Tech-savvy Nordic consumers actively embrace change. This extends to online checkout too, with many of the region’s e-shoppers now preferring Alternative Payments Methods (APMs) to traditional cards.

Let’s take a deep dive into the Nordic payments market and discover what’s fueling this disruptive trend.

Source: Nordic Embassy

Source: Nordic Embassy

The Nordic countries – Denmark, Finland, Norway, Sweden, and Iceland – may be relatively small, but combined, they represent the world’s 10th largest economy. Its consumers have big buying power too, with the largest spend per capita on the continent, 78% higher than the EU average.

The region’s businesses and consumers are hungry for fresh ideas and tech-innovation, consistently putting it in the global top ten for digital competitiveness.

This, together with high internet and mobile penetration, has helped make it one of the world’s most mature eCommerce markets. In 2021, Nordic eCommerce accounted for roughly one-fourth of Nordic businesses’ total revenues.

Nordic consumers actively embrace payment change

The region is a hotbed of banking, mobile, and fintech innovation. While other countries struggle with financial underserving, the Nordics have enjoyed decades of far-reaching banking services, with Norway boasting 100% inclusivity.

Unlike many change-resistant Western markets, Nordic consumers are highly receptive to new ways to pay. As a result, its consumers adopted digital payments and contactless much faster and more widely than in other mature markets. So much so, that it leads the global drive towards a fully cashless economy.

All of this has created an ecosystem that has seen explosive growth in APMs

APMs are ways to pay that fall outside cash or global card schemes (Visa, MasterCard, American Express) and include prepaid cards, mobile payments, e-wallets, bank transfers, and buy now, pay later (BNPL) instant financing.

For many years, Nordic governments and banks have been promoting digital and mobile payments as alternatives to cash, collaborating on initiatives like debit card schemes, digital banking IDs, and common payments infrastructure. Their success means that mobile payment adoption now surpasses most of the EU, including larger economies such as Germany and France.

Conventional payments are being disrupted

Traditionally, payment cards have dominated Nordic consumer preferences. In Norway, adults hold, on average, four cards (2.7 debit cards and 1.6 credit cards) – the highest number in Europe.

Across the region, global card schemes have 22 million credit cards, with Mastercard as the main player. High-interest rates, low loss levels, and revolving balances support credit card profitability in Norway. In Sweden, however, consumers have many other options for short-term borrowing, while elsewhere, interchange caps have meant issuers continue to struggle to raise margins.

In Finland, debit cards now command the biggest share of card volume. Both here and in Denmark, dual-function debit/credit cards help discourage consumers from relying on credit. Debit cards also have deep penetration, especially with domestic schemes like BankAxept in Norway and Dankort in Denmark.

Move away from physical retailing – to online and mobile channels – and a new pattern is emerging. Card use is falling behind, and APMs are starting to push out in front.

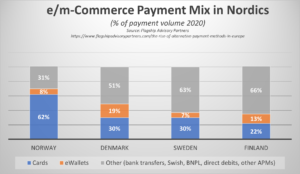

Nordics’ changing checkout mix

Nordic consumers, accustomed to the ease and convenience of banking and shopping on their phones, are now choosing new alternative payment options that better fit their needs – for access, convenience, cost, and speed.

In Denmark, Finland, and Sweden, APMs now dominate online checkout share. In many cases, volumes are transferred to credit/debit-linked digital wallets. In addition, new methods, including interest-free credit like BNPL, are starting to pull a larger slice of transactions at the checkout.

Source: Flagship

Meanwhile, in Norway, payment preferences are shifting away from cash and credit cards to digital wallets and buy now, pay later options (BNPL). Its neighbor Denmark leads the way in mobile payments, with two in ten Danes now using this method to pay for their online shopping. Invoicing is also popular, especially in countries like Sweden, where it is used by around 30% of Swedes.

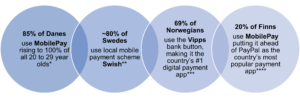

Mobile apps are taking APMs to the masses

Nordic has many home-grown mobile apps that have gained huge traction in the region, helping to fend off dominance by global players like PayPal. The big three are Swish in Sweden, Vipps in Norway, and MobilePay in Denmark and Finland.

*Source: Statista **Source: Riksbank ***Source:JP Morgan **** Source: Statista

Digital and Mobile Payment App Use

Source: JP Morgan

How are external and other economic factors influencing demand for APMs?

Although the Nordics had seen a big shift from physical stores to eCommerce prior to 2020, a report from PostNord reveals that COVID significantly advanced the region’s mass migration to online shopping, with a quarter more consumers using it than before the pandemic. By mid-2021, Nordic consumers were ready to bounce back with an uplift in online spending on leisure and lifestyle.

However, the recent global economic crisis, fueled by skyrocketing inflation, rising energy prices, and the conflict in Ukraine, has somewhat derailed this. One in four (25%) Nordic consumers no longer feel their households are financially secure. As a result, many are looking to reduce their spending.

Consequently, merchants are having to work harder to grow their Nordic businesses. Making changes to their checkouts – offering users more flexible types of payment methods that give them better visibility to budget and monitor cashflow – can help them get ahead.

Many are turning to BNPL as a quick fix solution to the cost-of-living crisis. All Nordic markets are expected to see double-digit growth in BNPL. From 2022-28 forecasts predict BNPL CAGR to increase by 33.8% in Sweden, 18.6% in Finland, 14.2% in Sweden, and 13.4% in Norway.

It’s not just about choice – it’s about the right choice

The best payment options for any merchant’s checkout are those that fit their customers’ preferences, experiences and buying decisions.

For instance, being able to offer deferred payment on large seasonal baskets, installments on big ticket luxury items, one-click mobile payments for spontaneous social shoppers, and prepaid for budget-conscious students and risk-averse travelers.

It’s also about improving the UX. Many APMs deliver faster checkout processes and more seamless and diverse customer experiences, helping to ensure higher conversion and encourage greater loyalty.

The right APM can also provide new-to-the-market merchants with greater sales and business security by allowing them to build more trust around their brand – through association. For instance, small and unfamiliar retailers can raise their credibility by offering a globally recognized and established BNPL brand like Klarna or trusted bank solutions like MobilePay.

New initiatives will pave the way for smoother cross-border APMs

The Nordics are looking at new ways to deliver real-time payments across borders and at scale. P27 initiative, led by Danske Bank, Handelsbanken, Nordea, OP Financial Group, SEB, and Swedbank aims to harmonize payments between member countries by providing an open-access, ISO 20022 compliant infrastructure.

Powering real-time payments, domestically and cross-border in multiple currencies, P27 will also align with SEPA to smooth payments with the rest of the EU. It could also become a major catalyst for APMs, allowing them to deliver the smooth, seamless experiences Nordic consumers want when buying online from overseas websites and helping to turbo-boost further growth and competition in the region.

Navigating Nordic APM Success

Nordics eCommerce represents a major market for both local and international brands looking to boost domestic and cross-border sales.

It’s clear that offering basic card payments at online and mobile checkout is no longer enough. While debit/credit cards still dominate in-store, in the digital space it is APMs that are the rising stars – whether it is Swish in Sweden, MobilePay in Denmark, Vipps in Norway, or Verkkopankki in Finland.

To be successful, merchants must optimize their payment mix for Nordic markets. Not only that, but they also must accommodate local, regional, and international payments regulations, requirements, and tax laws to stay compliant and protect Nordic customers.

Having the right online payment partners, like 2Checkout (now Verifone), can help smooth this process. Tapping into their regional expertise, collective industry data, and consumer knowledge can keep merchants with Nordic growth ambitions on track, ensuring they have the right APM heroes to get and stay ahead.