eLearning platforms have transformed education, breaking geographical barriers and democratizing access to knowledge. Well-known examples, such as Coursera and Udemy, illustrate the global reach and impact of these platforms. However, their success depends on more than just engaging content and robust technology; smooth and secure payment processes are equally critical. A frictionless payment experience ensures that users transition effortlessly from clicking on course information to accessing the virtual classroom.

This article explores how payment gateways play a pivotal role in streamlining eLearning platforms, enhancing user experience, and driving growth for educational businesses.

The Role of Payment Gateways in eLearning Platforms

Payment gateways act as digital bridges between learners and educational providers. They process payments securely, ensuring that funds move seamlessly from the learner’s bank account or card to the platform.

For eLearning platforms, payment gateways are not just about transactions—they’re about creating trust, delivering convenience, and ensuring global accessibility. Here’s why they matter:

- Global reach: eLearning often caters to international audiences. Payment gateways enable transactions in multiple currencies and payment methods, including credit cards, digital wallets, and locally preferred payment solutions. Understand your audience’s payment preferences and selecting a gateway with localized capabilities is essential.

- Security: Protecting user data – and your eLearning business – is paramount. Robust gateways safeguard sensitive payment details through encryption and compliance with regulatory standards. As online platforms are frequent targets for fraudulent activities, fraud detection mechanisms are vital to flag suspicious activity while ensuring legitimate transactions proceed smoothly.

- Efficiency & good UX: A simple and intuitive checkout process reduces friction, allowing learners to quickly enroll in courses without frustration. Features like saved payment details and cart abandonment reduction tools further enhance the user experience. These improvements not only streamline the enrollment process but also boost conversions, ultimately increasing acquisition ROI.

- Automation: With features like recurring payments and trial management, gateways simplify subscription models, allowing learners to stay enrolled effortlessly. Automation reduces administrative overhead for platforms and improves retention rates.

- Regulatory compliance: Adhering to global standards such as PCI DSS or navigating specific local regulations such as the GDPR or CCPA is essential for ensuring credibility and legal operation.

Key Features of An Ideal Payment Gateway for eLearning

To meet these objectives, eLearning platforms should prioritize the following features in the payment gateways they choose to integrate with:

1. Global Payment Options

Support for multiple currencies, international cards, regional payment methods and purchase processes in local languages ensures inclusivity for learners worldwide. While globally popular options like Visa, MasterCard, and PayPal are essential, localized solutions such as iDEAL in the Netherlands or Boleto Bancário in Brazil can improve conversions in specific markets. WordPress users, for instance, should ensure their plugins integrate with gateways offering these capabilities.

Supporting these options can be both technically complex and resource-intensive, but leading payment providers should offer them for your market.

Example of language, payment method and billing currency coverage by region. Source: 2Checkout (now Verifone).

2. Subscription and Recurring Billing

Because eLearning platforms rely heavily on subscription models, gateways should offer automated billing, customizable plans, and reminders. These features reduce churn and streamline renewals. Handling cancellations as well as free and paid trial periods requires advanced gateway capabilities that contribute to this.

The ability to easily create bundles and coupons should be part of the plan customization option.

It is also important to distinguish between voluntary and involuntary churn prevention, as the mechanisms behind each are quite different.

For example, voluntary churn – when a customer decides to cancel their subscription or downgrade from a (higher) paid version – involves tools and services such as:

- Send upcoming renewal notifications to avoid frustration and reduce the risk of refunds and chargebacks.

- Offer renewal discount campaigns and target specific customer segments that are more likely to churn. Similarly, offer early renewal campaigns – especially effective with manual renewal options.

- Offer a pause subscription option – for customers who don’t want to cancel, but don’t need to use your service for a period of time.

- Automatic renewal enrollment – offer this option from the start or run campaigns that encourage customers to switch from manual renewal and enjoy uninterrupted service. The manual renewal option should also be available for customers who want more control or want to try the product beyond the initial free trial period.

- Cancel inactive auto-renewal accounts – avoid chargebacks and delight those customers who may use your product later or recommend you to a colleague.

- Ask for feedback – try all of the above tactics and you may still not be able to persuade customers to cancel their subscription, so at least capture the reason why. A great opportunity to improve your product or service, or even the way you handle payments, may be a reason to switch payment providers.

Check out more tips and tactics to reduce voluntary churn.

Involuntary churn tactics and services are much more the responsibility of the payment provider – as what causes involuntary churn is most often related to payment processing issues such as temporary authorization failures, perhaps due to insufficient funds or exceeding the card activity limit, or permanent failures, such as stolen cards or closed accounts.

What tools and tactics should payment providers have in place to combat involuntary churn?

Check to see if the provider you want to integrate with employs intelligent payment routing, uses account updater services – and not only for the popular Visa, Mastercard, American Express and Discover, has an intelligent retry logic strategy, and handles expired cards.

An interesting one is “pre-expiration billing” – notifying customers before renewal time to give them a chance to update their cards and continue to enjoy your service uninterrupted.

Finally, check out the dunning techniques for hard declines.

3. Advanced Security Protocols

Gateways must comply with PCI DSS and offer features like tokenization, encryption, and 3D Secure 2.0. These protocols protect sensitive data while ensuring a seamless checkout experience for legitimate users.

4. Ease of Integration

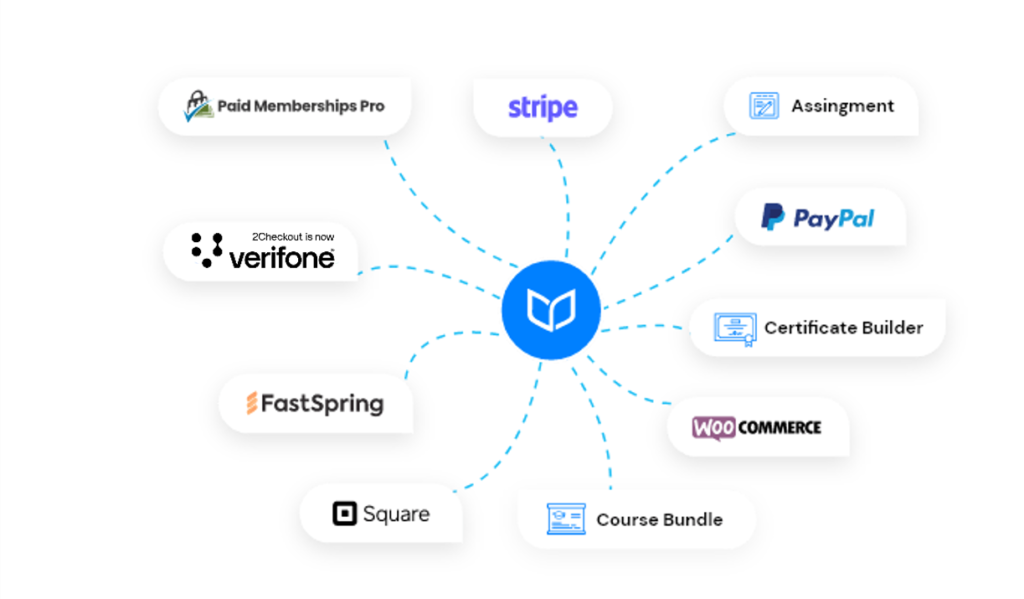

Seamless integration with Learning Management Systems (LMS) like Moodle, Canvas, WordPress Plugins such as EDUMA by ThimPress or proprietary platforms is a big plus. This reduces technical challenges and ensures a cohesive user experience. Extensive testing of integration scenarios—like failed payments, currency conversions, and regional transactions—is essential prior to launch.

Example of integrations available for CoSchool, a WordPress LMS plugin: Payment providers include 2Checkout, FastSpring, Stripe, etc.

Check out learning management systems with built-in shopping carts, or see what integrations are available.

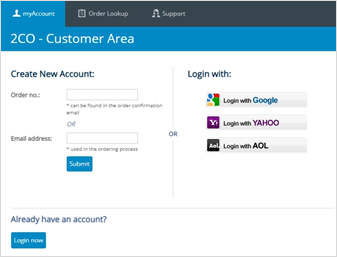

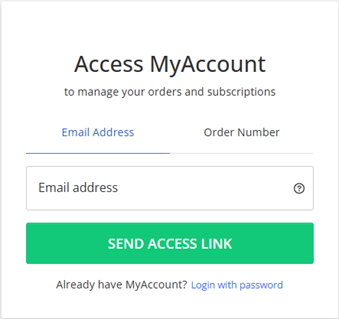

5. Support and Account Management for Shoppers

Ensuring seamless support for shoppers is crucial, especially for payment-related issues. Customers should have access to self-service options to update their subscription and billing details, view invoices, renew or cancel subscriptions, and contact the support team for payment inquiries. These features should be offered by the payment gateway and must be easily accessible—either directly through the payment gateway’s website or via integration with your “My Account” section.

Examples of “My Account” areas where buyers can manage subscriptions, access financial information, and expiration notifications. Source: 2Checkout (now Verifone).

Examples of “My Account” areas where buyers can manage subscriptions, access financial information, and expiration notifications. Source: 2Checkout (now Verifone).

6. Real-time Analytics

Analytics tools embedded in the payment platforms allow companies to monitor trends, identify bottlenecks and optimize go-to-market strategies. These insights can help reduce failed transactions and improve overall operational efficiency.

How Payment Gateways Streamline eLearning Operations

A well-integrated payment gateway enables learners to sign up and pay within minutes, simplifying enrollment and reducing friction. Beyond transactions, it supports global expansion, fosters trust through secure processes, and allows platforms to focus on their core mission—delivering transformative learning experiences.

As online education continues to grow, the role of payment gateways will only become more significant. From a single click at checkout to an engaging classroom experience, the journey starts with secure, seamless payments. By choosing the right gateway and leveraging its features effectively, eLearning platforms can position themselves for long-term success in a competitive market.

Choose 2Checkout (now Verifone) as your payment provider for your eLearning website and sell your courses online across the globe:

- Offer the localized experience your buyers expect

- Integrate quickly with any of 120+ carts (including 2Checkout)

- Get smarter subscription management tools that reduce churn

- Lock in recurring revenue

Sign up FREE here.