Payments may seem simple and unimportant – they just involve exchanging money for goods or services, right? Even young kids can go to the store and buy candy for pennies, or (these days) make bids on eBay for interesting comics or toys. But modern payments have the potential to be much more, and to contribute to your bottom line as a merchant as well. A more dynamic payments layer can become another important ally in your quest to sell more services more expertly, and even boost your sales by more than ten percent without any additional effort on your part.

Many people attempt to silo payments, picking a separate vendor to handle just payments, but it’s actually crucial to integrate payments into the entire shopping experience. Imagine if you had to walk across the street or next door to make a purchase at a local shop. You’d probably set down your item on the journey and give up on the process. That’s what it feels like to your customers when you send them away to log into separate services, like PayPal or Google Wallet, to pay for your products. You’re brushing them off and reducing the chance they’ll come back to complete the purchase.

There’s also a lot more to the payment experience than a simple transaction. What happens when customers reside in a different country, want to use a different payment method, or forget to update a credit card on their account? You want to handle all of these scenarios for customers seamlessly, rather than forcing them to figure out a solution on their own. But most existing payment solutions can’t accommodate all these customer needs. Also the obstacles in establishing the ability to take payments globally are often more than the merchant realized, and they spend time tackling those foreign payments obstacles instead of growing their business – losing valuable time-to-market.

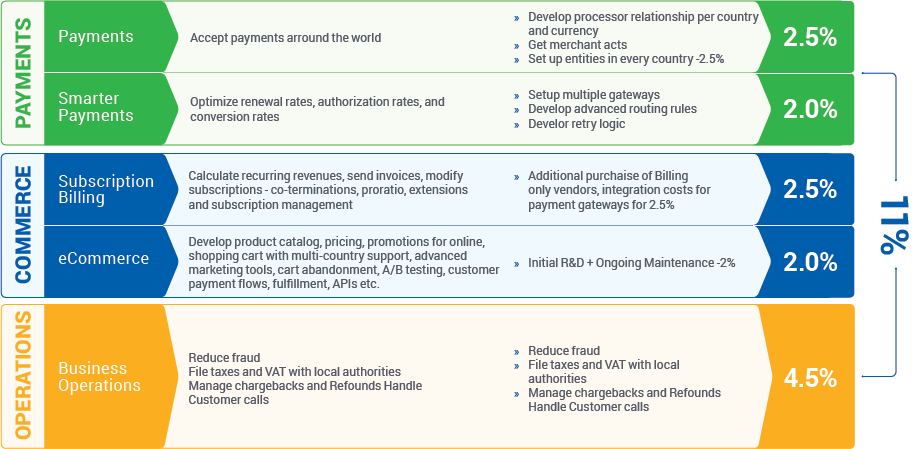

Instead of relying on an existing, but limited, external solution for payments, companies can increase conversion, authorization, and renewal rates by taking a more holistic and customer centric approach to payments. Rather than looking at payments as simply something to check off a list of requirements, companies should begin to view them as an asset that can improve the customer experience and boost sales. To do so, companies should focus on four elements:

- Integrate: Integrated payments create a seamless experience for your customer, whether for one-time transactions or subscriptions. Ensure that the integration covers subscription billing and recurring revenues, as well as ecommerce fundamentals like product pricing, promotions, and testing. Without each of these elements, you can’t truly create a positive, integrated payment experience.

- Optimize: Optimize renewal, authorization, and conversion rates with smart tools like automatic card updates, retry logic for failed payments, and intelligent payment routing to facilitate approved transactions. Taking a few simple steps can increase authorization levels by more than 100 percent (70 percent from account updating, 5 percent from retry logic, and 30 percent from intelligent payment routing). That’s a boost you can’t say no to.

- Expand: Turn distribution channels into revenue engines by expanding to the channels where your customers buy. Whether you utilize VARs, virtual sellers or affiliates, you can rapidly expand your global footprint and boost your sales worldwide.

- Fix fundamentals: A commerce solution needs to take care of fundamentals like fraud prevention, tax handling, chargebacks and refunds, and more, all to ensure that small issues never prevent big business.

It’s possible to buy various solutions for each of these areas and integrate them manually, or even build a custom solution yourself. However, it can be much faster, easier, cheaper, and more reliable to pick a complete commerce solution like Avangate that already combines all the elements in a proven yet flexible manner. The key is to select a platform that goes beyond payment fundamentals to offer real business opportunities.

For more tips on integrating, optimizing and expanding payments to get better revenue uplift, check out our white paper that describes how to Go Beyond Payments.