Updated June 2023

As the world is evolving, so is the digital environment. Consequently, speed has become a constant in the average customer’s life, especially when hitting the checkout page.

Being up to speed on the online payment methods is a mandatory practice for your business, as 4.11 billion people purchased goods online in 2022.

There are countless ways in which online payments can be processed, their popularity depends on individual zones around the globe and so merchants must adapt to current trends and specifics.

Sure, you may be aware of cards’ and PayPal’s popularity, but is your business really catering to the preferences of all audiences you’re targeting?

Let’s go over the best payment methods online and see if there are any you are omitting.

Global eCommerce payment methods

Whether they’re shopping from a desktop browser or from your mobile app, consumers nowadays expect different payment methods to be featured in online stores, so they can choose the one that suits that specific need. In order to be relevant to the widest audience you need to ensure your site has capabilities to support those payment means which are most popular online.

Considering this, it’s crucial for businesses to understand the most popular online payment methods available in the market. By doing so, they can ensure that their customers have access to a seamless and secure checkout process.

Bonus: See how easy it is to go global and other benefits of going beyond payments.

Credit & debit cards

Credit cards remain one of the most popular choices globally for online purchases, although their market share has been dented in recent years by eWallets. Credit card transactions increased roughly six percent between 2020 and 2019. On the other hand, debit cards have extended their lead as the most used card product, with 94 transactions per capita globally, versus 49 between 2020 and 2021.

Cards’ popularity as online payment methods was built on the protection features offered – card transactions have been regulated for many years by global or regional compliance standards and also by consumer protections issued by payment processors, such as those upheld by American Express, Mastercard and Visa.

Credit cards have a slightly more marked preference in Western markets vs debit cards, given some of their additional features. For example, some shoppers are incentivized to use credit cards to have access to the bank’s reward programs. In the US, more so, credit card spending impacts the user’s credit scoring and serves as an extra motivation to opt for it as an online payment method.

Credit cards have a slightly more marked preference in Western markets vs debit cards, given some of their additional features. For example, some shoppers are incentivized to use credit cards to have access to the bank’s reward programs. In the US, more so, credit card spending impacts the user’s credit scoring and serves as an extra motivation to opt for it as an online payment method.

For many years, card payments have been considered the top choice for consumers when it comes to making online purchases. However, in recent times, their claim to the number one spot has been fiercely contested.

As we move forward, it’s clear that the landscape of online payment methods is constantly evolving, with new and innovative options emerging regularly. Consumers are becoming increasingly tech-savvy and demand more convenient and secure payment options.

In the face of this shifting environment, payment cards are facing stiff competition from other payment methods such as e-wallets, mobile payments, and cryptocurrency.

eWallets

Also known as digital wallets, eWallets are one of the fastest growing online payment methods in B2C eCommerce all over the world, Juniper Research raveling that digital and mobile wallet payments accounted for 3.4 billion users in 2022, projecting to exceed 5.2 billion globally in 2026. Online wallets had the highest market share in the Asia-Pacific Region with approximately 69 percent of eCommerce payments. Middle East, Africa, and Latin America are forecasted to have the highest increase in mobile wallets market share online by 2024.

This alternative payment method works like a prepaid credit account, and stores the customer’s personal data and funds. When using an eWallet, the user no longer has to input his bank account details to complete the purchase, being redirected from the checkout to the eWallet’s page where they simply have to log in with their username and password to conclude a purchase.

The most popular digital wallets include PayPal (predominantly in the Western world), AliPay (popular in Asia Pacific), ApplePay, GooglePay, WeChat or Venmo. eWallets also work in combination with mobile wallets, employing a smartphone’s biometric options, which help the customer authenticate faster thus finishing their payments faster.

A new study from Juniper Research projected QR code payments as the most popular digital wallet transaction type in 2026 accounting for 380 billion transactions globally, and for over 40% of all transactions by volume.

Bank transfers

This online payment method involves the customer paying from their banking account with their own funds. It is perceived as having an extra layer of security, as transactions require authentication through the customer’s bank. Basically, when chosen as payment method during checkout, a bank transfer redirects the user to their internet banking portal, where they have to log in and authorize the transaction.

Bank transfers accounted for 9% of worldwide eCommerce transaction volumes in 2019, chosen primarily in Europe. In 2021 they increased by 8.6% to 2.5 billion, accounting for 22% of the total number of transactions.

Buy now, pay later

An online payment method that has gathered attention lately and which registered last year an estimate of 360 million people worldwide using BNPL services is Buy Now, Pay Later. This is a form of instant lending which more and more young consumers are turning to, as Teen Vogue also reports.

The reason for its growing popularity is that BNPL offers a convenient way to make purchases without having to pay the full amount upfront. This option allows consumers to spread their payments over a period of time, without having to open up a credit card account. With BNPL, shoppers can defer payments for a few weeks or even months, depending on the terms of the service. Availability of this option during checkout has been reported to persuading 30% extra buyers to finalize a purchase they wouldn’t have otherwise.

This alternative payment method is experiencing accelerated growth, reaching an estimate of $179.5 billion market value in 2022, and by 2025, this figure is predicted to almost triple.

Some of the options for this payment method include Klarna, AfterPay, and Bread.

Prepaid cards

Another alternative online payment method is prepaid cards, chosen primarily by unbanked users or minors. Customers opt for a prepaid card from a set of predefined available values and then they use the details on that card for online transactions.

Market penetration of prepaid cards has accounted 1.6 market share in 2020, some of the most popular cards chosen by users including Paysafecard or Mint.

Usage of this payment method is more marked in the gaming industry, driven most likely by audience demographics.

One of the biggest advantages of prepaid cards is that they can help consumers manage their spending and stay within their budget. Since prepaid cards have a pre-loaded balance, users are unable to spend more than what they have on the card, thereby avoiding the risk of overdrafts and accruing debt. Prepaid cards also offer users the ability to monitor their spending easily, thanks to online account management tools that allow them to track their balance and transactions in real-time.

As prepaid cards continue to gain popularity, we can expect to see even more innovation and new features in this rapidly evolving market. For instance, some prepaid cards now offer rewards programs that allow users to earn cashback, points, or discounts for certain purchases.

Electronic checks

E-checks are a form of online payment that are regulated by the Automated Clearing House (ACH) and involve drawing money directly from a checking account. With e-checks, the user authorizes the payment directly from their internet banking account, and the processing is similar to that of traditional paper checks, but much faster.

One of the advantages of using e-checks is that they offer a secure and reliable payment option for both individuals and businesses. This payment method is particularly useful for recurring payments, such as rent or utility bills, as users can set up automatic payments to be deducted from their checking account at regular intervals.

Electronic checks are popular among American merchants with large sales volumes and a high average amount and they are perceived as an affordable online payment method. Apparently, e-checks were the first Internet based payment used by the US Treasury for making large online payments, which can explain their popularity in this category of users.

30% of B2B payments in the U.S. and Canada continue to be made by check and at a global level, payments made by check account for only 31 percent of B2B payments.

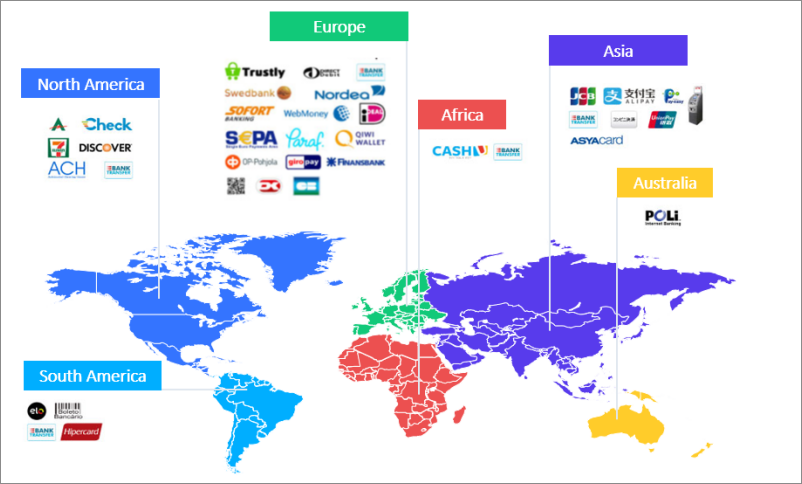

Local eCommerce payment methods

While understanding best payment methods for online businesses targeting global markets is essential, in order to enter some local markets, you have to understand how preferences vary in each region. Some markets, for example, have a stronger preference for cards, whereas in others the eWallet is king.

And, beyond the payment methods detailed above, certain markets also employ online methods developed specifically for citizens in that jurisdiction.

Local payment methods can range anywhere between 10% to 50% in adoption in a country, so be sure to consider local flavors when setting up an eShop there.

For example, in China, there is a prevalent usage of Peer–to–Peer payment apps (P2P), where you can transfer money to family members or friends for small expenses. Some of the most used payment providers are WeChat, Venmo and PayPal.

Europe

Overall, most European consumers opt for cards or eWallets for their online shopping, with some marked preference for different online payment methods in different markets.

In Germany, PayPal is used by for online shoppping with a 95 percent rate as of 2021, whereas just 16% of French opt for it. SEPA Direct debit is also a popular option among Germans, used for one time and for recurring payments as well.

In the Netherlands, the most popular payment method is iDEAL, with 66% of shoppers choosing according to Statista. On a market with a high adoption rate for internet banking, it comes naturally that shoppers prefer iDEAL, a standardized online banking-based payment method.

In France, a market with a high banking penetration rate, shoppers may opt for their cards, but as a merchant you still have to know their preferences. 2Checkout’s benchmark study found that 14% of shoppers here favor their Cart Bancaire, a local payment method available only in this market.

Over in Turkey, 17% of shoppers also prefer local cards, however, they do so because these local cards come with installment features. 80% of card transactions here are recorded through installment cards such as Maximum or Bonus Card.

As reported in recent research, in Spain, debit and credit cards are the preffered payment method, with digital wallets coming in second place. In 2023 is forecasted that cards will be used less and less, with digital wallets and bank transfers starting to take over.

North America and Latin America

Credit cards and debit cards remain the most popular online payment methods in the Americas, with more than 50% of market share in each region, but, beyond cards, preferences diverge.

Where North Americans are more likely to opt for their PayPal or other preferred digital wallet, South Americans are more likely to use a local credit card with installments. In 2022, credit cards were estimated at more than half of all e-commerce payments in Brazil and Chile, although, in Mexico, they would make up four out of every ten of those transactions. Coming second place in popularity is the instant payment platform Pix among Brazilian online shoppers, with debit cards ranking second among Chileans.

11.5% of the total volume of eCommerce purchases across the Latam region are e-wallets transactions as the internet penetration rate has reached 68.8%.

Asia Pacific

Asia-Pacific leads global preferences for mobile/ digital wallets, with more than 50% of this region’s online transactions being wallet based.

Chinese consumers are the biggest fans of this online payment method, on a market dominated by AliPay and WeChat Pay. 42%, almost half of all online transactions in China are paid via AliPay. Cards come second in preference in Asia Pacific, followed by bank transfers.

When it comes to digital payments, China is the biggest market, It has been reported that at the end of 2020, 1.22 billion people subscribed to mobile services in China, corresponding to 83% of the region’s population.

In terms of local preferences, about 5% of Japanese opt for Konbini, a local cash-based payment method in that country, which allows shoppers to order online and then pay in a convenience store. Given Japanese people’s propensity to visit convenience stores often, ATM payments at these stores became quite popular for shoppers here. JCB card payments are also a shopper favorite in Japan, given the fact there are 146 million card holders in Japan and recently JCB has also launched an app.

Africa

Mobile payments are gaining popularity in African American online shopping markets due to the lack of access to traditional banking services for the majority of African American consumers. This has created a need for alternative payment options, such as mobile payments, that are accessible and convenient for these consumers. Mobile payments allow consumers to link their mobile phone number to their payment account, enabling them to make purchases directly from their mobile device.

Consumers who buy online in Africa have a propensity to pay by cash as of 2022, though in countries such as Morocco card-based payments and bank transfers are prevalent

In this area, cash is still the most popular payment method, accounting for a 60 percent of the total transactions in 2022. Additionally, in Kenya, 44% of transactions were by card and 19% by bank transfer.

In a majorly digitalized world where speed is the new norm, safety is a variable all consumers keep in mind when trying to avoid payment fraud. So, what are the safest online payment methods?

Credit cards use encryption and fraud monitoring to keep the sensitive data and accounts secure, and they are the safest payment method.

ACH payments are processed to a network (Automated Clearing House involving a series of security features like encryption and the implementation of access controls.

Regardless of whether you are a business owner or a shopper, it is crucial to conduct thorough research to ensure financial safety. Choose payment methods that are reputable, secure, and have a proven track record of protecting consumers against fraud. By taking these precautions, you can enjoy the convenience of online shopping with peace of mind.

If you’ve made it this far, you now have a much stronger grip on what are the most popular payment methods online and you have a good start on how to approach each market. Getting to know the different online payment methods will allow you to adapt locally, which in time will lead to better conversion rates on your site. Keep cultural preferences in mind while tailoring local strategies and choose those digital tools that will ease your entry into new eCommerce markets.

If you want to learn more about eCommerce in specific countries all around the world and how to reach new audiences with the 2Checkout help, read our ‘Enter New eCommerce Markets with 2Checkout Guidance’ series.