform, as failure to observe updated tax requirements can lead to hefty fines for merchants. So, if your current provider isn’t continuously updating their services to keep the pace with the dynamic digital commerce landscape, it might be time to switch suppliers.

3. Difficult to expand cross border

Another important clue that you have in all likelihood outgrown and need to change payment providers is a lack of ability to expand into other markets.

So ask yourself:

- Does my payment provider comply local commerce and taxation regulations?

You want to make sure that it is compliant with local laws within the jurisdictions you are selling in, and if they aren’t, that’s a serious problem. Make sure they have the tools needed to address European VAT rates or U.S. sales tax, and that they can support you in compliance in any new territory or market you’re eyeing for expansion.

- Do they offer flexible business models to work with?

Each new market you take on may call for a certain payment model and the provider you’re working with should offer all alternatives needed to support your cross-border expansion goals. You may be looking to work in a Payment Service Provider model (PSP) in some markets, whereas in others you could need a Merchant of Record model (MoR), for the added benefits of outsourcing back-office operations. An upgrade might be needed if you currently don’t have access to different business models to handle payments.

- Do they work with local acquirers?

This is another aspect that can offer your business a clear advantage. Your payment service provider will process transactions based on your merchant location, so you want to be able to process a payment locally. Working with local acquirers is a great help in this respect, and has been shown to offer better authorization rates.

4. Poor integration

This is yet another crucial component of your payment provider’s service. When running your business, you need things to be as smooth as possible, not all over the place and very confusing. Specifically, if your provider uses a tech stack from multiple providers, this can make the integration process a bit more confusing, and this may be a sign that you’ve outgrown your payment provider, or at least need to find a more organized one.

Bottomline, your payment provider should fit in seamlessly with the rest of your tech stack, because there rarely is ever an all-in-one solution. You need to find platforms that truly allow you to integrate and aggregate data, because one of the worst aspects of poor integration is siloed data. If your payment solution can’t easily integrate with your ERP, CRM or PIM, you’ll find yourself wasting a lot of time on keeping track of operational activities and should probably consider a payment provider upgrade.

You also need to consider your software development team and how your payment integration affects their workload. If you’re noticing a lot of work for them, and a poor ability to integrate into your eCommerce platform, this will prove problematic for your operations and threaten the stability of your business in the short, and long term.

On that note, make sure that your payment provider has an organized Software Development Kit (SDK), as this will ensure an easy integration for your software developing team.

5. Low or limited support from existing provider

There is nothing that the average consumer hates more than poor customer service.

Turns out, businesses hate it too, and it can really challenge the sustainability of your operations if your payment provider isn’t helpful in times of need.

If you often notice technical issues leading to chargebacks, transaction declines and delays in receiving payments, this is definitely a red flag. But what you have to consider next may be a little less obvious unless you have taken further steps to solve the problem.

More specifically, how does your payment provider react to your problem when you contact them?

Do you notice any of the following?

- Difficulties getting a human on the phone, instead of a computer

- Unqualified staff answering your questions

- Long wait times on ticket resolution, and several escalations

- Generic feedback, not tailored to your own inquiry

- Many lost chargeback disputes and refund requests, without you being consulted

If you answered yes to any, or most of these statements, you’re probably with a provider that is a sinking ship, and who will likely threaten the profitability of your business if it hasn’t already. If you add missing shopper support to the list, meaning no options for your consumers to address and get answers for their payment queries, then the situation is indeed dire, especially when you sell internationally and need your provider to cover multiple time zones, instead of your team.

Source: Salesforce

What to look for in a payment and eCommerce provider to maximize growth

So now that we have gone over the telltale signs that you have outgrown your current payment provider, let’s go over what they should offer you before making the switch and committing to their business.

The answer is pretty straightforward: A full all-in-one modular platform that lets you use capabilities adjusted to your stage and which covers your main business needs for growth:

- Global payment processing, with good coverage

No matter where your clients are, and where your business is, you want to have a secure and localized buying experience that is tailored to the country you are in.

- Periodic platform updates

Opt for a provider who offers transparency on their yearly roadmap and who always provisions for market regulation updates in a timely fashion.

- Multiple business models supported

For optimal support in expanding cross-border, consider a flexible payment provider that can work with you in any model that is needed, whether PSP, MoR or hybrid.

- Easy integration with your tech-stack

The payment solution you use needs to seamlessly fit the rest of your company’s tech stack so consider the integration efforts needed before upgrading your payment provider.

- Round the clock merchant and shopper support

To ensure no disruptions in your operations or your shoppers’ journeys, opt for a payment provider who’s there for you when trouble comes knocking. As your company scales, support becomes that much more important in upholding your brand promise, so carefully consider the availability of support when upgrading payment providers.

So have you outgrown your current payment provider?

That’s for you to decide, but chances are you probably have. If you’ve read this far, you’re probably starting to see some of these issues come up in the relationship with your current provider, and you now want to make a shift.

Ready to take the next step? Discover the 2Checkout all-in-one monetization platform and see the revenue uplift potential we could be helping you achieve.