Although the worst of the coronavirus is hopefully behind us, COVID-19 has unarguably made some significant changes for online businesses around the globe.

This holds especially true for Brazil – a lucrative target for many eCommerce brands that are looking to expand.

Bonus: Check out this guide on how to start an eCommerce business.

A Fast-Growing Digital Commerce Market

With a large population of over 211 million, 34% of which constitutes a relatively younger generation (36 to 50 years of age), Brazil is without doubt considered one of the most economically robust countries on the South American continent.

Brazil’s young demographic provides a plethora of opportunities to online businesses who wish to reach new customers within the market, in either B2C or B2B spaces. That’s because younger populations like millennials, xennials or generation Z spend significantly more time shopping online than older generations – whether for personal use or business.

To add to that, the pandemic has transformed the way Brazilians shop – with many resorting to online purchases for all their needs, whether essential or non-essential.

Before the coronavirus took place, Brazil was forecasted to close the year 2020 with $17 billion in online consumer revenues. As a result of the pandemic effect, the Brazilian market has blown this 2020 online retail sales prediction with a staggering $20.5 billion by the end of May 2020.

Even now, with a post-pandemic regression, the local market seems to continue its steady and rapid growth for years to come.

Regardless of this booming trend for Brazil’s eCommerce, some of the country’s current regulations and demographic factors pose challenges that may negatively affect non-local online businesses.

How international eCommerce businesses deal with the challenges of the Brazilian market

Understanding and catering to Brazil’s unique payment preferences, wisely navigating through duty and banking requirements, as well as aggregating, consolidating, and mapping local audiences for diversified marketing is what cross-border sellers need to start doing to wrestle market share away from giant retailers.

Largest Latin American Mobile eCommerce Market

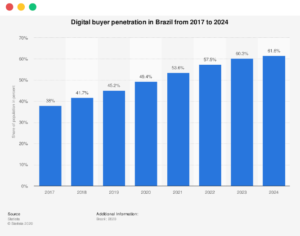

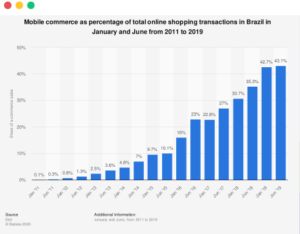

Brazil’s 150 million mobile phone users, in addition to the country’s high internet penetration rates, make it Latin America’s giant for mobile eCommerce. Brazil’s preference for conducting online purchases through mobile phones is a relatively recent trend. Just in 2012, there were only 1.3% of online transactions made through smartphones. Fast forward to the end of 2019, and that number has blown to a staggering 43.1%.

The figures are steadily rising, with mobile online sales predicted to overtake purchases made through other mediums such as desktops and laptops, and bring in $25 billion in revenues by 2023.

This is great news for cross-border sellers who wish to dive into the Brazilian market. Now’s the time to leverage this opportunity by actively optimizing online stores, cart flows, and payment methods for mobile devices.

Pandemic Drives Buyers and Sellers Online

The onset of the Covid-19 pandemic saw an increase of Brazilians turning to digital commerce for their needs, both among B2C and B2B groups. End consumers flocked online to purchase essential and discretionary goods, driving orders up 70% in 2020 versus the previous year.

The same shift had been noticeable in B2B as well, with 68-84% of B2B decision makers in Brazil declaring they now prefer remote human interactions or digital self-service.

Subscriptions Are on the Rise

Did you know that Brazil spends more than $200 million per year on recurring goods and services?

Subscriptions have been quite a big contributor to the country’s eCommerce market growth in the past years:

- One out of every two Brazilians are subscribed to video streaming services;

- 42% of Brazilians opt for digital music subscriptions.

Investment firms are a big player, too, with SaaS startups receiving 15.1% of investment money.

How Brazilian Shoppers Like to Pay

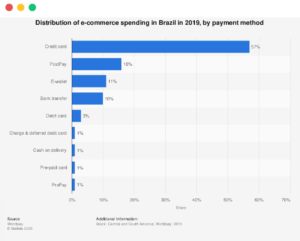

Some of the most widely used payment methods in Brazil are:

Credit Cards Installments

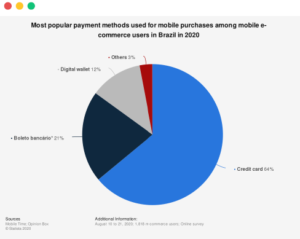

Credit cards are the leading form of payment in Brazil’s economy, but that’s not all. Paying in installments is something local shoppers expect to have as an option either in brick-and-mortar retail stores or online.

As a cross-border retailer, providing your Brazilian shoppers with this choice can help you to gain their trust, and boost sales by 50%.

In addition, national bank cards are a prerequisite for any installment purchases, which would explain why a majority of credit and debit cards used by locals are issued within Brazil

It is essential therefore to have local acquiring, otherwise, your authorization rates will plummet, driving your ROI in the red.

Boleto Bancário

Boleto is one of Brazil’s official payment methods that’s regulated by the Central Bank.

It substitutes cash payments by allowing locals to exchange their physical cash for a ticket in the form of a pre-filled slip that can be used online through mobile apps, or through ATMs and banks. The fastest variation is Boleto Flash, which provides the quickest payment confirmation in the market, even instantly confirmed when paid with Pix.

Boleto is also a popular payment option in the B2B space, chosen by businesses on account of its cost benefits.

Being quite popular, Boleto is only second to credit card payment methods and is preferred by a whopping 21% of Brazil’s online shoppers in 2021.

The local currency commands

Brazil’s strict currency regulations make it illegal for retailers to publish prices in U.S dollars. As a result, most transacted purchases occur in the local currency Brazilian Real because using any other currency for this purpose is extremely complicated and costly.

eWallets – PayPal, Apple Pay, Pix, Google Pay

Popular local and global online payment platforms are quickly growing their market share among Brazilian shoppers.

Just as with Boleto, eWallets don’t require bank accounts to be used, which provides both convenience and security.

Brazilians Lean Towards Localized Checkout Experiences

With five distinct regions, Brazil has a wide diversity in terms of its many cultures and languages. This is why Brazilians usually like to go for fully localized, native stores that target their specific demographic group.

Cross-border sellers should make the most of this by using dynamic templates on their sites that localize language and pricing based on geographical locations.

Stay Up to Date with the Compliance Landscape

As far as data privacy is concerned, the Brazilian General Data Protection Law (‘LGPD’) is the one regulating the processing of data in public and private sectors. The LGDP was passed in 2018 and entered in effect in September 2020, and is at present enforced by the Brazilian Data Protection Authority (‘ANPD’).

Another challenging aspect of cross-border business in Brazil is indeed its costly and complicated customs.

For one, when it comes to Brazil’s national post deliveries, any item valued between $50 and $3,000 may be subject to a 60% duty that’s payable by the customer.

A possible solution to this challenge is to work with a local fulfillment agent. Agents usually have licenses that allow them to help you import the items at much lower tax rates.

Closing Words

Despite the few challenges that regulations, requirements, and regional diversity pose to cross-border sellers, Brazil’s demographic factors, as well as growing trends in the nation’s online preferences make it a lucrative region to expand one’s presence too. Finding a partner to help you overcome these hurdles is the smart way forward, allowing you to focus on marketing and customer experience.

Want to learn more about selling online in Brazil? Check out our eBook “eCommerce in Brazil: A Merchant’s Cross-Border Guide to Online Sales” to get a better understanding of eCommerce dynamics in the country and to expedite your plans to sell in Brazil.