In 2024, payment systems are expected to evolve even more as people and companies require faster, more secure, and more convenient solutions. This switch is not just the world’s latest whim or trend but a revolutionary move towards a financially integrated and holistic environment.

Mobile wallets and contactless payments are becoming increasingly omnipresent, offering exceptional convenience and efficiency. They eliminate the need to handle cash and cards, reducing theft and loss. Moreover, these technologies are opening up new opportunities in security, implementing biometric identification and high levels of encryption to secure users’ data.

With changing times, there is much to uncover about the future of contactless payments for eCommerce businesses and customers.

Let’s discuss all these in detail.

The Current State of Mobile Wallets and Contactless Payments

In 2021, the mobile wallet industry processed over US $1 trillion worth of transactions, a 31% year-on-year increase compared to 2020. Additionally, the value of digital wallet transactions is projected to increase from US $7.5 trillion in 2022 to US $12 trillion in 2026.

Technological innovation, changing consumer preferences, and evolving market dynamics shape the current state of mobile wallets and contactless payments. Let’s delve into these intricacies to understand its nature.

1. Penetration and Usage

Mobile wallets, digital purses, or contactless payments are another emergent trend in 2024.

A great example of this is Apple Pay. With over 2.8 billion users worldwide, this payment gateway has become integral to various financial transactions, from everyday purchases to peer-to-peer transfers and bill payments. Still, variations are noticed across the regions depending on developing infrastructure, culture, and legal requirements.

While mature markets, such as the USA, UK, or Japan, offer a high percentage of users who use digital payment systems due to well-developed infrastructure, there can be challenges in developing countries to provide convenient access to smartphones and affordable Internet, along with the problem of financial illiteracy.

Further, the level of security and authenticity in online payments is a crucial driver of adoption in different regions.

2. Popular Use Cases

The convenience of mobile wallets and contactless payments has been evident in the retail, transit, and even e-commerce segments.

Contactless payments are the most recent payment innovations affecting retail stores. They make the markets less congested and eliminate contact between buyers and sellers.

M-Commerce has also benefited from the enhancement of ticketing systems, where commuters can use their mobile wallets to pay for their fares instead of bundles of tickets.

3. Technological Innovations Shaping the Future

Mobile wallets and contactless payments are the best examples of how innovation continually shapes the growth of these emerging technologies. Fingerprints and facial recognition are examples of biometric authentication methods that make it more secure and convenient; on the other hand, blockchain and cryptocurrencies are also on the rise for new borderless economies.

Mobile payment combined with the IoT implies that payments will be instant and extend to smart home gadgets and wearables. 3D payment voice commands, augmented reality interfaces, and P2P Payments show how evolving and elastic mobile payments are.

4. Future Market Insights and Trends

Companies such as PayPal, Alipay, Apple Pay, Google Pay, and Samsung Pay remain leading actors in the market.

Mobile payments have been predicted to have tremendous futures. Digital wallets are critical in mobile payments today because they are convenient, robust, and secure. Among the main trends in the coming year are biometric authentication, the connection of payment applications to the IoT, augmented reality in payments, and POS systems.

Furthermore, personalization with the help of artificial intelligence (AI) will drive customers to get more specific, whereas “Buy Now Pay Later” options will appeal to a more diverse group of customers.

Benefits of Mobile Wallets and Contactless Payments

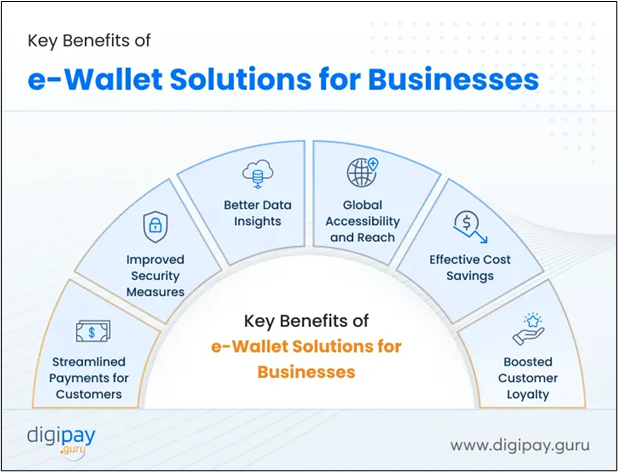

Mobile wallets and contactless payments offer numerous benefits to consumers and businesses, contributing to their widespread adoption and growing popularity.

Here are some key advantages:

1. Convenience:

Mobile wallets are generally wallet apps that enable users to save money, credit and debit cards, loyalty/physical/barrier tokens, and even cryptographic currencies. This makes it easier to avoid carrying physical wallets and sifting through cards when transacting, making these processes swift.

2. Accessibility:

Mobile wallets enable consumers to make payments at any time at any time as long as they have their mobile phones or other devices. This increases the general shopping experience and makes shopping easier from physical stores and online shops.

3. Speed:

Technologies such as Near Field Communication (NFC) and Quick Response (QR) codes increase the speed of payments through contactless means. This way, users don’t have to wait for a long time in a queue to pay for their products or services, as they can use their smartphones or scan code to complete the business transactions in seconds.

4. Security:

Mobile wallets also contain acceptable security measures, namely encryption tokenization and biometric identification (e.g., fingerprint scanning and facial recognition), which aim to shield consumers’ financial data. The above measures help reduce the dangers attendant to standard forms of payment systems, such as card fraud.

5. Cost Savings:

Mobile wallets and contactless payments also mean actual cost savings related to cash, receipt, and online transaction fees for businesses that adopt this method. Also, mobile payments minimize the chances of making mistakes when handling many formalities in a company, thus improving business processes.

6. Integration with Emerging Technologies:

Digital purses and contactless payments are deeply intertwined with progressive trends such as augmented reality, voice interfaces, and the Internet of Things – meaning new and exciting possibilities are available for effective and engaging shopping experiences and interactions.

Additionally, businesses can streamline their operations by incorporating online invoicing software, which complements the seamless nature of contactless transactions by automating billing processes and enhancing overall efficiency.

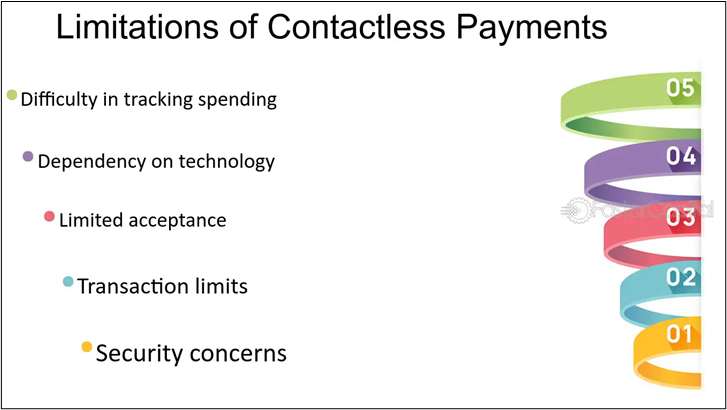

Challenges and Considerations in Contactless Payments (Statistics and Global Trends)

Understanding the opportunities, risks, and issues related to contactless payments requires working within the context of this technology.

Let’s delve into some of the key challenges and considerations backed by relevant statistics and global trends:

1. Security Concerns:

According to a survey by Deloitte, 60% of respondents expressed their concerns over smartphone hacking. This has poorly affected mobile payments, particularly among older adults who rarely change passwords.

Although many improvements have been made to make transactions more secure, such as tokenization and biometric authorization, people still worry about the security of contactless transactions being susceptible to fraud and hacking.

2. Consumer Adoption and Education:

While contactless payment solutions are increasingly popular worldwide, particularly in segments of Asia-Pacific and Europe, definitive user education campaigns still need to be improved. Some or most consumers, particularly the elderly, might have little knowledge of the technology or have certain negative perceptions regarding safety and efficiency. These campaigns include educating consumers to embrace contactless payments by highlighting the various advantages of the method and security measures to enhance its usage.

3. Infrastructure Development:

The World Bank reports that 1.4 billion adults worldwide remain unbanked, lacking access to formal financial services.

The critical problem of implementing contactless payments, including NFC terminals and sufficiently stable connections, is developing the necessary infrastructure, especially in rural areas and other regions with weak penetration. Therefore, government organizations, financial IT developers, and other technology providers must address this issue to ensure all customers have access to contactless payment services equally.

4. Acceptance and Merchant Adoption:

The statistics from a Visa survey revealed that 67% of all small businesses have embraced contactless payments since the virus outbreak.

While large organizations and outlets have adapted and integrated digital payments, small-scale traders may find it challenging to obtain the appropriate technology, which involves owning and installing the right tools.

5. Privacy and Data Protection:

A study by Ipsos revealed that 84% of consumers are worried about the privacy implications of contactless payments. Customs must also ensure consumers’ data privacy when using contactless payment services, which is especially important when handling large amounts of transactional data, and meet legislation requirements such as GDPR.

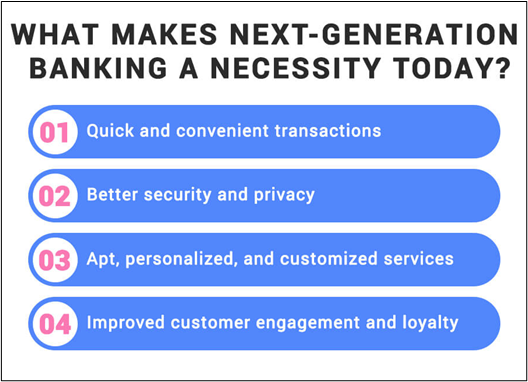

The Future of Next-Gen Transactions: Trends for 2024

Next-gen transactions are taking the front seat in the car with all the benefits it offer to owners and customers.

However, some trends are shaping the use of contactless payments in 2024. Let’s take a look at them.

1. Gen Z Leading the Mobile Payment Revolution

The convenience of mobile payments particularly appeals to younger consumers.

Mobile P2P transfers have become popular among Generation Z due to their proficiency in using technology and flexibility when transacting. In fact, according to eMarketer, 80.4% of new users adopting mobile P2P transfers between 2023 and 2027 are expected to be from this generation. This indicates that mobile payment systems will become a key part of the future as the next generation increasingly embraces new ways of handling money.

2. Contactless Payments Gaining Momentum

Mobile payment solutions like Near Field Communication (NFC) and QR code technology have increased acceptance. A significant concern for obtaining fast, safe, and clean means of payments, particularly in the post-pandemic era, has enhanced the applicability of contactless technologies. This trend is remodeling one of the latest frontiers of online and offline stores by making buying faster and easier for the consumer.

3. Biometric Authentication for Enhanced Security:

Due to the high number of mobile transactions, security is at risk. One issue is that hackers can now easily crack passwords and PINs. Biometric authentication methods, including fingerprint scanning and facial recognition, are some of the solutions to these challenges. They facilitate mobile payments and enhance the level of security.

4. The Emergence of Super Apps

Super apps are becoming a trending topic among technological giants and are considered a new category for combining various services.

It is an applied software in which certain activities, such as payment and shopping or social interactions, are housed under single applications, thus providing a one-stop solution. These super apps are currently hugely popular in a few regions, such as WeChat Pay in China; therefore, this trend can go global.

5. Mobile Wallets Becoming Multi-Functional

Services such as Apple Pay, Google Pay, and Samsung Pay are not only payment solutions at the fore; they are increasingly becoming more than that. They now contain extra elements like loyalty programs, tickets, and boarding passes to become effective instruments for daily payment in the present day.

6. The Rise of Mobile Point-of-Sale (mPOS) Systems

Mobile POS technologies are among the most promising POS technologies.

Technological advancement has seen many developments in the field of POS, specifically mPOS. These devices provide flexibility and mobility, allowing businesses to process transactions anywhere, enhance customer experience, and integrate seamlessly with other business tools like inventory management and CRM systems.

This makes mPOS particularly advantageous for small and medium-sized enterprises (SMEs), which can use these systems to compete with larger retailers. Consumers also benefit from the speed and convenience of mPOS transactions, enjoying seamless and secure payments.

7. Cross-Border Mobile Payments Streamlining International Transactions

Mobile payments facilitate cross-border transactions, making them cheaper and faster. This trend is advantageous to consumers and businesses that deal in international trade or e-business and underlines the impact of globalization on mobile payment technology.

Conclusion

In 2024, one thing is clear: the future of finance is digital.

Having analyzed the current position and perspective of these technologies, it is seen that these novelties are changing the ways of transactions, interactions, and business functioning worldwide.

The introduction of mobile devices and payment methods like m-commerce, contactless payments, and the application of super apps have also enhanced economic development and globalization.

However, addressing the challenges and considerations accompanying this transformation is essential. Four significant components help to bring mobile wallets and contactless payments to the greatest possible extent: consumer awareness, infrastructure, security and privacy, and merchant acceptance. Once you have dealt with these issues, there is no doubt that mobile wallets have a promising future.

About Author

Natasha Merchant is specialized in content marketing and she has been doing it for more than 6 years. She loves creating content marketing maps for businesses and has written content for various publication websites.

At present, she is helping SaaS Buy to improve online visibility with the help of SEO, Content Marketing & Link Building. natasha@saasbuy.com