A Merchant of Record assumes the financial liability of payment processing. But how is it different from a Seller of Record and Payment Service Provider?

In this article, we’ll cover everything you need to know about the differences, including:

- What each term means

- How Merchant of Record is different from Seller of Record

- How it’s different from a Payment Service Provider

- A side-by-side comparison between the three

- How to choose the right partner for your online business, and

- Implications of each model on payment authorization and conversion rate

What is a Merchant of Record?

A merchant of record (MoR), also referred to as a “reseller”, is the legal entity authorized to sell to customers and process their credit and debit card transactions on behalf of a merchant.

They process the actual payment of product services when a seller cannot do so due to legal limitations or geographic access.

Here’s an instance:

If you own an online retail store, you can reach a global market. Still, you need a processing system that complies with local legislation and can convert between currencies to accept payment.

You can process these payments yourself by setting up local merchant accounts, which is easily expensive and comes with a lot of overhead.

A Merchant of Record provides you with a payment processing system and bears all the legal obligations of a typical business that operates within the territory, including financial compliance.

How does a Merchant of Record work?

A Merchant of Record works like an intermediary reseller; they receive payments from your customer; pay you for the products, and ship to the buyer.

This whole process happens in seconds.

When customers input their payment details at your website checkout, the payment is processed in the name of your MoR because they own the merchant account in the backend.

So, your customer’s credit card statement will bear the name of the MoR, who is also responsible for all the legal demands of the territory.

And typically, you’re selling to your MoR, who resells your customers.

Merchants of Records is helpful if you want:

- Global Financial Compliance: If you sell to a global audience, MoR will help you collect and remit taxes to comply with consumer protection regulations.

- Borderless SaaS Payment: An MoR can collect subscriptions and process payments frictionlessly.

- Pro Merchant accounting: An MoR is cheaper, safer, and more efficient than traditional merchant accounting, setting up local offices and other infrastructures necessary for processing cross-regional payments.

What is a Seller of Record?

A Seller of Record is simply the legal entity referred to and identified as the seller of a product to the end consumer.

They are also responsible for accounting transaction tax and the risk of a product liability unless stated otherwise.

How does a Seller of Record work?

The goal of a Seller of Record is typically to simplify sales tax and maintain commerce policies for online sales.

For example, you can outsource your sales responsibilities to a Seller of Record to focus on production and distribution.

The SoR will provide vital financial elements like a payment system, channels, processors, and settlers to process payments.

Every transaction recorded via the payment systems will point to your Seller of Record, who identifies as the original seller at the time of the transaction.

Seller of Record is helpful if you want:

- Outsource liabilities: you can focus on customer acquisition and product upgrades and outsource the seller’s liability and legalities to an SoR.

- Reputation Control: an SoR identifies the original seller to control the production brand through a seller contract.

- Manage Recourse: In an unsuccessful purchase, a Seller of Record is responsible for customers’ legal rights that demand compensation or refund.

What is a Payment Service Provider?

A Payment Service Provider (PSP) is a third party that allows merchants to accept payments.

They provide you with electronic payment services that allow you to accept online payments for methods like digital wallets or credit cards. Or bank-based payment methods such as bank transfer, direct debit, and online banking.

A PSP typically connects you with multiple payment networks, acquiring banks and cards, so you can seamlessly process payments without a direct relationship with any of these providers.

This makes you less dependent on these financial institutions and free from the technical requirements to create such a connection.

How does a Payment Service Provider work?

A Payment Service Provider is more than a Payment Gateway.

Payment gateways simply validate transactions and ensure funds are available to complete the process. In contrast, Payment Providers provide these and the connection you need to access the funds.

A typical online business needs to access payment from different financial institutions. You can decide to apply for personal relationships with each of these financial institutions, which will cost you time and millions of dollars in contract and tech, or use a PSP.

A PSP also helps merchants control online transactions, data protection, fund remittance, fraud, and multi-currency processing.

Some PSPs also allows merchants to provide next-generation payment processing like e-checks, wallets, and prepaid cards.

But unlike a Merchant of Record or Seller of Record, you’re responsible for the financial requirements and regulations.

Payment Service Provider is helpful if you want:

- Manage your transactions: accept various online payment methods, like online banking, credit cards, debit cards, e-wallets, cash cards, and more.

- Reduce processing cost: financial institutions cut processing costs for PSPs because they manage in bulk. This will cost way more if you try to partner directly.

Merchant of Record vs. Seller of Record

The main difference between Merchant of Record and Seller of Record is that MoR acts as a reseller and doesn’t necessarily take up the seller’s identity.

The MoR may appear on the credit statement of the customer, but the transaction can be traced to the seller who owns the store or website.

A Seller of Record assumes the seller’s identity; you essentially give them the legal right to sell your goods under their name and identify as the original seller.

Merchant of Record vs. Payment Service Provider

The main difference between a Payment Service Provider and a Merchant of Record is that a PSP is a payment-only solution.

On the other hand, the Merchant of Record is responsible for the entire order process, payment processing, financial risks, regulations, and liability.

One of the advantages of the MoR model versus PSP is that it does local processing (MoR works with local acquirers – by comparison to PSPs which work with acquirers in the merchant’s country) and this impacts costs and authorization rates.

Merchant of Record vs. Payment Gateway

A Merchant of Record is different from a Payment Gateway.

A Payment Gateway is a “software program” that allows merchant accounts to process credit cards online.

It connects credit card data from the point of sale device or software to the credit card processor to successfully process payments.

In contrast, an MoR is an “entity” authorized to “resell” to your customer and bears the transaction’s liabilities.

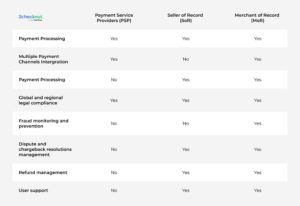

Difference Between a Merchant Of Record, A Seller Of Record, And A Payment Service Provider

Payment Service Providers exclude tax remittance, complete fraud protection, compliance with globally recognized security standards (such as PCI DSS) or government regulations, managing refund requests, chargebacks, or any other assumption of risk on behalf of merchants.

Essentially, they do not take on any other financial responsibility or assume any financial risk of processing payments.

In contrast, an MoR handles everything from ordering, payment processing, reconciliations, refund requests, currency conversions, chargebacks, data privacy regulations, even tax compliance.

On the other hand, a Seller of Record Identifies as the seller of a product to the end consumer.

Also, while Merchants of the Record act as resellers, they don’t take up the identity as the original seller as an SoR. Only the customer’s card statement will bear an MoR’s name, not the entire transaction details.

Another difference is by business operation.

If your business only operates locally, you can use a Payment Service Provider and act as your Merchant and Seller of Record.

The PSP solution is best suited for domestic businesses that only require a third party to process payment.

The actual value of outsourcing your payment solutions is when your business is global. Then, you’ll need an international merchant account to calculate accurate taxes, allow local payment methods, and comply with international regulations.

Which Kind of Partner is Right for Your Online Business?

Depending on your business, you may need one or a combination of these payment systems.

If your business only operates locally and has the required resources in place, then it’s feasible to act as your own merchant and seller of record as it’s easier to maintain a merchant account, standardize processes for settlements, reporting, and reconciliations than when you’re transacting business within home country borders.

Hence, MoR solutions benefit global sales and B2B or B2C sales with relatively simple sales cycles.

On the other hand, PSP solutions are best suited for domestic businesses or services requiring third-party or onsite support.

The actual value of outsourcing your payment solutions plays out when brands plan on expanding globally. To do so, you’ll need an international merchant account that’ll calculate accurate taxes, allow local payment methods, and comply with international regulations.

Here are some key factors you should consider while choosing a partner:

1. Security

Nothing beats using a secure system when dealing with payment processing.

Before you settle on any payment gateway, confirm that their security is intact and PCI compliant.

You’ll need to confirm the PSP is permitted by your local financial regulator or the central bank.

You also want to ensure that they use an SSL certificate to ensure that your customer’s confidential information is encrypted to prevent data interception.

2. Support

You can’t and do not want to afford downtime as this could increase your bounce rate.

Look for a payment solution that you can reach via email, chat, and phone. Make sure the partner is available 24/7 to immediately deal with any issues that may arise.

3. Easy Integration

You want to ensure that your payment solution is easy to integrate.

The ideal solution would be to select a payment gateway system that doesn’t mess up your website’s UX or slow the payment process.

It should also provide multiple payment options and be user-friendly; otherwise, you could end up losing customers.

Implications on Payments – Authorization and Conversion Rates

The type of payment provider you opt for can have different effects on your authorization and conversion rate, which is vital in surviving in today’s retail landscape.

What are Authorization Rates?

Every time a customer inserts or swipes their credit or debit card, it requires authorization.

Authorization rate, also known as auth rate or approval ratio, is the percentage of a merchant’s transactions that successfully pass through the authorization process and result in a completed payment or approval.

It represents how much you may be losing to declined cards.

An unsuccessful authorization will reject or decline the customer’s card, maybe due to insufficient funds, institutional, or technical issues. But either way, you’re losing customers.

What are Conversion Rates?

Although they are closely related, authorization rates are not the same as conversion rates.

Auth rates simply measure the percentage of a merchant’s debit and credit card transactions that successfully pass through the authorization process with approval. In contrast, conversion rates refer to total purchases divided by the number of consumers visiting the payment page.

In some cases, an authorized transaction may also go uncompleted (such as in cases where the customer abandons the order before it’s finished). In such cases, the transaction is said to be authorized but not converted.

What are the Implications of Higher Auth Rates and Conversion Rates to Merchants?

Choose a payment gateway that allows customers to complete their transactions in the first attempt.

When auth rates are low, most customer transactions will decline. Usually, the customer has the option of trying out other payment methods. However, a majority will simply abandon the order entirely.

A study by Sapio Research indicates that 33% of falsely-declined shoppers abandon the transaction and retailer entirely.

Again, higher auth rates can lead to higher revenue volumes for merchants and more completed transactions.

This makes auth rates one of the most critical ways for merchants of all sizes to unlock revenue — especially those operating on a global scale.

For a marketplace, the payment experience plays a critical role in the conversion. The merchant usually doesn’t handle the payment flow, hence selecting the right payment solution for your business is extremely important.

If your payments processor contributes to your low auth rates, it costs your business; you may need to consider other payment solutions.

Achieving a 100% conversion may probably be a flight of fancy. However, optimizing your payment experience so that customers can complete their transactions will in no small way accelerate growth for the business.

Bottom Line

While Merchants of Records, Sellers of Record, and Payment Service Providers are often used interchangeably, they perform different functions for your business.

If you want an affordable all-in-one payment solution that incorporates all these functionalities for your business, see 2Checkout.com.

It’ll help you participate effectively in the global market through various payment processors and admin tools designed for online businesses.