In the dynamic landscape of the digital economy, B2B payments play a pivotal role in shaping business interactions. These transactions, occurring between businesses rather than consumers, facilitate the exchange of goods, services, and funds.

As we step into 2024, the significance of B2B payments intensifies, driven by technological advancements, changing consumer behavior, and global market shifts. Fiscal year 2023 witnessed an unprecedented surge in B2B payments, reflecting the growing reliance on seamless financial processes.

From supply chain management to cross-border trade, B2B payments are the lifeblood of commerce, impacting efficiency, liquidity, and competitiveness. Let’s delve into the trends and challenges that define this critical domain in the coming year.

Trend 1: Digital Wallet Adoption

Digital wallets have been witnessing an unstoppable growth and adoption within the B2B payment landscape, reshaping the way businesses conduct transactions. The surge in mobile payment adoption, driven by widespread smartphone usage, has prompted traditional banks to adapt by offering tailored online banking solutions for businesses.

The B2B digital payment market size is projected to grow significantly, from USD 4.2 billion in 2023 to USD 8.2 billion by 2028. This growth is attributed to the steady increase in the adoption of methods such as e-wallets and digital cards.

Fintech sector’s growth has introduced innovative payment solutions, such as digital wallets, further driving the shift in the B2B payments landscape. Although digital adoption is relatively new in the B2B payments, it is a Fintech sector with a significant market opportunity.

The B2B payment landscape is rapidly evolving, with digital wallets playing a pivotal role in this transformation. Businesses are embracing this trend, leveraging the convenience, speed, and security offered by digital wallets to optimize their financial operations.

Challenge: While digital wallet adoption is expected to surge in the B2B payment landscape of 2024, challenges such as security concerns, interoperability issues, and resistance to change from traditional payment methods can pose significant hurdles.

Trend 2: Blockchain and Smart Contracts

Blockchain’s foundation is distributed ledger technology (DLT), where transactions are distributed and verified by a network of computers, ensuring transparency and security. With its decentralized approach, blockchain eliminates the need for intermediaries like banks, facilitating faster and less expensive payments.

Cryptocurrencies, built on blockchain technology, are becoming an attractive option for B2B payments. They offer advantages such as fast cross-border transactions, reduced transaction fees, and increased privacy.

Blockchain also facilitates programmable payments through smart contracts, which automate payment processes based on predefined conditions. For instance, JPMorgan is leveraging blockchain to make corporate transactions more flexible and automated.

In the retail sector, blockchain and cryptocurrencies are making online payments more secure and easier, negating the need for customers to pay additional charges.

Moreover, blockchain is revolutionizing cross-border payments by providing efficient and secure solutions, overcoming the challenges of traditional banking systems.

Cryptocurrency and blockchain technology are transforming the B2B payments landscape by offering secure, transparent, and efficient solutions. Their influence is expected to grow substantially in the coming years.

Challenge: Despite the potential of blockchain and smart contracts to revolutionize B2B payments, their adoption faces obstacles like regulatory uncertainty, lack of technical understanding, and scalability issues.

Trend 3: Real-Time Payments

Real-time payments (RTP) have become a significant trend in the financial world. As the name suggests, RTP are payments that are processed instantly, continuously, and round the clock. With RTP, transactions between bank accounts are initiated, cleared, and settled within seconds, regardless of the time of day.

Real-time transactions have been identified as one of the key trends to shape the future of B2B payments. RTP networks, such as the one provided by The Clearing House, enable consumers and businesses to conveniently send payments directly from their accounts.

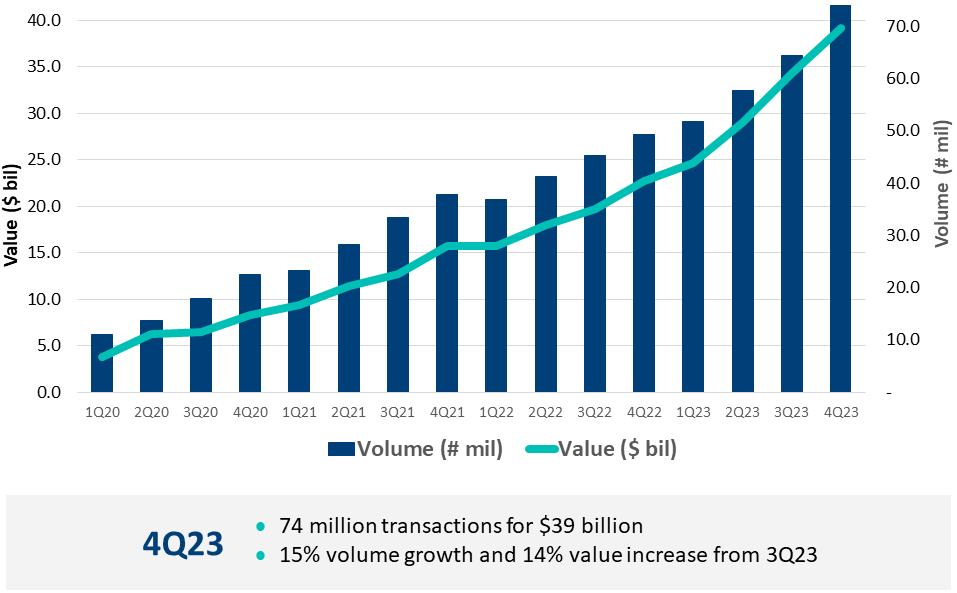

Source: The Clearing House

The macro environment today demands efficiency gains, further automation, and cost reductions. Real-time payments, offering immediate funds availability, align with these demands, enhancing operational efficiency, and improving cash flow management for businesses.

Moreover, the real-time balance feature of RTP offers a confirmation of funds. Once a payment is authorized, the payer’s account reflects the deduction of funds immediately. This feature adds another layer of security and trust in the payment process.

Importantly, RTP operate on a 24/7/365 model, allowing users to send and receive payments at any time. This non-stop operation is especially beneficial for global businesses that deal with different time zones.

The rise of real-time payments is set to transform the way businesses handle transactions in 2024, offering secure, efficient, and instantaneous solutions.

Challenge: Real-time payments promise instant, 24/7 transactions for businesses. However, integration complexities, data security issues, and the need for global standardization can impede their widespread adoption.

Trend 4: Embedded Finance and APIs

Embedded finance, powered by APIs, is expected to become a significant trend in the B2B payment landscape of 2024. This innovative approach allows businesses to integrate financial services directly into their existing product offerings.

In B2B , embedded finance can streamline the payment process, reduce manual tasks, and minimize potential errors. The integration of APIs enables seamless connection to third-party financial services, making these benefits accessible within existing business platforms. For instance, e-commerce sites offering loans, social media platforms introducing payment functionalities, and payment facilitators are all examples of how embedded finance is being leveraged.

The market size for embedded finance in the B2B sector is predicted to expand significantly. Anticipated to grow to $6.5 trillion by 2025 (from $2.5 trillion in 2021), the potential for B2B applications is vast.

Embedded finance and APIs are set to reshape the B2B payments landscape in 2024, offering more efficient, integrated, and customer-friendly payment solutions.

Challenge: Keep in mind that embedded finance and APIs are set to reshape the B2B payments landscape, but challenges like ensuring data privacy, managing third-party risks, and coping with regulatory compliance can arise.

Trend 5: Cross-Border Payment Innovations

Cross-border payments have been revolutionizing the B2B landscape, witnessing consistent growth and paving the way for a transformative 2024. This sector, currently the fastest-growing segment in the cross-border space, is primed to reshape global commerce.

The growth of cross-border payments in the B2B realm can be attributed to a few key factors. Firstly, digitalization has played a significant role, providing businesses with the tools and platforms necessary to easily facilitate international transactions. Secondly, the expansion of international trade has driven demand for efficient, reliable cross-border payment solutions.

Despite making up less than 20% of the total market by 2030, B2B cross-border payments are a force that cannot be ignored. The market witnessed a gradual increase of $14 trillion with a growth rate of 10%, from $137 trillion. This figure is expected to rise 53% to $290.2tn in 2030.

In 2024, the cross-border payments segment is anticipated to grow at the highest CAGR of 11.63% in the B2B payments market. This growth is fueled by the increasing importance of cross-border transactions in supporting the growth of business-to-business trade and commerce.

The surge in cross-border payments is set to significantly impact B2B transactions in the following year and beyond. As businesses continue to globalize, the demand for efficient, secure, and fast cross-border payment solutions will only increase.

Challenge: Innovations in cross-border payments are shaping B2B transactions, yet they can face hurdles such as high transaction costs, regulatory complexities, and issues related to foreign exchange volatility.

Conclusion

As the market continues to grow and evolve, businesses must adapt to new technologies, customer preferences, and regulatory requirements. The trends we have discussed in this blog post provide opportunities for companies to innovate and enhance the customer experience.

Staying ahead in this dynamic environment requires an informed and proactive approach. It’s crucial to understand not just the opportunities these trends present, but also the potential hurdles that can arise. By doing so, businesses can strategically navigate the changing landscape and harness the power of these trends to drive growth and efficiency.