The popularity of subscriptions continues to grow year after year, in spite of the social changes and uncertainty brought by the COVID-19 pandemic. Shifts of preferences within the category are, however, noticeable, with the new normal driving people to reevaluate and reconsider the terms under which they enter and renew recurring subscriptions.

2Checkout’s latest global study on subscription usage, which was conducted over April and May, 2021 with respondents from 90 countries, reveals how consumer preferences in the category are changing and what merchants selling subscriptions should consider in order to improve the customer experience going forward.

The pandemic has not deterred subscribers

With social distancing rules in place and restrictions keeping people indoors, subscriptions registered an uptick in popularity. 37% respondents report buying more subscriptions after the onset of the pandemic while 51% others kept all their previous subscriptions active. Only 13% of respondents were affected enough by the socio-economic changes brought by the pandemic that they had to give up some of their previous recurring services.

The rate of acquiring or renewing new subscriptions is an encouraging factor in the category, with 49% of respondents reporting they purchase subscriptions a few times a year, about a quarter purchasing at least once a month, and 26% acquiring subscriptions at most once a year.

Entertainment and online news are top consumer picks in 2021

Comparable to last year’s preferences, the entertainment subscription category is still holding strong and attracting subscribers in droves. 73% of respondents report getting at least one entertainment streaming service (like Netflix or Spotify) or an online press subscription (such as subscriptions for news outlets like The New York Times). It is clear that the lockdown and restrictions period has made consumers that much more interested in on-demand content, whether we’re talking about text, audio, or video.

Software came in a close second in preferences, with 43% opting for downloadable software while cloud-based software attracted 30% of respondents. Rounding up the tech category, 17% also acquired or renewed their cloud storage subscriptions.

Shoppers value flexibility

As far as choice in the category goes, one of the most important factors when choosing a subscription remains the flexibility of canceling at any time. 52% of respondents report not wanting to be locked into recurring contracts, perhaps a natural reaction to the recent lockdown conditions.

Recommendations from friends, access to one’s preferred payment method, as well as the availability of a free trial were also reported as important factors that have driven adoption up, for at least half of subscribers.

Mobile wallets are the payment method of choice

While online shoppers prefer to have multiple payment options available during the checkout, the most popular methods used for paying subscriptions were mobile wallets and cards. 71% of respondents report opting for eWallets like PayPal or ApplePay, 41% used credit or debit cards, and 37% used online banking to pay their recurring contracts.

Shoppers value convenience

Our latest survey shows that 65% of respondents favor automatic versus manual renewals. An 11% increase versus 2020, this growing preference for automatic renewals attests to users’ increasing needs for convenience. At the same time, it opens up new opportunities for merchants to provide customers with uninterrupted service.

Shorter billing cycles and usage-based pricing are growing in popularity

By contrast to 2020, when yearly payments were reported as a crowd favorite, this year consumers favored paying in quarterly (46%) or monthly (35%) cycles. This could suggest a need for more control of recurring payments, but also more experimentation (and implicitly shorter commits) in the subscription category.

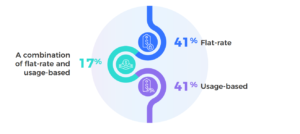

As far as pricing models are concerned, preferences are quite evenly split between those who favor flat rates and those who prefer usage-based pricing. In contrast to last year, fewer respondents report that flat rate is their preferred pricing model (41% versus 65% in 2020), which could suggest a need for pricing schemes that are better tailored to individual consumption patterns.

Customer support can make it or break it

One of the most important factors contributing to subscription cancellation was found to be a poor customer support experience – almost half of respondents (45%) are ready to cancel their recurring payments if they go through an unsatisfactory service episode. 36% cancel when they don’t use the subscription enough, followed closely by those who cancel when the recurring cost becomes a burden (36%) and those who cancel when faced with unexpected extra charges (34%).

Conclusion

In spite of shifting preferences, subscriptions popularity among consumers is growing year after year. To build the experiences users are looking for, merchants need to stay up to date with their audience’s evolving expectations and needs and maximize usage of eCommerce tools to offer the personalized, convenient and flexible experience today’s shoppers crave.

Go deeper in the results of 2Checkout’s 2021 Subscription Survey by checking out the full infographic.