Profit is an essential part of growing a business so it is obviously important to circumvent any avoidable costs and losses. However, the nature of working with customers means that some will be happy with you and your products and some will not… for all sorts of reasons… some reasonable and some not so reasonable. A lot of human psychology is at play when customers decide who they want to have a continuing working relationship with.

Ultimately, doing what you can to make customers happy will help your company, and unhappy customers will not. Mistakes of all sorts result in refund requests. If you, as a merchant, deny a refund, or if your customer directly contests the charge with their bank, the next step is a chargeback — a process involving additional parties and costs that you want to avoid.

What is a chargeback?

Our updated resource on the subject “Understanding Chargebacks and How to Avoid Them” addresses the subject and answers any questions you may have on it. The new eBook also includes a visual diagram showing the chargeback process a customer goes through to get their money back if the direct refund route with the vendor didn’t work.

A chargeback occurs when a bank forcibly pulls money from the merchant and returns it to the customer. It generally happens when the customer is pretty unhappy. If the customer wasn’t able to obtain a refund, or they are just tired of working with the vendor, they escalate the process by approaching their bank to get their funds returned. When the customer gets their money back using this method, it results in a chargeback to the vendor.

Unfortunately for the vendor, the product in question doesn’t get returned. So, when faced with a chargeback, it can be quite a setback.

How does a chargeback work?

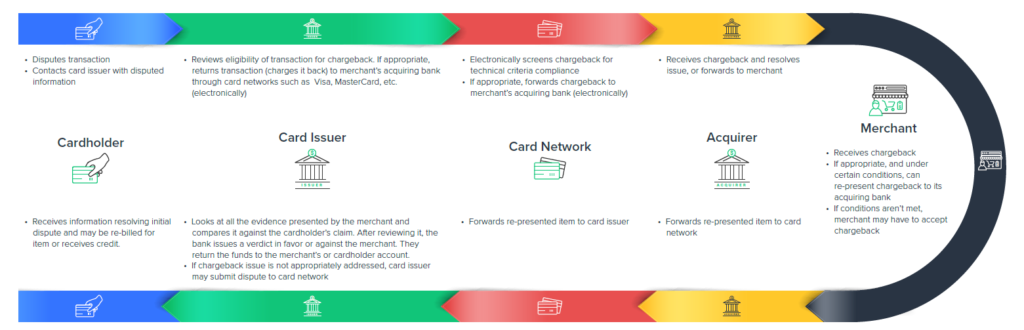

The chargeback process is initiated in two scenarios: 1) the customer requested a refund for a charge from a vendor and the vendor declined or 2) they did not want to work with the vendor to get their money back and went straight to the company that issued their credit card instead.

When a consumer files a dispute with the company or bank that issued their card, the bank then gets to decide if the consumer is right in thinking they deserve a refund or not. If the bank thinks the consumer is in the right, they will charge the expense back to the vendor’s bank via the card network (ex. Visa, MasterCard). The vendor’s bank will either accept this chargeback or forward the information to the vendor. At this point, if the vendor doesn’t agree with the conclusion, they can argue their case to their bank.

The worst-case scenario of the chargeback process is if the case reaches the arbitration stage, in cases when the card issuer and the vendor’s bank do not agree. Arbitration is carried out by the card network, who reviews evidence from both sides and then decides who has final liability for the transaction.

This sounds like quite the process, doesn’t it?

It’s a good thing chargebacks are easy to avoid. Building solid customer rapport can make interactions with your customers great. If they like you, they will come to you, and if they come to you asking for a refund, you have a chance to solve this amiably.

Each step of the chargeback process has a time limit by which the party in question must respond. The time limit starts with the cardholder who made the purchase. They generally have 120 days from the date of purchase to initiate a chargeback with their card’s issuer, but depending on the reason for the chargeback it could range from as little as 60 days to as many as 180 days. At that point, once the unhappy customer has initiated the dispute, it could take anywhere from 90-120 days to resolve.

- During the chargeback process, you can review the status of this dispute with card networks, which can be either Open, Won, Lost or Accepted.

If the chargeback is “open” it means it has not been resolved yet. If the status is “won” that means that the vendor won. If the status is “lost” that means that the vendor lost and the customer is being reimbursed, and if the status is “accepted” that means that the vendor accepted the chargeback and reimbursed the customer.

Why you want to limit chargebacks

A chargeback here and there might not seem like a big deal. Unfortunately, there’s a little more to it than that. You’re not just getting hit with the chargeback (refund). You:

- Lose the item sold that could have potentially been returned had the customer gone through the refund with you directly,

- Get slapped with a chargeback fee,

- Face a dispute resolution fee, and

- Lose the time it took to dispute the charge.

In addition to the costs you could incur, you want to keep your chargebacks below the monitoring threshold instituted by your card’s network. As of 2019, Visa updated their chargeback limit making their card users remain below a 0.9% chargeback rate, whereas before the limit was set at 1%. Merchants who go above the threshold imposed by Visa find that their monthly profits can be seriously affected. The payment network applies fines for chargebacks above the acceptable limit ($50 for each dispute filed against you) and it can force merchants to enroll in its monitoring and enforcement programs, at the end of which merchants can be liable for review fees of up to $25,000.

Why do you get chargebacks anyway?

It’s clear that if you are facing a chargeback that you have an unhappy client on your hands. But why? We could come up with 8 different reasons for which a customer could want their money back and be willing to go through the pain of the chargeback process. Here are a few of them (check out our eBook on chargebacks for the others):

- Agreed refund not processed – Uh oh! Hopefully, this was just a mistake! Unfortunately, it’s a mistake that is going to cost you some money. Try not to let these happen.

- Duplicate order – This means the purchase showed up twice on the customer’s credit card bill when they only ordered once.

- Order not fulfilled – For some reason the customer didn’t receive the product they purchased or couldn’t access it (software).

Here’s the top reason for chargebacks: canceled recurring transaction or installment billing dispute. You might get this code because:

- A recurring transaction was charged after a customer had requested that it be canceled

- Their account had already been closed, yet they were still charged

- The charge was greater than what had been previously defined

In our eBook you can find the second-most frequent reason for chargebacks.

Ways you can lower your chargeback rate

There are 10 ways you can decrease your chargeback rate — they all revolve around clear communication, transparency, and honesty. If the vendor is easy to work with, the customer won’t go to their bank to file a dispute. Just issue a refund right off the bat.

Here are 5 ways to lower your chargeback rate. Check out our eBook for 5 extra tactics.

- Clear, transparent pricing in cart – Customers need to know that they are signing up for recurring billing in order to keep them from being surprised. One reason that they initiate a dispute for a chargeback is that they don’t know why they are seeing a renewal order on their credit card statement. If they feel they are being taken advantage of, they will act accordingly and file a dispute. So, be upfront with them and make it clear in their shopping cart that they are signing up for recurring billing. Now is not the time to be sneaky and try to get easy renewals — it will backfire on you.

- Keep customers informed – Remind customers within a reasonable period of time that their subscription is expiring and when the renewal date is. Email notices or in-app pop-ups a few weeks leading up to the renewal should do it! It’s also good to give them the opportunity to unsubscribe from the auto-renew option. The last thing you want is an unhappy customer.

- Clear product details – Make sure your customers are getting exactly what they thought they would. What is included in the different packages you offer? What is not? A dissatisfied customer could initiate a dispute.

- Billing policy transparency – Some chargebacks are initiated simply because people forget. Credit card statements are received so much later than the purchase date of an item and it can be really difficult to match those up with old purchases because of having forgotten a purchase was even made and/ or it not aligning with the description that was expected. Take the opportunity to customize the information that appears on credit card statements to make sure it is as clear as possible. Then, tell your customers how the purchases will appear on their statement. A+ for transparency.

- Have flawless customer service – People will feel like they are in a corner and you are intentionally not being present if they can’t easily find your contact information or you don’t readily respond to them reaching out. So, ensure you respond to all customer inquiries and be pleasant and accessible.

How do refunds work if PayPal was used?

If you’re using an eCommerce payment processing system, chargebacks are a little different. The easiest way for a customer using PayPal as their payment method to get a refund is to file a dispute through PayPal.

A dispute through PayPal simply means that PayPal holds the funds while the vendor and customer talk through the issue. A dispute progresses to a “claim” after 20 days if there was no resolution between the vendor and the customer. At the point of a claim, PayPal acts as the intermediary and will come to a conclusion for the vendor and customer using the documentation that is provided. (It pays to keep all your documentation!)

If PayPal decides to issue a chargeback, a vendor can appeal the decision, but would need to provide additional documentation. If PayPal rules in favor of the vendor and the customer disagrees, the customer can initiate a chargeback with their bank.

A customer can either request a refund directly from the vendor, dispute a charge by going through PayPal to get to the vendor, or file a chargeback through their bank.

Disputes through eCommerce platforms are normally treated as refund requests. eCommerce platforms help facilitate clear communication between parties. The aim of the vendor should be to resolve disputes before they are escalated to chargebacks. Chargebacks cost time, money, and sometimes customers; so, just be easy to work with and do everything you can to get a simple refund request (or no refunds at all!).

Key takeaways

Chargebacks are nasty for more reason than one. They mean you likely have an unhappy customer, they suck up the time of the employees you have handling them, and they cost money.

If your company struggles with chargebacks, take the time to understand why your customers are asking for them — then do something about it! That should make your chargeback rate go down.

Merchants working in a Merchant of Record Model with 2Checkout benefit from chargeback help from us. We help you address chargebacks if you provide all the documentation you have regarding the disputed order within 3 days of the dispute.

Read our eBook Understanding Chargebacks and How to Avoid Them to fully understand chargeback disputes and to learn how to best approach these cases.