The CFO is the lynchpin of any SaaS business. Armed with the right insight, they can shape offerings and build strategies that drive growth and power success. But first, they must ask the right questions.

At the heart of every great SaaS business, you’re almost guaranteed to find a knowledgeable CFO. Their in-depth understanding and accurate forecasts help other finance functions, product development, payment managers and the C-suite make the right decisions, at the right time, to secure sustainable growth.

It’s a demanding role that involves diverse responsibilities including:

- finding investment to fund growth, kick-start projects and develop products

- forecasting and managing budgets to stay competitive and profitable

- defining and monitoring the metrics that keep the business on track

- shaping revenue strategies, pricing models and operational efficiencies and outsourcing models

- dealing with constantly evolving financial and regulatory compliance.

No surprise that CFOs can feel overwhelmed.

To handle such a huge operational burden, CFOs must have the right resources, capabilities and support to do the job. As with most modern functions, knowledge is key to securing this.

Without the right information, data and metrics, CFOs will struggle to manage their company’s fiscal health, to scale and direct growth. But to help them focus their efforts and get the answers they need; they must first ask the right questions.

Here are 7 top line questions that can help SaaS CFOs win:

1. How is our SaaS business really performing?

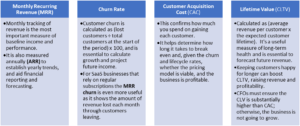

Accountable to the board and stakeholders for financial performance, CFOs must be able to measure success. For SaaS businesses that rely on recurring revenue this involves looking beyond income and costs to customer satisfaction and retention. The most useful metrics for measuring SaaS performance are:

2. How can we effectively manage cash flow in a SaaS business?

Like all businesses, SaaS companies face a constant battle managing cash flow. For those that are venture-capital funded, reaching the stage where they are cash flow positive is key to unlocking further capital for growth. To prevent liquidity issues and avoid nasty surprises, it’s important to plan, forecast and constantly monitor income and expenditure.

To optimize cash flow, SaaS CFOs must manage subscriptions and billing efficiently. Slow manual processes and reporting issues can delay payments, and too many bad debts can cause your cashflow to crash. Shifting to automatically recurring payments and pre-authorized direct debit collection is better than relying on easily invoices and card payments which users may forget to pay. Finding new customers is expensive and raises costs, so reducing churn and improving customer retention should also be a priority for SaaS cashflow management.

3. What is the best pricing model for our SaaS product?

More than acquisition and retention, product pricing impacts your bottom line – a single figure increase can create double digit uplift in your revenue. Knowing what your product is worth is as important as its features and functionality. Subscription prices with ongoing customer payments and complex product packages mean you need to put more effort into getting pricing right.

The model you choose will depend on your strategy – whether it’s competitor, value or feature driven, as well as your product options, your audience/markets and the importance of maintaining a consistent revenue stream.

The four most common SaaS pricing models are:

Usage

- The cost relates directly to how much the customer uses it-the more they use the more they pay

- A transparent and low-barrier option for customers, this is typically used by infrastructure and web services

- However, the revenue stream is unpredictable which can make it harder to plan

User count

- The cost relates directly to the number of users with costs rising at set incremental amounts as new users are added

- One of the simplest, most direct pricing models, it’s widely used by SaaS businesses as revenue scales with adoption and is easy to predict

- It’s open to misuse (shared logins) and is prone to churn as customers grow and seek lower cost alternatives

Tiered

- Let’s you deliver multiple packages or sets of features to different target audiences, each with a specific price

- It’s the most common model used for SaaS businesses as it allows diversification, upselling and growth potential

- Too many options, however, can be overwhelming, reduce focus and are heavily reliant on audience understanding

Flat rate

- One product, one feature set and one price for all customers

- It’s easy to market it as a model often used by project management software

- It leaves little scope to diversify or up-sell per feature

4. How can we forecast revenue and expenses accurately?

Forecasting is the foundation to SaaS success. It impacts decisions around pricing, marketing, resourcing and cashflow, and determines expansion strategies, ability to attract finance and investment. It also allows SaaS businesses to factor in risk, and ensure they are more resilient to market change and disruption.

Having clean and accurate performance data and regularly monitoring external as well as internal trends are vital to the quality of revenue and cost forecasting. AI powered, predictive analytics, can help you to more accurately analyze historic data and market trends and create better more timely and informed revenue and cost forecasts. It can also help to track performance against forecasts, in many cases in real-time.

To help deal with market unpredictability, it’s worth including ‘what if’ scenario planning in your forecasts. For example, the ideal target-case based on aggressive sales assumptions, a conservative base-case using the average historic trends, and a worse-case, if external factors outside your control impacted the business.

5. How can we manage the financial impact of customer churn?

Churn is the percentage rate at which your customers cancel their recurring revenue subscriptions. Churned customers represent lost revenue and growth. It’s much cheaper to keep an existing customer than to acquire a new one so churn can also impact profitability. According to some studies, it takes twelve months on average for a SaaS business to break-even with the expenses for a single customer – so early churn is really bad for business. It’s also why high churn rates can be a warning sign for potential investors.

There are two types of churn:

- Voluntary churn, when the user chooses to leave, because of poor onboarding, bad user experience or customer support, failure of solution to deliver value and competitive pressure of a better deal.

- Involuntary churn when it’s not a conscious choice. For instance when the customer’s payment method has expired, or a payment has been inadvertently declined.

It’s important to understand where and why churn is happening so you can implement effective strategies to counter it.

While customer reviews, close-out feedback and surveys are an important source of insight, data is often spread across multiple functions and teams, which can make reasons for churn hard to identify quickly. Having tools that help gather data and consolidate data into a single source of truth – from what product, what plan, and what features were being used, the timelines and contact paths of every customer – can help spot specific trends and trigger faster remedial action. For instance using payment declines to trigger communications or dunning flows that prompt the user to update their payment method before the subscription is cancelled.

6. What are the tax implications and considerations specific to SaaS companies?

SaaS businesses have unique and complex tax considerations especially when selling digital goods cross-border or inter-state. Generating revenue from inbound sales into jurisdictions outside your home jurisdiction may have consequences for indirect and direct taxes as well as payroll tax for remote employees. For example, from a US sales tax perspective, the economic nexus imposes the obligation to collect taxes from you digital sales, meaning that a percentage should be applied to the total value of products sold, based on the location of the shopper. Tax planning strategies and best practice are vital to ensure compliance, prevent financial exposure and risk. To develop these, you must have access to the relevant sales, trading and HR data to be able to accurately determine tax status. You must also stay regularly informed of any changes to local and international legislation and how this affects the business. There are many sources out there that can help including eCommerce Taxation guides from 2Checkout – for the and the.

7. How can we optimize our SaaS company’s financial operations?

Every function, from monitoring and measuring to planning and financing, involves complex processes and is heavily reliant on multiple data sources. Being able to automatically aggregate, assimilate and analyze this using AI tools can reduce time and effort and improve accuracy and insight. It also provides CFOs with better information to make more informed decisions, set better targets and more precise forecasts.

At the same time, payment providers can provide a raft of easy-to-use financial management tools and reporting interfaces that can track transactions and provide real-time revenue-related metrics as well as ensuring greater security and easier compliance.

Getting the answers you need may depend on business maturity.

For CFOs in established businesses, obtaining the answers to the above may be relatively straightforward as many of the metrics required will be relatively consistent and easy to quantify based on historic trends and data.

If your SaaS business is just starting out, they may be much harder to estimate, and more likely to fluctuate as the business evolves. Benchmarking competitors’ customer churn rates and lifetime values and ensuring your development and marketing costs allow you to stay profitable at this same level of retention, can help keep you on track.

In both cases, CFOs can also tap into the expertise of their financial management and payments partners to establish realistic goals against industry norms. With the right answers, they can make sure they make the best decisions, from whether to outsource, the type and size of resource they need to achieve their goals and the tools required to help their business to grow.