eCommerce companies lose $31 billion each year due to chargebacks. What started as a legal mechanism to protect shoppers from fraud has become a persistent threat to the profitability of online merchants—as well as a hassle for the consumers who should benefit from it.

Let’s have a look at how the chargeback process works and why merchants should always keep the number of open chargeback requests to a minimum.

What are chargebacks?

Let’s start with the chargeback definition:

A chargeback is a transaction in which an issuing bank pulls funds from a merchant and gives them back to a consumer. This usually occurs because the consumer has escalated a dispute about a purchase to their bank for resolution.

A chargeback is different from a refund. Instead of contacting the merchant from which the purchase was made and requesting a refund, a shopper can go directly to their bank and request that the funds be removed from the merchant’s account.

How are chargebacks used?

What is a chargeback in simple terms? It’s a mechanism designed to protect customers from fraudulent retailers. Today, however, we’re seeing the opposite problem: fraudulent customers taking advantage of honest retailers.

Typically, a cybercriminal will obtain a person’s card details and use them to make illegal payments. The cardholder naturally has no idea until they happen to check their account or are contacted by the bank.

Once spotted, the cardholder can ask the issuing bank for a chargeback. The bank will investigate the transaction in question and, if fraud is suspected, will forcibly remove the funds from the merchants’ account and return them to the cardholder’s account.

Chargebacks as a deterrent for merchants

Chargebacks are also meant to deter merchants from engaging in unethical or fraudulent practices. These might include delivering products that don’t match the advertised specifications or are defective, accepting payments but not fulfilling the orders, or adding hidden extra charges to the shopper’s card.

Since dissatisfied customers have the possibility to request their money back by sidestepping the seller altogether, eCommerce companies will normally try to provide the best products and services to their clients. The vast majority of businesses are run this way without any incentive. But for merchants who might consider fraudulent activity, chargebacks are a useful guard.

The chargeback process

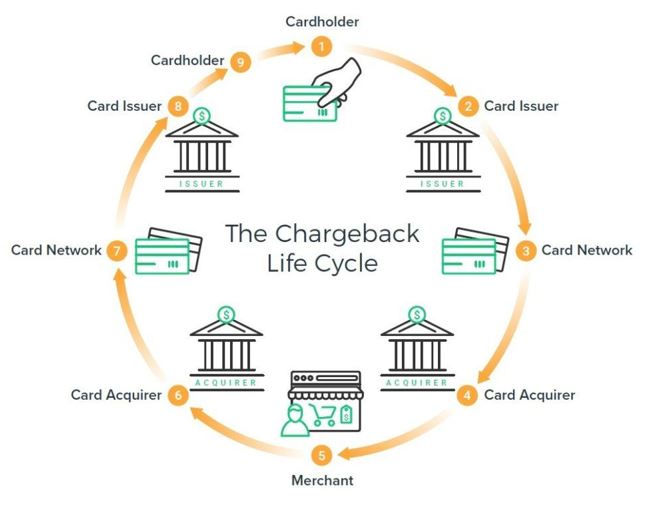

Here’s a play-by-play of how chargebacks typically turn out:

| 1. The cardholder disputes a transaction by contacting the card-issuing bank and requesting a refund.

2. The bank first checks if the transaction is eligible for a chargeback. If so, the transaction is charged back to the merchant’s acquiring bank via the relevant card network: Visa, MasterCard etc. 3. The card network screens the chargeback for compliance against its technical criteria. If confirmed, the chargeback is forwarded to the merchant’s acquiring bank. 4. The acquiring bank may transfer the money instantly from the merchant’s account to the cardholder, or forward the request to the merchant first. 5. The merchant receives the chargeback notification and, if certain conditions are met, can represent (i.e. oppose) the chargeback to its acquiring bank, providing documentation to show that the transaction was legitimate and should stand. If the necessary criteria are not met, the merchant will have to accept the chargeback.

|

6. The acquiring bank forwards the merchant’s representation to the card network, who then forwards it to the card issuer.

7. The card issuer then reviews the case again and, if the merchant’s case is compelling, charges the cardholder’s account again for the disputed transaction. However, if the issuing bank considers that the chargeback issue has been inappropriately addressed by the merchant’s representation, it may submit the dispute to the card network. This triggers arbitration by the card network. 8. In arbitration, the card network decides which party is responsible for the disputed transaction. Should the merchant wish to fight the arbitration decision as well, there is an additional fee of approximately $500, although very few transactions would justify the cost of such an action. |

What are the most frequent causes of chargeback requests?

According to 48% of merchants, Card Not Present (CNP) fraud is the largest source of all chargebacks, while a significant number also comes from order not recognized complaints. More than 80% of consumers admit that they’ve filed a chargeback out of convenience, which is rather worrying.

Order Not Recognized

‘Order not recognized’ occurs when the shopper doesn’t recall placing a new order or doesn’t recognize a transaction that is listed on their bank statement. It is often related to subscriptions with recurring billing.

Most customers don’t know (or remember) that they agreed to be automatically billed for a product or service, often because they just checked a box in the shopping cart without really reading it, or because the box was pre-checked and they didn’t realize what it meant. Therefore, they will dispute the charge.

Fraud

Fraud is harder to detect and fight, as it can take many complex forms. Card Not Present (CNP) payment fraud has exploded in recent years in step with eCommerce, with mobile payments and data breaches exposing shoppers’ data to fraudsters.

The 50% of fraud losses comes from ‘friendly fraud’ and chargeback fraud.

- Friendly fraud happens when a family member buys something using the shopper’s payment card without them being aware of it. Therefore, when the card holder sees the unknown order on their card statement, they open a chargeback request.

- Chargeback fraud is when a shopper intentionally abuses their chargeback rights to both retain a purchased item and get their money back.

The increased consumer awareness of chargeback rights and the ease of disputing a charge—coupled with the difficulty merchants have in fighting chargebacks—has led to an escalation in chargeback fraud in recent years.

Understandably, an increase in chargeback activity has a considerable impact on a merchant’s bottom line and is damaging for the eCommerce climate overall.

The serious impact of chargebacks

Credit card chargeback requests produce cascading effects that ripple far beyond the refund costs themselves. For a start, every single time shoppers file a chargeback request, the merchant is required to pay a chargeback fee—irrespective of how the chargeback process is eventually resolved.

Chargeback rate

In addition, even if merchants dispute chargebacks and win those disputes, their chargeback rate does not improve.

| What is the chargeback rate?

Chargeback rate is a metric that describes the ratio between the total number of transactions and the total number of chargebacks a merchant has earned. It is calculated by dividing the number of open chargebacks by the number of finalized transactions in the previous month. Why is this important? Once chargeback rate creeps above a certain level (approximately 0.9%) payment providers may terminate accounts with merchants. |

The average eCommerce chargeback rate for merchants using the 2Checkout digital commerce platform is between 0.3% and 0.4%. This is well below the 0.9 % threshold and considered a very healthy chargeback rate.

Risk of fines and penalties

Every chargeback request, valid or not, brings merchants one step closer to fines or even losing their merchant accounts with the acquiring banks.

Depending on the card association’s rules, fines imposed on merchants for exceeding chargeback rate thresholds can reach $10,000 or more. Repeat offenses will then lead to merchant account termination and possibly inclusion on MasterCard’s MATCH list, which will forbid the business from obtaining another regular merchant account with acquiring banks for five years.

Businesses that find themselves in such a situation often have no recourse but to apply for high risk merchant accounts, which usually come with steep costs that cut deeper into the merchant’s profitability.

Chargebacks are a difficult fight for honest merchants

The negative impact of chargebacks is compounded by the fact that even though a reported 72% of merchants respond to chargebacks, the average net win rate is slightly under 9%.

Nevertheless, merchants can – and should – set up preventative measures to protect themselves from chargebacks. Doing so will not only help them avoid significant profit losses, but also contribute to the health of global commerce overall.

It’s 2023—What can I do to prevent chargebacks?

It all comes down to providing a great customer experience: effective and timely communication towards the shopper, transparency, responsiveness in customer service, and features and policies that encourage customer retention and discourage fraud.

Your best resource for actionable ways to reduce—and eventually stop—chargebacks is our free ebook on Understanding Chargebacks. Check it out now and slash your chargeback rate!