At this point, it’s been proven time and again that having a good overview of an account is essential and indispensable to any successful CSM.

I believe we’re now entering a stage where SaaS businesses need to hyper-optimize their dashboards and health scoring setup to include more than just tired, unreliable metrics such as logins.

Today, I’ll make a case for subscription, payment, and other account-related metrics in customer success.

Money makes the business world go round. Tracking how customers spend in relation to your product can ensure you’ve got a full-picture view of the account.

Below, I’ve put together some definitive advantages & tips for monitoring payment-related metrics for customer success. Furthermore, this doesn’t just apply to SaaS – any business that can track user activity inside their product can gain some eye-opening insights into the minds of their customers.

You Can Monitor Payments and Subscriptions Automatically

The first and most obvious benefit to setting up payment and subscription metrics in your CS software is time. Specifically, the time you or your CSMs spend looking up that information & transferring it to a report or trying to compare it to other metrics to gain useful insights.

By adding subscription-related metrics to your customer success software, you’ll get everything you need front-and-center. This will allow you to:

- Have a full view of the account in one go;

- Easily see connections with other metrics;

- Stay on top of renewals & optimize them;

- Fix payment issues before they happen;

- Increase the speed of customer service.

Last but probably most important, you’ll be able to set up advanced health scores that track complex user activities within your product.

You’ll Be Able to Increase Upsell & Cross-Sell Opportunities

You’ve probably heard that the likelihood of selling to existing customers can be up to 70%. Because you’re monitoring customers from all perspectives, including financial, you’ll know:

- when to reach out for an upsell

- when to reach out for a cross-sell

- what to say to up your chances of convincing customers

So, that 70% can go even higher if you do it right.

The simplest way is to set up an automated message that goes out 25-28 days after the number of invoices increased by one. In essence, that means you’ll reach out right before a client has to pay again to say: hey, maybe you could use an upgrade this month.

However, I recommend a more advanced approach that takes into account user activity within the product:

- Set up an automated notification a few days before your customer needs to pay this month’s invoice.

- When you get the notification, analyze other metrics & health scores in the account, such as the number of features used and the number of features maxed out – prioritizing trial features, if you have any.

- Determine if the customer would benefit from an account upgrade & set up some short scripts for the possible replies.

- (Optional) Analyze the customer’s support requests to see their preferred channel of communication. You can also set up customer support metrics & health scores and track the number of requests per channel.

- Reach out and propose an upgrade directly! If possible, do so via the customer’s preferred channel.

Pro tip: one successful approach we’ve seen is offering a free trial. The duration of the trial depends on your business, but using a “show, don’t tell” approach can work beautifully.

You can further analyze payment and account metrics by comparing them with the login health score. This will let you know when multiple people are using the same user account. Once you know that, reaching out for a cross-sell is just an email away.

You Will Find Innovative Ways & Metrics To Track

You can even move beyond these basic tactics of using payment metrics and determine some advanced stats to help in your customer interactions.

Some examples:

1. How many subscription changes for this account? Setting this up as a health score can tell you that a client would like a higher plan but can’t always afford it or prefers to use it only for a specific time. In any case, you might want to have some offers ready to make that customer loyal and the account more stable.

2. How many payment issues for this account? A basic metric, but If an account has many payment issues, maybe reach out to the customer and discuss why that’s happening & how you can prevent further issues. Your customer success software will show you if multiple accounts have frequent payment issues – in which case, maybe it’s a sign you need to start accepting recurring payments. The payment issues metric can be upgraded to a health score by color-coding it and tracking it as follows:

- 0-30 days since last payment: green

- 30 days since last payment: yellow

- 30+ days since last payment: red

- Then you can make the resulting health score high impact, therefore if it goes red, you’ll immediately see the global account health drop.

3. How often does a customer miss a payment? If a customer always makes payments late, it’s most often due to lack of time. Recurring payments and automatic renewals can work here as well. However, ignoring this problem might lead to involuntary churn.

4. Any relation between support requests vs. subscription changes? By monitoring both support & subscription metrics & health scores, you’ll be able to see if there’s any correlation between the two. If support requests lead to account upgrades – that’s great & you should give your team a bonus. If, however, they lead to subscription level churn, there’s clearly a delicate underlying issue there that needs fixing.

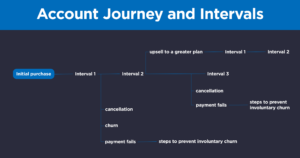

5. How many intervals does this account have? Payments, upsells, renewals, exchange of products – all of these things happen and affect how we perceive an account. The time between these milestones is typically defined as an “interval.” One of the most advanced ways to pair your payment data and customer success is by tracking the number of intervals as a health score. What you get from that number is highly business-specific, but you will want to give both inactive and very active customers a closer look.

Sounds great, right? It’s just the start. The specifics of your business might give you some wild and brilliant ideas of other advanced ways to use account & payment health scores. Go into your CS software, set up the integration with your account tool, and have fun tracking the things that matter to you!

You Can Segment Customers Based on the Data

Segmentation is another cornerstone topic for customer success. In my Customer Health Score guide, I briefly mention you can segment customers based on the data received from payment, account, and billing software. Here are some metrics you can use for that:

- Total income. Tracking total income is an easy and efficient way to determine your customers’ spending habits within your product. Then once you have that data, you can prioritize and segment accounts based on it. How you support different segments is up to you, but having separate ones for large, medium, and small accounts is essential.

- Number of invoices due. By tracking the number of invoices due, you can tell how your customer uses your product. Maybe they’re purchasing many extra services or add-ons. Maybe they’re accumulating invoices due to payment issues. You can compare this metric with others and find out why. After that, creating user segments is the next logical step. Color-coding this one and adding it as a health score is also very useful.

- Number of invoices paid vs. account age. A ratio of these two metrics is also useful to analyze. A high number of invoices paid in a relatively short period means you’ve struck gold – that’s a customer that loves your product, loves your company, and can automatically propel your business forward by years. On the other side of the spectrum, if the ratio is low, maybe it’s time to reach out for an upsell.

We know that 80% of profits can come from just 20% of customers. Imagine the possibilities if you create a segment called “Frequent Add-on Customers” – you could push every new feature to them before you launch it and cash in on the exclusivity factor to make them feel extra special.

You then Use Segmentation to Optimize Automation Playbooks

Based on the information you gathered from the previous tips, you can now make or optimize customer success automation playbooks for your new segments. 63% of customers want businesses to know their needs and expectations, no matter how unique. That number goes even higher to 76% when we’re talking B2B.

So if you can make an automated playbook that detects when a customer in the “high spender” segment has issues with payment while trying to upgrade, you’re well on your way to making that customer a loyal one. All you have to do is reach out and help. And this small example can apply to any scenario.

You’re Also Able to Define Lifecycle Stages Based on Renewal Dates

Remember what I said about intervals earlier? You can also use intervals and renewals as metrics to define lifecycle stages. For example, free trial customers are definitely in the early stages. After the conversion stage, you can determine a specific number of intervals or renewals that apply to each customer lifecycle stage: retention, loyalty, nurtured, and growth.

It’s a trial-and-error process, but the returns of knowing each customer’s precise location on the lifecycle will be hard to ignore.

You Can Act Proactively to Prevent Payment-related Churn

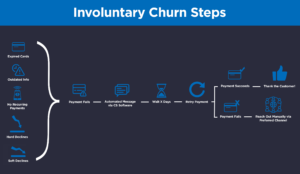

Involuntary churn can be a bummer. It’s an unnecessary business detractor that can easily be circumvented by just implementing SaaS renewal best practices. But we’re here to think outside the box and move beyond typical best practices.

Involuntary churn typically takes up 20-40% of your churn rate. If you want to increase that number & stay ahead of it, you need to track renewal-related metrics and health scores. The most common involuntary churn reasons are:

- Expired cards;

- Outdated billing info;

- Uncertainty regarding recurring payments (the customer may think it’s recurring when it’s not or may have missed the option to make that payment recurring);

- Hard declines – generally related to fraud;

- Soft declines – typically when the card reaches its limit or multiple transactions happen simultaneously (rarely, but it happens).

For most of these, you can create automated messages that go out whenever the health score that monitors payment fails goes yellow. If you don’t have account updaters, you can even set up a basic health score to see if a customer has updated their payment info before their card expires:

- Has this customer updated their payment info?

YES: green

NO: red

Once you customize your customer metrics and health scores to account for all the involuntary churn scenarios, you’ll see involuntary churn drop consistently. The only requirement left is for you to take the appropriate actions for each churn reason.

Customer Success is More than Just Metrics

Of course, tracking all these metrics and health scores is like having the tools for the job without actually doing it.

Customer success is more than a department, more than an approach. It’s a mentality when dealing with customers, regardless of whether you’re a SaaS or not (even if it is more in line with SaaS businesses).

Once you have your customer success software, one of the first recommended steps is integrating it with your account & billing tool and your CRM. An adequate account overview for each customer is the bare minimum and tracking subscription and payment-related metrics is becoming essential to set yourself apart in the SaaS crowd. So, will you stand out?

About the Author

As the CEO of Custify, Philipp Wolf helps SaaS businesses deliver great results for customers. After seeing companies spend big money with no systematic approach to customer success, Philipp knew something had to change. He founded Custify to provide a tool that lets agents spend time with clients—instead of organizing CRM data.