In just a decade, smartphones have become an integral part of our modern lifestyles. We work, bank, pay, and play on them. Consume games, film, and music, socialize and connect, locally and globally.

It’s estimated that there are now 6.648 Billion smartphone users worldwide, with global penetration in the mid-80%. That’s a lot of mobile phones, and a lot of consumer traffic representing a huge 24/7 channel for B2C and B2B merchants, especially those with apps.

Apps are booming but gatekeepers’ have control

App growth is also skyrocketing. The global mobile application market size was estimated at US$187.58 billion in 2021 and is expected to reach US$ 206.73 billion in 2022.

Despite demand, most apps are still only available through app stores which act as the gatekeepers for smartphone software. The Google Play Store and the Apple App Store are the biggest of these and represent a combined total of over 5.6 million Android and iOS apps worldwide.

Those looking to sell app-based digital products and services through these channels have faced restrictions on their use of third-party payment systems. Instead, they have been forced to use Apple and Google’s proprietary payment platform within their apps.

While user safety is cited as the primary reason for this, it has nonetheless left app stores free to dictate terms and reap lucrative commissions, typically 30% of every transaction. Until now, app developers, have had little option other than to accept this massive hit as a cost of sale.

The stranglehold on payments is starting to loosen

In March 2022, Google Play Store announced trials to accept third-party payment methods from other sources – but only if offered alongside the Google option. Developers must still pay the app store fee albeit at a 4% discount. Meanwhile, Apple is still sticking to its ‘no third-party payments’ position, despite growing pressure from various legal actions.

As the industry waits for the final ruling on the long-drawn-out Epic vs Apple case, South Korea has already passed an antitrust law that affects both Apple and Google. Meanwhile, in the Netherlands, Dutch dating apps can now skip Apple’s in-app payment systems thanks to a new anti-competitive ruling.

Other countries could soon follow suit with more legal challenges. This could soon open the door to higher revenue opportunities for app developers – and a whole new raft of SaaS apps that are ripe for lower-cost payment integration.

Integrating third-party in-app payments could become central to mobile subscription and sales strategies in 2023

But adding payments to an existing app can be much trickier than developers think. There’s more to it than adding a pop-up form and some back-end code. There’s also the not-so-simple issue of regulations and requirements to consider as well as the constant updates that are required.

For those used to plugging straight into Apple and Google payments platforms, the key is understanding how payments works in the wider world. This includes the parties involved, the different payment rails, and transaction flows. And, of course, the security processes that keep everything compliant, like PCI DSS and PSD2 SCA (Strong Customer Authentication) which requires two factor authentication for online transactions in Europe and the UK (with some exemptions and exceptions).

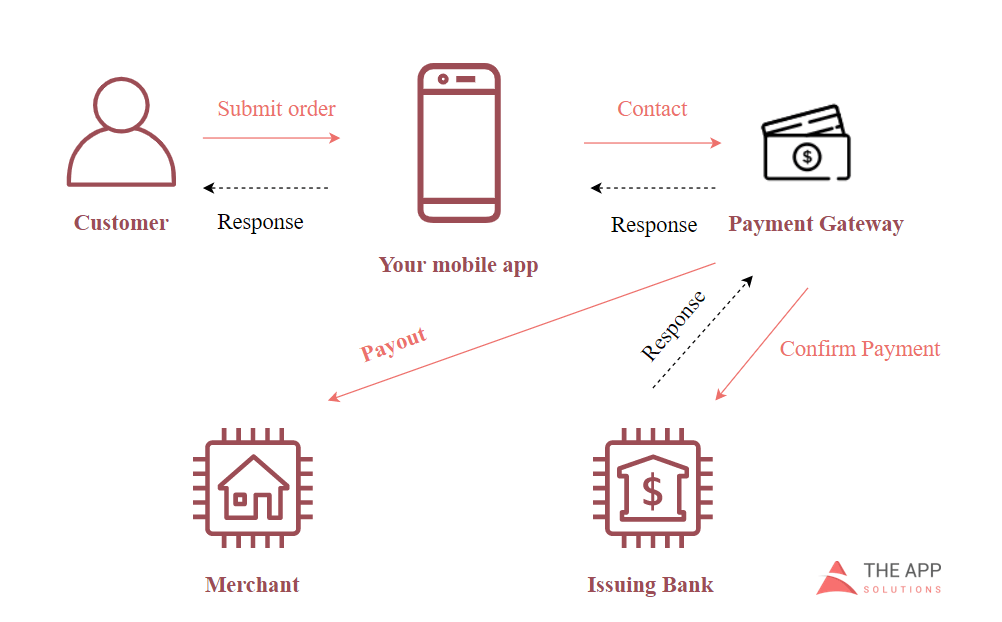

In-app transaction path and participants

In a typical in-app transaction (see diagram), the app sends a request to the payment gateway, which then further communicates with the user’s card issuing bank and the merchant to authorize the transaction and settle the money into the seller’s bank account.

SaaS developers will need help and support

Although SaaS businesses will have experienced app programmers, they may be unfamiliar with this new ecosystem, the nomenclature and workflows. Similarly, they may not have the SDKs readily available to deliver fast implementation.

That’s where having a specialist payment partner comes in. They can help do a lot of the heavy lifting. Providing the necessary platforms and SDKs that developers can use to simplify integration, go to market faster and help make subscriptions and in-app purchases smoother.

What developers can expect to gain

So, what happens if app stores open payments up? Using a payment system of choice for SaaS mobile apps will allow developers to maintain a seamless user experience, without having to pay up to 30% of every sale.

Other third-party providers are likely to offer much more competitive fee structures, especially for lower value transactions. This means that developers and merchants could potentially earn more from every purchase, which could have a huge impact on their bottom line, and long-term viability.

There are several other advantages to be had by moving to an alternative payment solution rather than sticking with the App Store status quo. Here are our top five:

1. Advanced monetization tools

Developers will have access to a wider range of options to help boost AOV/ARPU for users by encouraging upselling, cross-selling, and promotions.

2. More flexible pricing and packaging

A dedicated payment system integrated into the app allows merchants to better match price with consumer perceived value. For example, tiered pricing and usage-based pricing, as well as trials, renewal discounts and incentives that help drive app store optimization.

3. Increased due revenue

Most recurring revenue companies consider dunning an important part of their revenue recovery strategy. Having integrated in-app payments with more streamlined dunning processes can help improve communication with customers so developers can recover more due revenue from hard declines to minimize customer churn.

4. More payment choice for customers

Customers want more choice at the checkout. In many countries, alternative payments and digital wallets now rival cards. With more options to explore, developers can better localize their apps for user relevance to help boost conversion rates.

5. Better support and security

As well as offering solutions, third-party payment providers can also provide expert advice and compliance support – from the latest authorization techniques and security solutions to the best use of AI and ML driven anti-fraud systems.

It’s time to democratize in-app payments

As the European Parliament’s proposed Digital Markets Act gets ready to regulate the treatment of payments within mobile platform stores, it may not be too long before we see a wholescale shift in in-app payment models across Europe.

Some businesses are already preempting regulation and working to get ahead of the curve.

They are getting ready to promote alternative payment methods in-app using multiple payments gateways (including Direct Carrier Billing) so they can reduce their costs with payment processors.

Owning payments from the bottom up makes sense for developers – it reduces friction, creates a better UX and creates more purchase choice for their app users. It also unlocks new opportunities for revenue uplift for merchants across the digital commerce lifecycle, from acquisition to activation, upgrade, and renewal.

Taking the first steps

To intergrade in-app payments, developers will need a reliable processor to act as an intermediary between the merchant and the other financial institutions involved.

Before deciding:

- Clarify and understand pricing models, including fees per transaction, minimum and maximum amounts.

- Check that their solution is 100% compatibility with your chosen CMS/e-commerce platform.

- Confirm that they can support all the payment platforms required – not just cards and PayPal but also any local methods or APMs that are important for your audiences.

- Make sure you can provide the necessary internal resource to manage the relationship and allocate support for payments internally.

Stay ahead of the curve

Having the right strategy and partners in place will help developers quickly take advantage of any relaxation in app store payments restrictions as they happen, so they can reap the advantage sooner and steal a lead on the competition.